How-to Straight down Rates of interest on the Credit line

- Funding costly single orders Getaways, another vehicle, another type of fitness facility in your house – speaking of all of the pricey that-time purchases. To help you reimagine the way in which this may connect with your money, you could potentially pay it off incrementally which have HELOC.

Family Equity Credit line Requirements

Since the term indicates, one must have a home in buy to help you be eligible for a good family equity credit line. But, this is not the only HELOC demands. Some tips about what you should know before applying.

- Needed an effective credit rating to apply for a great HELOC. Basically, a credit score of 620 is advised, but the large, the greater.

- The debt-to-earnings proportion (DTI) would be less than 50%. It means you’re making over twice what you features to spend monthly for the expense.

- Really financial institutions need you to very own no less than fifteen% to 20% of your property ahead of opening a different credit line facing it.

2 kinds of HELOC

- Regular HELOC Financing An effective HELOC try a personal line of credit that is not a great charge card, but functions like a credit card; where you could acquire a certain amount from the equity of your house to have a certain amount of go out (draw months). You are going to pay minimum monthly payments following draw several months getting the dominating and you may notice.

- Interest-Merely HELOC Funds Just like the a secondary option, you could desire pay only the attention towards money you draw from your own credit line in the beginning out of your loan. Minimal payment per month in draw period simply covers the brand new attract for the financing.

Objective Federal also offers both choices, and certainly will work on their people to choose hence percentage package helps to make the very experience because of their situation.

Goal Federal HELOC Finance

Getting local San Diegans, they’re able to rely on Objective Government provide lower, reasonable pricing because of Cleveland installment loans no bank account their house guarantee personal line of credit. Stay in your regional Mission Fed part, or call us today.

Whether or not you really have a mortgage, or property guarantee credit line the concept underpinning good loan of every form try, that you gain the cash now and are also guilty of investing the primary straight back having notice. Thus, the goal is to try to demonstrate that you are reliable. How does you to do that? Improve your credit score.

- Using the debts punctually is a surefire way to boost your credit score throughout the years.

- Having multiple lines of credit readily available (and you can paying down every one monthly) is yet another treatment for increase score.

- Another type of experience to lessen their a great obligations, pay back the bill on your own credit connection charge card, otherwise sign up for an increase in their personal line of credit.

Enjoy Your Personal line of credit

Regardless if you are considering reinvesting of your property having a massive venture, or you need certainly to consolidate all your valuable a good finances significantly less than one to umbrella, a home equity personal line of credit is actually an option. You can not only prevent extortionate charge card costs, you could plus prevent hidden fees and instant costs.

Having Mission Federal’s home loan programs across the the Borrowing Relationship twigs of Oceanside about north to the Chula Panorama department for the this new southern, you can have these types of gurus within low pricing. To learn more about the various mortgage options available, visit the webpages otherwise get in touch with a lender out-of Goal Provided Credit Partnership today.

The message given is supposed for educational objectives. Objective Federal Borrowing Partnership disclaims any liability having conclusion you will be making according to the advice offered. Records to almost any certain industrial things, techniques, otherwise characteristics, or perhaps the accessibility any trading, organization, or agency term in this post will not constitute affirmation, handle otherwise guarantee by Mission Government Borrowing from the bank Relationship.

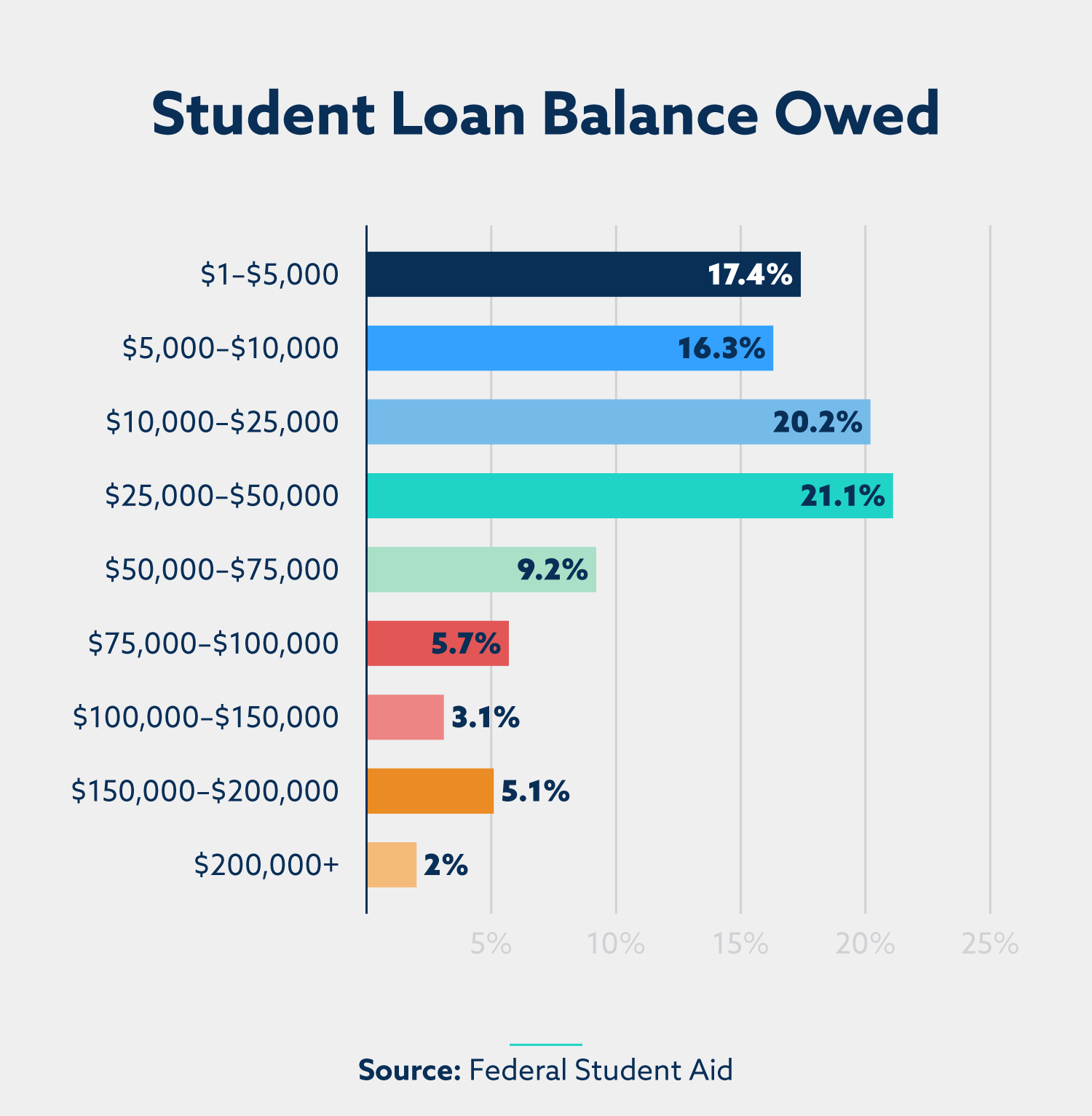

- Debt consolidating In the case in which you possess figuratively speaking, credit card debt, or any other money with a high-rates of interest, you could combine all these to your one membership. This is exactly a reasonable solution when the interest facing your own residence is below your financing software.

Comments are Closed