how to get a cash advance from a bank credit

now browsing by category

Perfect Line protected line of credit borrower requirements

You continue to need offer a personal verify regardless of if zero guarantee is required. Into the Home business Virtue personal line of credit, for every manager delivering a promise have to have at the very least 20% attract, with all of finalizing citizens along carrying 51% demand for the firm or maybe more.

SBA 7(a) loans

SBA eight(a) fund try identity financing that can be used getting a number of different objectives. Wells Fargo contours well-known uses of their SBA 7(a) loans particularly once the:

- Company order

- Companion pick-aside

- Increasing your company to the next

- A home purchases

- Products instructions

The maximum amount you might borrow is $5,000,000. Terminology is just as a lot of time as the 3 hundred months (or twenty five years) whenever you are using the financing to possess industrial a residential property. Otherwise, the latest maximum title try 120 days (10 years). Rates are going to be possibly repaired or variable, and tend to be susceptible to SBA interest rate maximums. This new SBA do costs costs in order to financial institutions in the event it factors such funds, and it is extremely possible that you will see Wells Fargo admission such fees onto your because the borrower, whether or not Wells Fargo doesn’t publicly disclose charge for SBA situations.

SBA 504/CDC funds

SBA 504 money are designed getting construction or a house purposes. Read More >

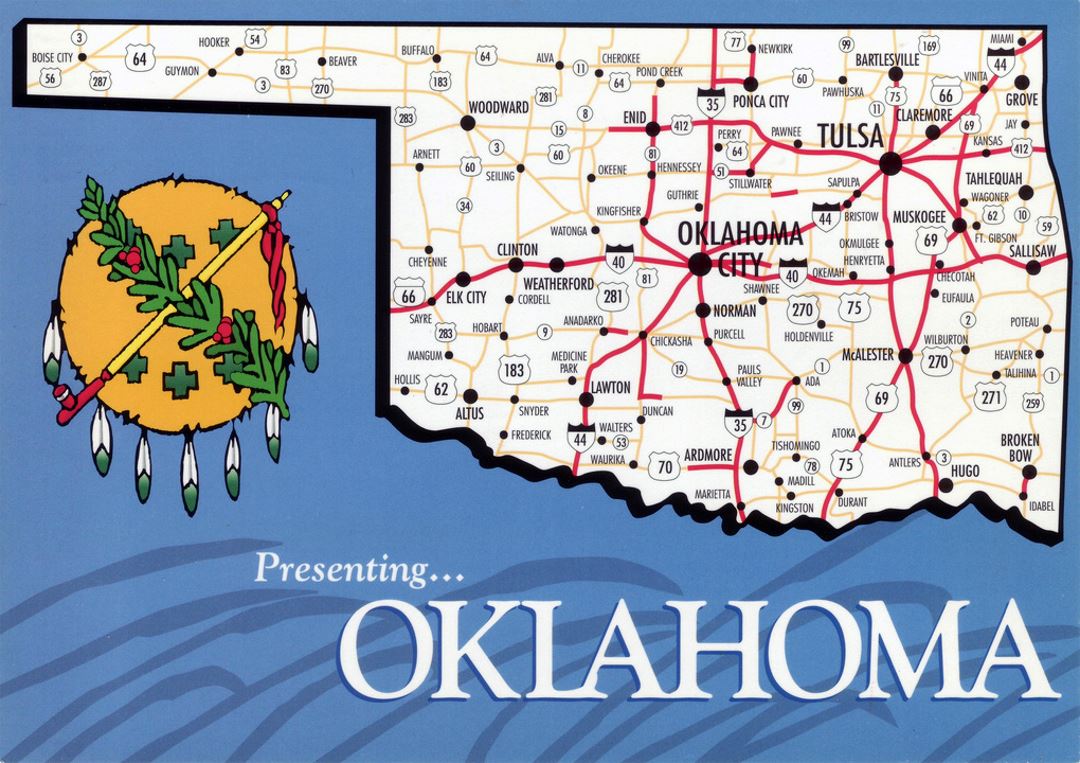

Conforming and FHA Financing Restrictions by Condition

Summary of Alaska Mortgages

Alaska is the largest state regarding You.S. with regards to square mileage, however it keeps an inhabitants less than 1 million, it is therefore many sparsely populated condition. If you find yourself looking to purchase a house right here, luckily for us that financial cost for the Alaska remain this new national mediocre. But not, home prices are higher than the new You.S. average. Alaskan counties’ compliant loan restrictions are from the large mark, and you can FHA loan limitations was higher during the almost a couple-thirds of your nation’s counties.

National Mortgage Prices

- Alaska assets taxes

- Alaska old-age taxes

- Alaska tax calculator

- Find out more about financial cost

- How much cash home is it possible you manage

- Assess month-to-month mortgage repayments

- Infographic: Greatest towns to locate a mortgage

Alaska Mortgage loans Analysis

Alaskan a home is more pricey than just average. Inside the Alaska, the new median household value is $304,900, that is more than the brand new federal median household value of $281,eight hundred, with regards to the You.S. Census Bureau.

The compliant mortgage restrict for every single county throughout the condition is $1,089,300, that’s higher than the high quality $472,030. Read More >

How to Reduce Loan providers Mortgage Insurance policies (LMI) Can cost you

Questionnaire Housing market

There has been much discuss the Questionnaire property business over the past 18 months, it’s difficult to keep up. The next the marketplace is roaring, another it’s reducing. No surprise people are confused. After the previous interest rate develops plus the media anticipating a beneficial doomsday assets freeze, simply a little modification when you look at the assets costs is seen. While other people experts’ are flagging a decline inside the property cost as high as 50%, they are the exact same experts’ which said the property sector manage freeze when Covid-19 strike. In reality assets prices enhanced by the as much as 40% in some portion whenever Covid-19 lockdowns struck, so we manage recommend getting expert’ views having a whole grain out-of salt.

Focusing on how the house marketplace is working and you may hence suburbs are proving all the way down thinking is expected regarding a questionnaire mortgage broker. Ensuring that the financial institution valuation of the home rises against the cost otherwise re-finance number is paramount to making certain good financial acceptance. Read More >

Preciselywhat are some suggestions to get an informed mortgage cost?

Since the newest Given features technically pivoted so you can rate cuts, mortgage rates are essential to continue easing. But not, experts fret that it will end up being a progressive process. The newest Given won’t beat rates at once, otherwise right away, until you can find signs and symptoms of a pending financial crisis.

Within his remarks pursuing the Sept. 18 plan conference, Provided Couch Jerome Powell told you, Once we normalize cost, you’ll see new housing industry normalize. not, the guy including accepted that other problems hurting the new housing market — highest home prices and lowest directory — aren’t fixable from the central lender.

Will financial rates fall-in 2024?

Financial prices have previously fallen around step one% off their 2024 level. Following the basic 0.5% rate losing Sep, brand new Provided is actually projecting reducing cost by the a unique half a percentage this season, with an increase of incisions for the 2025.

Home loan rates had been popular down given that later , and that will almost certainly remain in case the Provided incisions pricing as a result of the remainder of this current year, said Matt Vernon, direct out-of consumer financing at Financial regarding The united states. Read More >