Wells Fargo trailed the individuals lenders into the finance originations throughout the 2021, based on Bankrate, with Skyrocket Home loan at the step one

You to workforce can surge whenever interest levels are reasonable and you may homes index are abundant, and you will feel sharp work cuts when ascending interest rates and you will tight collection provides discourage to shop for and you will refinancing.

Experts state Wells Fargo and other federal and extremely-regional banks have forfeit share of the market so you can on the internet financial institutions, such as Skyrocket Financial, Joined Shore Economic and you may Loan Depot.

When measuring because of the value of money, Wells Fargo is actually third at $159 mil, JPMorgan are fifth during the $134 cash advance online West Virginia million and you can Financial off The united states Corp. are seventh from the $85 million.

Bloomberg News reported within the an enthusiastic Aug. fourteen post one Wells Fargo is actually move back off delivering financing to possess mortgage loans created by third-party lenders, and helping Government Casing Government fund.

However,, Perhaps my personal section is actually we are really not finding becoming extremely higher regarding the mortgage team for the new sake of being in the mortgage providers.

Not the only one

The blend off far more fintech lenders, tightened up financing requirements because the casing bubble burst of 2008-eleven, and you may a sharp fall-from yet this present year in refinancing pastime enjoys most other banks questioning its part and you can size on the sector.

This new Financial Bankers Association’s home loan statement, create Aug. twenty two, receive all home loan originations provides fell forty eight% away from 3.55 billion on the next quarter from 2021 to a single.85 million in the 2nd quarter of 2022.

Truist chief monetary manager Daryl Bible said within the bank’s meeting label with analysts one highest rates of interest was pushing loan amounts and you can obtain-on-sale margins.

Truist leader Bill Rogers advised experts that financial probably (would-be) a small apartment second half of the season (compared to) the original 1 / 2 of the entire year.

Tim Wennes, chief executive of You.S. section to have Santander, told CNBC that bank’s choice to go away home-based financial lending into the February was motivated mainly from the lowering of home loan volumes. It has set its credit work at vehicles funds, that are giving high productivity.

For most, particularly the faster associations, almost all of the financial volume is actually refinance craft, which is drying up-and may drive good shakeout, Wennes told you.

Fintech positives and negatives

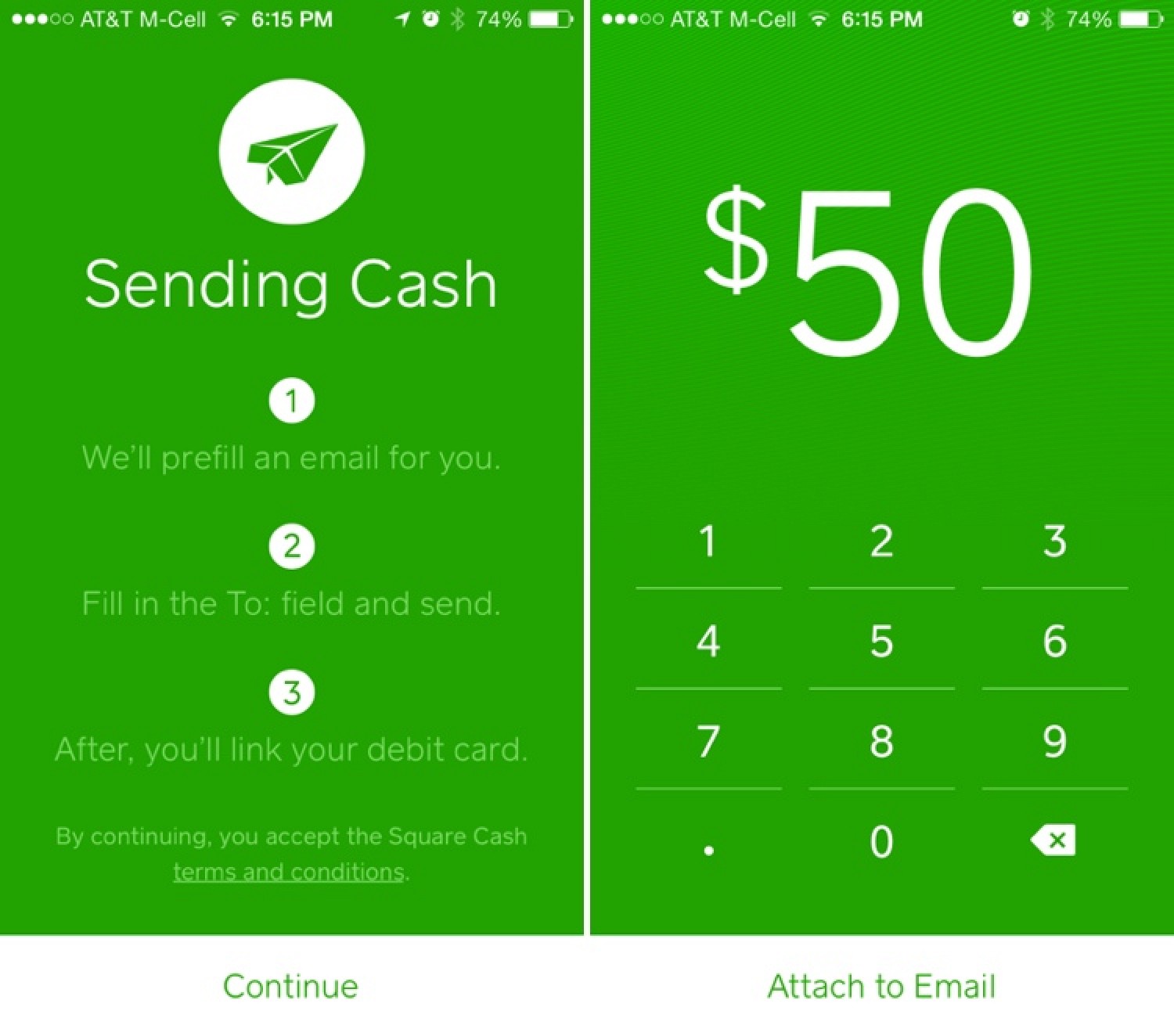

An instant and you will smooth method ‘s the main competitive advantage one to fintechs has actually more than conventional finance companies, borrowing from the bank unions or other traditional lenders.

Fintechs has established the lifestyle to your finest using larger investigation, investigation analytics, advanced formulas, and you can phony cleverness – and this enable choice loan providers to raised assess borrower’s creditworthiness and you will visited over the years lower than-served communities, penned Sandra Lankford in the a beneficial July twenty two site to your search business Wolters Kluwer.

Someone and you may businesses submit its suggestions on the web otherwise compliment of an app, publish records electronically, and possess one-point off exposure to the lender.

Choice loan providers are not the right choice for everyone home-based otherwise commercial borrowers. Consumers buy an educated interest rates and terms, that will nevertheless come from finance companies.

Though fintech businesses are known for scientific developments and you may bringing functions eg digital mortgage loans, pointers defense remains a top concern, she told you. At exactly the same time, the federal government cannot control low-bank loan providers due to the fact firmly because the finance companies.

The solutions

Of a lot antique banking institutions and you may borrowing commitment possess responded to the new fintech competition of the seeking to accept a number of the same large studies analytics.

Such as, Truist might have been broadening with the a digital-basic method released inside 2019 of the predecessor BB&T Corp. and its chairman and you will chief executive Kelly Queen.

Initially called Disturb otherwise pass away, the financial institution softened the phrase so you’re able to Disturb and you can flourish as it connected fake cleverness and you can robotics with the the back-workplace, customer-service and you can compliance functions.

Comments are Closed