Brokers play trick region during the the brand new Athena money

Its an indication of just how undoubtedly Athena Lenders beliefs the next-cluster channel which co-designed its the newest loan offerings in concert with mortgage brokers.

Athena launched its the suite off Tailored financial loans, which includes Mind-Functioning Lite Doctor and you will 80 85% No LMI, towards Tuesday.

The brand new non-financial financial told you they might deliver unequaled representative and you can avoid customers sense, scaled with faithful BDM assistance and you will borrowing communities having quick workshopping.

Ahena federal BDM specialised factors Stephane Feuillye (envisioned over left) told you the company accepted the latest crucial need for agents in the mortgage business.

Brokers display an extremely equivalent objective to help you Athena where it occur to own finest benefit and you can experience for people, Feuillye said. It aligns thus directly which have Athena’s mission to change lenders once and for all. Setting brokers right up for achievement is actually eventually vital that you Athena.

Feuillye told you it was as to why Athena try obsessed with strong partnerships in which they co-created the equipment and you can solution experiences they required, and those that its consumers expected.

I co-tailored the Customized product experience myself with agents to deliver to your the fresh underserved needs of higher level borrower cohort, told you Athena Ceo Hudson banks for personal loans and you may co-maker Nathan Walsh (envisioned a lot more than right).

Tailored finance to have borrowers

Along with the Notice-Employed Lite Doctor and you will 80% – 85% No LMI, being now available, Athena is even opening a low-Natural Persons and Trusts device when you look at the Sep.

These items would be made available to agents compliment of a couple of aggregators the latest white label Mortgage Solutions Versatility Tailored diversity, in order to LMG courtesy Athena Tailored.

Feuillye said Thinking-Operating Lite Doctor was made to have consumers into the an effective economic reputation but which expected specific liberty within the paperwork that they had to include.

Particularly, rooms the income tax come back is not aligned to when they want to make a progress construction financing, the guy told you.

All of our formula promote flexible income verification, and our wide product range does mean they don’t need visit you to definitely bank getting an effective lite doc unit following go somewhere some other and go through the whole process once more once he or she is prepared to proceed to complete doc.

An alternate key feature advised of the agent co-design was Tailored’s personalised pricing. Feuillye said that it accepted that not all entrepreneurs was in fact the brand new exact same. We should be rather fulfilling users for their business options having a speed one to reflects their state.

Tailored’s 80 85% No LMI provider served a great individuals exactly who will had bucks tied up up in other potential and didn’t need to decelerate getting into the business otherwise desired extra freedom without having any price of LMI.

Feuillye said whenever revealed inside the Sep, the fresh non-trade trusts and you may people product would offer an answer for dealers and you can care about-working individuals looking for an enhanced cure for construction their house expenditures.

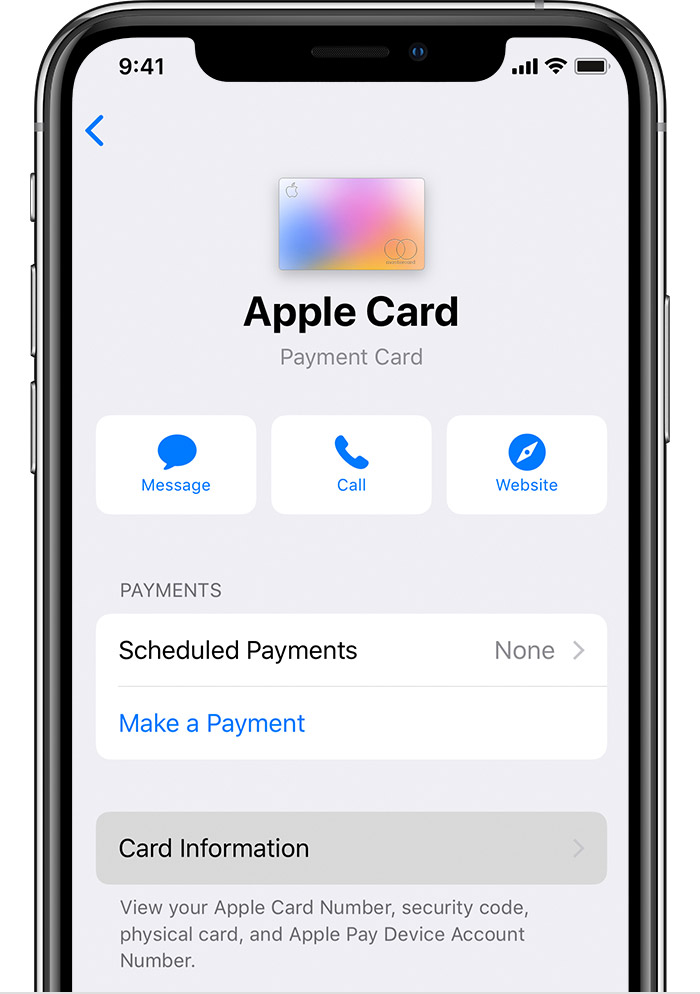

An entire room now offers our very own rich have: splits, offsets, multi-security and you will a rich digital experience in brand new mobile application. This will be supported by great prices and you can costs, including best in industry SLAs and you will representative assistance, the guy said.

Agent viewpoints assisted Athena

Walsh told you a significant part out-of Athena’s proposition and another off this new keys to the latest victory it was feeling having its aggregator couples are a persistent method of listening to broker opinions.

Getting that notion what’s higher, in which will there be work to would, in which certainly are the opportunities to consider exactly how we will perform one thing in a different way, said Walsh.

There is certainly a keen underserved section of people and self-operating consumers who need so much more liberty in terms of their financials, plus are entitled to a fully appeared product.

Once you glance at most tailored factors to be had, he or she is rather first, while these things gives splits, offsets, multi-security and you will a refreshing electronic knowledge of new mobile application.

Increase for BDM and you can credit organizations

Athena even offers strengthened its BDM and you may borrowing from the bank communities that have the latest employs. Walsh told you it had extra generous knowledge of advanced financing circumstances.

Our company is purchased maintaining the reputation of the means to access, reliability and rates across the both of these organizations. The first size throughout these groups might possibly be tracked lined up to help you volume and we’ll continue to generate as needed.

I’ve been supporting agents to enhance the companies to own much of my personal 20+ 12 months career home based loans, Feuillye said. Being able to accomplish that on Athena … is one thing I am genuinely enthusiastic about.

Athena to your gains trajectory

The fresh new low-financial fintech was depending in the by Walsh and co-inventor Michael Starkey that have a goal to improve lenders once and for all.

Initially, all of our interest was to your prime proprietor occupier and you can buyer places; with those individuals facts completely inside market, it was time to resolve the next options, Walsh told you. I consulted having brokers widely so you’re able to proportions those individuals markets towards better you need, and identified Customized just like the next section of notice.

Thus far, Athena features paid $seven.5 billion money and all the products it makes are noted on serviceability aggregator Quickli, recognising the significance of it representative tool.

Starkey told you Athena proceeded in order to level right up listing RMBS financing, just like the present in February for the $1bn Olympus contract. The guy said that it effects are off the right back regarding good individual demand for securitised financial obligation, along with the new business’ progress thanks to top quality financing.

Within both a consumer and you will an industry peak, i have focused on strengthening a business having a track record getting prioritising transparency, fairness and you may stability to deliver effective worth, said Starkey.

The point that we likewise have solid variety in financing at the an investment level that have funding out-of major regional and offshore banks represents the entire standing of our own team in the business.

Comments are Closed