who is cash advance?

now browsing by category

What things regulate how far your instalments try?

- The total amount your acquire, also referred to as the borrowed funds principal.

- Their interest rate, or the portion of the mortgage principal you need to pay annually on top of people dominant money.

- The duration of the loan. Essentially, the new prolonged the loan identity, the reduced your monthly payments was although far more attention you can spend in the end.

- People constant charges and charges. This may is membership charge, including provider and you will management costs, in addition to loan providers home loan insurance rates (LMI).

6 approaches for very first homebuyers making an application for a mortgage

All you need to know about seeking and you will, first off, protecting very first mortgage so that you can score on to the home steps as quickly as possible.

The information within article will be out of a general nature only. Read More >

How can Va Funds Are employed in Idaho

Idaho helps make good location to calm down for experts and you will active-obligation services players by the low cost off lifestyle they also offers. Whether you are thinking of moving Idaho or an existing citizen, to purchase another home is an exciting chance of another initiate. And you can, when you are an experienced or provider affiliate, you’ll save on the mortgage having an enthusiastic Idaho Virtual assistant household loan.

There are many benefits associated with making an application for Virtual assistant lenders during the Idaho, in addition to 0% down-payment, all the way down interest rates, and you will a simple acceptance processes with Griffin Financial support.

Elements We Serve

:max_bytes(150000):strip_icc()/terms_t_termloan_FINAL-c1e9e252157e408c8f0f549338f2411b.jpg)

Griffin Financing is actually seriously interested in serving our very own Idaho veterans and you can bringing these with a knowledgeable financing to assist them go its needs. Regardless if you are searching for a mortgage solution when you look at the Boise, ID, or Nampa, ID, we could assist. We offer Va funds on the following parts:

- Boise City

- Meridian

- Nampa

- Idaho Drops

- Caldwell

- Pocatello

- Coeur d’Alene

- Twin Falls

- Article Falls

The audience is signed up to incorporate loans to any or all Idaho citizens, not just the individuals listed, therefore make sure to call us to go over your choices for Virtual assistant funds.

Va home loans functions exactly the same way when you look at the Idaho which they create in any most other condition. This type of money, when you find yourself guaranteed of the Service away from Veterans Issues (VA) aren’t available through the Va. Read More >

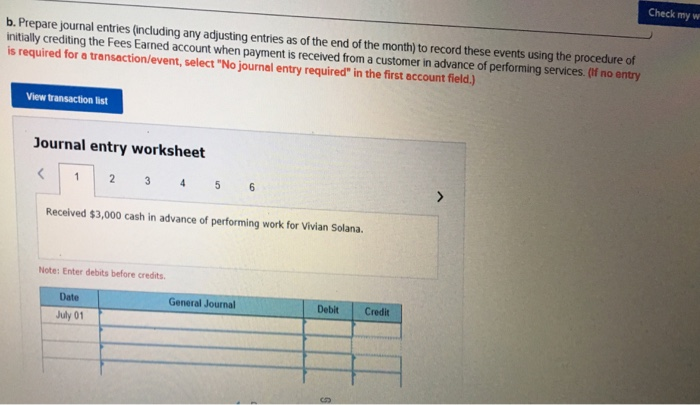

This considerably improves the efficiency away from underwriting a loan

The cash to possess an advance payment is going to be talented, and the review path to help with the brand new current is fairly simple. Just be sure to evaluate along with your taxation provider with the effects away from gifting a downpayment.

This is when old-fashioned software are going to be simpler. Because of the data offered, you’ll find often assessment waivers otherwise waivers of value provided by DU or LP.

FHA Mortgage loans

FHA signifies Federal Property Administration. Their purpose is to try to give homeownership. The underlying mission isnt and also make an income, however they including never jobs due to the fact too big of a loss. FHA mortgage loans could be more expensive regarding highest desire costs on account of approving people with below mediocre borrowing from the bank.

FHA mortgages need way more administrative red tape. Per app will get a keen FHA case count, a beneficial CAIVRS statement, and you will a restricted Denial regarding Participation (LDP) / General Coverage Agreement (GSA), all the extracted from the FHA partnership. Having consumers which can’t obvious one of those accounts, a great deal more efforts are required towards financial software. Read More >

Might you get a house shortly after case of bankruptcy into the Delaware?

Sure, you can get on the a house once more immediately after a case of bankruptcy during the Delaware and every other county, but be equipped for large interest levels. A bankruptcy proceeding will stay in your credit report getting seven so you’re able to a decade, however it ends up affecting your borrowing somewhat immediately following two years if the you declaration might have been current truthfully. If you wish to get a mortgage just after a case of bankruptcy submitting call 302-703-0727 otherwise Incorporate Online

Make sure you look at your credit history a-year, and make sure that levels which were section of their personal bankruptcy was discharged. Attorneys get paid so you’re able to file the latest case of bankruptcy and also no notice to make sure that your credit report try particular following personal bankruptcy. Read More >

Submit an application for a mortgage on line, over the telephone otherwise on paper

Whether you are buying your first otherwise next house otherwise try investing in a home, and so are looking for home financing, our company is right here to assist. The second procedures provides you with an indication of our techniques to own an established domestic.

Name our very own dedicated home loan gurus to the 1300 747 747 Mon-Fri 9am-5pm AEST or strategy an appointment at your nearby part.

Our lending team will help know very well what financial options are most appropriate to you personally centered on your current financial predicament, conditions and you can objectives.

We’ll review the job and you will create a primary report about your own conditions. When the everything’s okay we will ticket that it onto a credit Assessor for a full assessment and you may acceptance.

A good Conditional Acceptance could be granted once we arrange the home is cherished, and we will inform you when the whatever else was outstanding.

Whenever we has actually what we you would like your application normally proceed and we’re going to material you which have a formal recognition. Immediately, all of our attorneys usually issue the loan package which has the fresh new official mortgage provide.

When you have the home loan pack, cautiously investigate loan preparations and you may small print before signing the newest data. Read More >

Applying for a business financing for rent house is just like making an application for a personal bank loan

Playing with a business financing for rental property helps you build a genuine property collection giving finance to purchase solitary otherwise multiple leasing characteristics and offer money to possess renovations and you will updates in order to improve local rental money.

You’ll find a multitude of financing options for somebody, however, looking for a business loan for rent possessions will often end up being eg running into a brick wall. Read More >

A review of leveraged finance and you may CLOs

Chris Galipeau, Elder is why Financial support Markets Steps category, recently spoke that have Scott M. D’Orsi, CFA, a portfolio Manager inside Putnam’s Fixed-income classification with the Active Knowledge podcast. He could be a portion of the cluster handling Putnam Drifting Speed Income Fund.

Scott D’Orsi: A beneficial CLO, or collateralized mortgage obligation, is basically an incredibly levered funds. It will be capitalized with about 90% debt that is structured on the several tranches (segments of a more impressive pond from ties), always four, regarding AAA down to BB. Addititionally there is a security tranche of about 10% otherwise shorter. Read More >