is cash usa a payday loan

now browsing by category

PBOC QE and you will a re also-acceleration out-of financial borrowing from the bank development needs time to work

There’ll not at all end up being inflows on Hong-kong-detailed Bitcoin Exchange Exchanged Loans (ETF). If financing is streaming southbound into Hong-kong avenues compliment of Stock Hook, they aren’t used to buy home-based equities or assets. This is why Mainland Chinese might be forbidden regarding to buy Hong Kong Bitcoin ETFs. Soz to you issuers purchasing the individuals costly advertising inside the latest Hong kong city programs – Beijing ain’t going to ensure it is that easy getting comrades to help you get Bitcoin exposure.

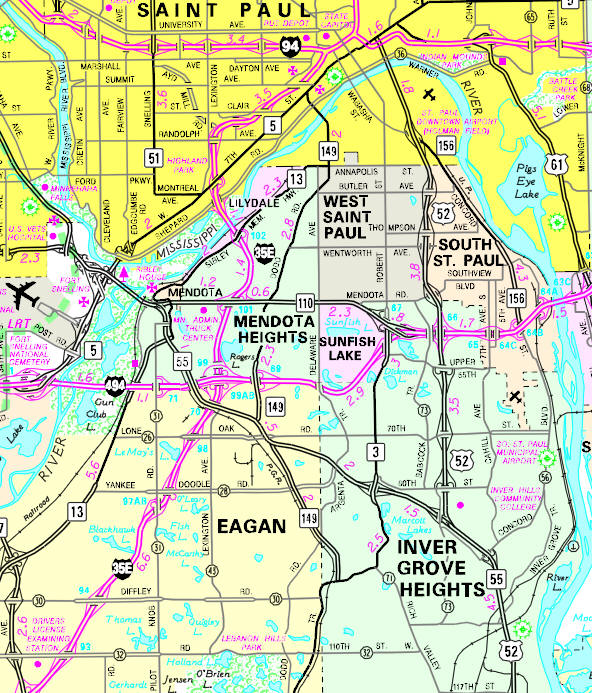

As i will not have a map out of inflows with the a great domestically listed Bitcoin tracker product otherwise a good Bitcoin/CNY price ticker to review, I know one carries and property underperform a boost in the fresh new central bank’s equilibrium sheet. Read More >

What is the difference in pre-acceptance and you may pre-qualification?

The fresh new small respond to: Yes-financial pre-recognition make a difference their borrowing from the bank. But not, it mainly depends on which type of credit assessment their bank really does. To know about the essential difference between a difficult credit assessment and you may a smooth credit assessment, pre-recognition and pre-degree, keep reading.

Why does mortgage pre-acceptance performs?

Home loan pre-recognition happens when a lending company confirms your financial suggestions to approve you for an interest rate. Before selecting qualities, you should always contact a lending company locate a concept of the amount borrowed might be eligible for.

Regarding the mortgage pre-recognition techniques, home financing professional feedback your financial guidance to decide just what financial financing you are eligible for and provide you with mortgage choices in advance of giving you an in depth guess. You to definitely guidance usually includes the month-to-month mortgage payment, their rate of interest, in addition to closing rates.

This new monetary information the mortgage expert reviews during the pre-acceptance process is then regularly dictate the rate you qualify for together with home loan number. New monetary guidance usually assessed will probably be your credit rating, credit history, spend stubs, tax statements, month-to-month personal debt costs, financial comments, and you can homes fee background.

Constantly, the financial pre-approval was best for as much as 3 months. The rate and you will home loan the latest professional provides for your requirements tend to also have a professional function to work payday loans Mckenzie well with if you’re trying to find characteristics. It will allow you to budget for the mortgage payments and figure out the highest value of you’ll be able to to purchase.

The top difference between pre-recognition and pre-qualification getting a mortgage is that pre-acceptance spends verified guidance to help you accept you for a loan and pre-degree will not. Read More >

Reverse Mortgage loans (Money Having fun with Domestic Guarantee Sales)

Well-known Info

- Ways to get An opposing Home loan

- Other problems To take on

Regarding the Contrary Mortgages (Finance Having fun with Household Collateral Sales)

An other home loan is a type of mortgage offered to homeowners who are about 62 years of age. Reverse mortgage loans is a method getting old home owners so you can borrow funds in accordance with the equity within home. Contrary mortgage loans can be a useful product to have property owners in later years. It is critical to think about the terms and conditions, can cost you, and dangers of obtaining one. A number of the dangers regarding bringing an opposite mortgage get become dropping your house in order to property foreclosure, heirs can get inherit quicker, the newest financial will set you back and expenses associated, complications with what you can do to get retirement benefits, or other challenge such statutes and caveats in order to reverse mortgages. You should be careful of one contrary home loan bring if you do not can understand the terms and conditions really.

All you have to Discover

An opposing home loan functions the lending company in fact and also make repayments to you. You might want to rating a lump sum payment, monthly payments, a line of credit, or specific blend of people options. The attention and you can charges associated score folded to the reverse financial mortgage balance each month. It means the quantity you owe grows through the years, while your residence guarantee decrease. You are able to secure the label to your residence the whole big date, additionally the balance isn’t really owed unless you get out or die. Whenever the period arrives, proceeds from the newest residence’s selling are widely used to repay brand new financial obligation. If there’s one equity remaining, it is on the estate. Read More >