How long Will it Take Banking institutions To Agree A home loan In Southern AFRICA?

Providing a home loan the most crucial actions so you’re able to are a property owner. But how really does the text software techniques work and exactly how much time can it simply take finance companies in order to approve a home loan inside the Southern area Africa? We’re happy your expected! Firstly, it is important to observe that the amount of time it does grab for acceptance can differ away from person to person and you can lender to help you bank. For the reason that a mortgage application’s success is determined by several different items you to definitely impact both lender and yourself. For example, your own credit record and also how big is your own deposit you will definitely apply to just how much you can afford. Yet not, you will find several mediocre waiting minutes as possible loosely plan doing.

Preferably, it may need a minimum of one day to acquire done approval; although not, due to application backlogs, waits or people maybe not meeting what’s needed, the method is postponed for at least 2 to 4 days at the most. Stanley Mabulu, Channel Government Lead within FNB Lenders (quoted out of Businesstech on the web declaration).

When you pick possessions the very first time and implement for a home loan, you could find on your own concerned about the method. Fortunately that facts what you need to carry out and you will what you are able anticipate can take a lot of the stress outside of the process. Anyway, you need to take pleasure in your own travels of getting the first property while the very much like you can. These are pleasing times! On top of that, into info our company is going to display, you can initiate the process with confidence!

1: Score Pre-Accredited

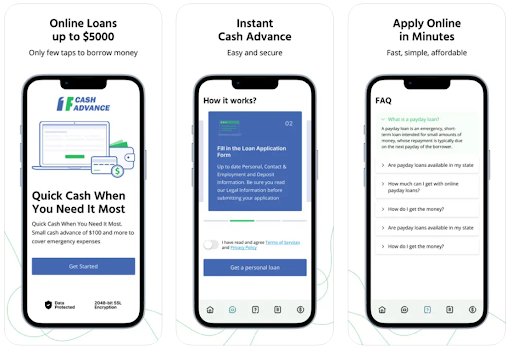

Talk about your finances to see if you can be comfortably manage home financing towards the top of your current expenses. After you are feeling confident, www.cashadvanceamerica.net/title-loans-co/ it is usually told that you buy on your own pre-accredited. By doing this you can avoid picking out the home of your dreams then having it is way-out of your house mortgage budget. Providing pre-qualified will provide you with a so good manifestation of just how effective you are able to getting to the finance companies.

2: Pick Your property

You should have a property in mind after you pertain having a mortgage up until the financial will help. Consult with one of the best auctions and check out functions for sale in your own need metropolitan areas. After you select the domestic and your provide could have been recognized, you may then make an application for a home loan. Ideal tip: prior to any has the benefit of, if you find alternatives you adore on line, constantly generate a consultation to possess a bona fide-existence seeing. Pay close attention to the size and style, features and you will condition of the house and, before you sign the fresh new legally joining OTP, definitely read all of the associated files cautiously.

Step three: Indication Give to purchase

After you’ve found the house you’d like to get, both you and the vendor commonly sign the deal purchasing. It should identify the standards getting found of the both parties. The deal to acquire want to make allotment about how to see your own necessary financing. It should likewise incorporate a good 72-hr term whereby the seller can invariably field the house whenever you are their bring remains pending financial support, however, if it obtain a good offer, chances are they have to offer 72-hours’ observe in order to safer capital and get away from losing out into the household. This is exactly why it’s important add your residence application for the loan the fresh new second you have the closed Offer to purchase. By doing this you are able to we hope get the financing so you’re able to back their offer as soon as possible therefore, the deal shall be finalised.

Comments are Closed