advance america loan payday

now browsing by category

Can be an FHA Financing Be used on accommodations Property?

To acquire an investment property so you’re able to rent is one way so you’re able to pursue strengthening money because of home. Specific better-known You.S. a home moguls started with the exact same short expenditures and you will built up its profiles through the years.

There is no be certain that the first money can be the origin abreast of you carry out a genuine estate kingdom. However, having a rental possessions does offer the possibility to produce recurring inactive earnings and you will house admiration. Read More >

As to the reasons Mortgage loans Is actually Rejected: 50 Reasons You are Denied a home loan

Taking home financing is never a yes point, even when you may be new richest individual in the world. And even when you have the best 850 FICO rating.

You’ll find loads of underwriting direction that really must be met to help you qualify for a home loan, for both new borrower together with possessions. Very perhaps the most creditworthy debtor could nonetheless come across roadblocks in the process.

In reality, the big lending company in the united states, Wells Fargo, rejected 84,687 of your 399,911 household get apps it gotten (21.2% getting rejected price) loan places Paonia, and additionally those people that have been pre-accepted, according to an excellent Marketwatch study. Read More >

FHA Lenders: The reasons why you Need certainly to Haggle With the Supplier

Of several first-day homebuyers dislike the very thought of settling, haggling, or otherwise looking to to switch the price of the house that have a supplier. Into the a beneficial seller’s markets there’s not much discussing it is possible to, the simple truth is. But when standards be much more good into the debtor, settling may be to the advantage. Why must An initial-Go out House Client End up being Happy to Discuss On the Provider? Probably the most visible reasoning so you can haggle toward merchant of a residential property you prefer is to find a lesser price. It becomes significantly more extremely important whether your appraisal returns all the way down compared to property’s price tag. The consumer cannot be obligated to romantic the deal within the cases the spot where the home’s appraised worth is gloomier versus price tag. The new FHA financial itself would be issued having | way more.

Factors For choosing Very first House or apartment with A keen FHA Financial

First-time homebuyers searching for Iowa installment loans their first family and you will an using bank to apply for an enthusiastic FHA mortgage loan might not see what he is trying to find inside the another house within basic. Since you go on the house possession journey, numerous things will become a great deal more noticeable. Whenever planning for very first mortgage and you will planning your borrowing so you can use, contemplate these types of concerns. To buy A primary The home of Fit Future Means Couples deciding on their first domestic is invited alterations in household members size, means to possess an interest space otherwise a faithful workplace, and you may room to enhance having chairs and other property. Read More >

Things to Look out for in a residential property

Owning a home can also be broaden an investment profile, getting an equilibrium facing much more erratic assets like stocks and you will ties. From the including tangible possessions for example property, buyers can aid in reducing complete risk and get to an even more steady economic portfolio. This diversification is very helpful throughout the economic downturns whenever traditional expenditures might underperform.

Diversification Off Capital Portfolio

Investment is also diversify a financial investment portfolio, providing a balance facing even more erratic property such brings and you can ties. Of the together with tangible property particularly assets, traders can reduce complete chance and go a more steady economic profile. This variation is very of good use throughout financial downturns whenever conventional expenditures you’ll underperform.

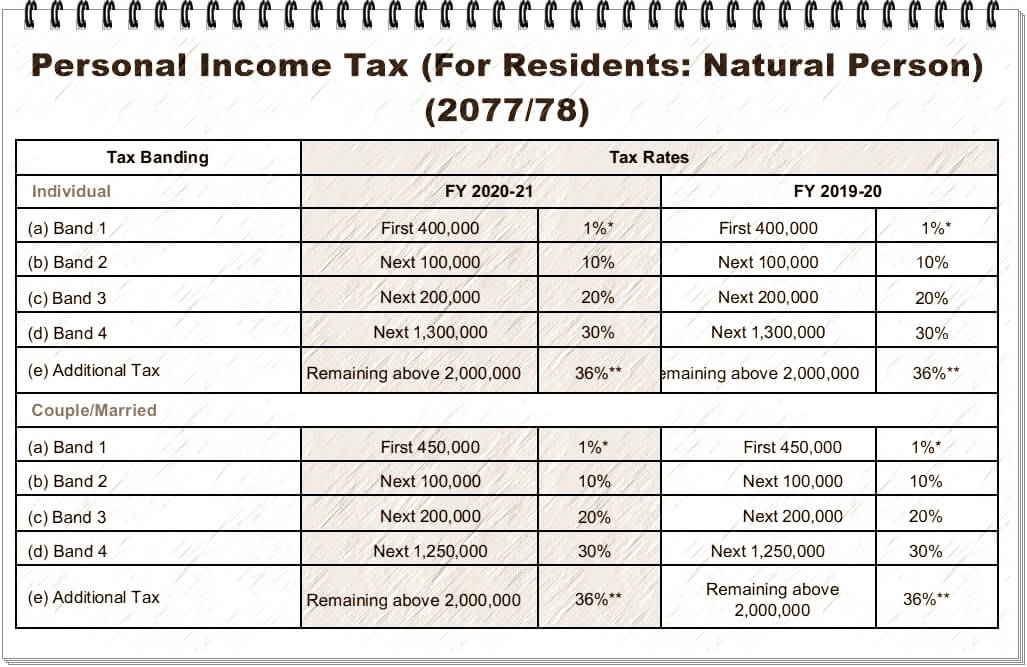

Taxation Experts

Providing investment property finance and managing investment property could possibly offer various income tax deductions, that somewhat get rid of taxable earnings. These types of deductions are mortgage appeal, possessions taxes, functioning expenses, depreciation, and you can costs for solutions and restoration. Such as for instance taxation experts can be improve the complete profitability of financial support.

Inflation HEDGE

A residential property opportunities usually are noticed an effective hedge facing rising cost of living, given that property viewpoints and you may leasing money normally raise with ascending rising cost of living. This is why as cost of living grows, therefore does the value of a house and earnings they yields, protecting the newest investor’s to buy fuel. Rising cost of living hedging are an option good reason why seasoned buyers imagine funding assets loans and include a property investment within profiles.

Influence

Real estate allows the use of leverage, meaning you might handle a massive advantage which have a relatively brief quantity of initial capital. Read More >

Mortgage prices disperse large, but refis was returning to healthier levels

After a long refuse fueled because of the all the way down rising cost of living and you can an air conditioning work sector, financial costs seem to have bottomed away for now

- Simply click to fairly share for the LinkedIn (Reveals for the brand new screen)

- Simply click so you can current email address a relationship to a pal (Opens within the the brand new screen)

- Click to express with the Texts (Opens in the newest window)

- Click to copy hook up (Opens up in brand new windows)

Shortly after an extended decline precipitated by the all the way down rising prices, a cooling labor industry and you may tips from a national Reserve policy alter, home loan cost seem to have bottomed aside for now. Read More >

Everything you need to Realize about To find property during the Pre-Property foreclosure

Whilst costs from real estate properties into the Ny try rising gradually, it’s still possible for the average American to get the think of homeownership from the opting for pre-foreclosed residential property. Property in the pre-foreclosure are obtainable from the lower pricing than just the actual sector value. Thus, if you are searching purchasing a house in the sensible prices, a property for the pre-foreclosure is a great financial deal to you. But not, a realistic means is required to make a financially sound decision.

Advantages of To order a good Pre-Property foreclosure Possessions

- Less Competition: Battle try faster because most properties aren’t noted.

- Short To get Process: Quick and simple home buying techniques as most people try desperate to sell the home as quickly as possible to get rid of property foreclosure.

- Excellent deals: You can negotiate and buy the property for less than the current market speed.

- Finest Neighborhood: Likelihood of delivering assets during the a much better people.

Pick Pre-Foreclosure Guides

Firstly you will want to select legitimate pre-foreclosure prospects. It would be a daunting task because so many pre-foreclosures functions are not detailed. Thus, roll-up your own sleeves and commence because of the planning a summary of areas where you want to has actually a house. Just after it is done, it is possible to make a diagnosis by the looking at public information or regional push after which check out men and women elements in person to discover more on pre-foreclosed property. Read More >