no credit check loans payday

now browsing by category

Just like the a lending company, we believe really highly concerning the equity in our loan conditions

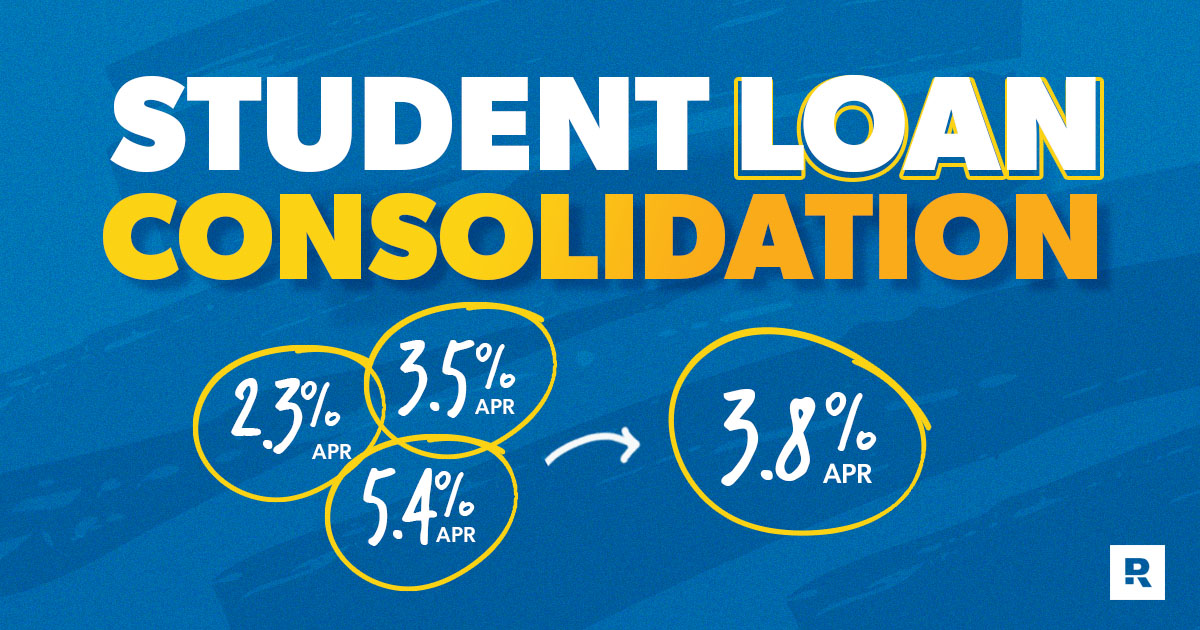

Do you know the Great things about Refinancing?

Refinancing is a great alternative since the most of the time, the individual is basically taking a far greater deal. Why which you re-finance really does not matter once the at the days end, you do therefore attain specific experts. Depending on your needs and you will choice, other refinancing solutions can assist you to gain access to some it really is great rewards

Straight down Monthly obligations

One of the primary benefits associated with refinancing would be the fact in lots of instances, you can reduce your payment. Your own payment is sometimes determined by how big is your own mortgage and your rate of interest. Because your financing will often be shorter additionally the terminology commonly be renegotiated, its extremely possible for one actually spend less for every single times by refinancing your own cellular family.

Monthly payments are extremely highest, particularly if you are on a fixed income. Read More >

To acquire a home out of an NRI? Your residence mortgage will be capped at 60% of value

Conclusion

- Brand new TDS component is actually a significant situation whenever trying a house mortgage since the bank doesn’t fund they. A house consumer possess a few solutions: inquire the brand new NRI vendor to track down a lower TDS certification otherwise spend the money for taxation in the down payment

Mumbai-created citizen Chitransh had in the end receive their dream domestic. The guy as well as the supplier, a keen NRI, decided on a repayment construction: 10% given that an effective token count, 15% within a month, and also the remaining after securing financing throughout the financial. Our home rates are ? 2.six crore, and you will Chitransh wanted to fund ? step one.95 crore as a result of a loan.

However, his bundle dropped aside as he contacted a financial to have good mortgage. The mortgage movie director advised your the mortgage wouldn’t safety the % TDS otherwise taxation subtracted at supply he must put towards Tax Agency.

During the a property sales, the customer have to put 20% (surcharge and cess a lot more) of property’s overall sales well worth, and not only the profits, because TDS when the supplier is an NRI.

Which meant I got to pay almost 50% of your really worth away from my personal pouch, which had been impossible in my situation,” told you Chitransh, just who desired to just use his first title. “I inquired owner easily could use the fresh advance payment getting TDS, but he advised I am able to only use about 10% of the twenty-five% I’d to spend him in the 1st week when he expected the remainder financing having his son’s relationships

We nonetheless had a need to shell out nearly ? Read More >

Ideal for brief mortgage number: Connexus Credit Relationship

When you have a checking account with Flagstar, you can score a good 0.25% rate write off for individuals who set-up automatic loan money out of your membership.

The conclusion: Connexus Credit Commitment now offers quicker financing wide variety, smaller conditions, and increased maximum CLTV, therefore it is an affordable selection for borrowers seeking financing smaller tactics otherwise keep their interest costs off. Read More >

When Was A home Collateral Loan Right for Me personally?

- You may also face a foreclosure risk. If you are not capable of making payments, the financial institution can get seize the house your utilized just like the collateral.

- You only pay closing costs whether your household equity borrowing from the bank is actually one types of apart from an unsecured loan.

- You should make one or two home loan repaymentsone to into present financial together with almost every other to suit your the fresh new household collateral financing.

Advantages and disadvantages Of money-aside Refinance

- You can buy a special home loan with greatest financing terms and conditions and you can rates of interest.

- You need to use the money-aside total pay back your own high desire borrowing-credit and private finance.

- Substitution your current mortgage with a new you to definitely helps make the loan title prolonged (restriction three decades), lowering your repayment numbers.

- You may want to face a foreclosure chance if you’re not able to generate payments.

- Since your mortgage name offers aside with the the new home loan, thus do that point where you make attract payments. Read More >