How do you Get A traditional Financing?

First-date home buyers will encounter the fresh new (and you can confusing) jargon if they are making an application for a home loan. “Compliant mortgage,” “fixed-speed,” and you can “money fee” are only several to mention. not, the quintessential complicated title undoubtedly try “antique mortgage.”

What is actually a normal mortgage? When the you will find old-fashioned mortgage loans, what exactly are unconventional mortgage loans? What is the difference between these two variety of home loans? We’ll address such inquiries and a lot more within article.

What exactly are Old-fashioned Mortgage loans?

A normal financial, called a conventional loan, is actually property consumer’s loan one funds 80% otherwise a reduced amount of the purchase price of the home. While the financing restriction are 80%, buyers need a good 20% advance payment saved up and you may available to them to be eligible for a normal financing.

If you are preserving this much tends to be simple for many people, of several earliest-big date homeowners provides a hard time saving right up such a massive down-payment number because they provides loans (e.grams., a great student loans).

Due to the fact limitation loan amount is 80% of mortgage, antique mortgage loans often have no form of higher-proportion or financial insurance fees. We’ll reach more on one later on.

Preciselywhat are Unconventional Mortgage loans?

Unconventional, non-antique, otherwise high proportion mortgages is the real opposite regarding conventional mortgages. Strange mortgage loans coverage more than 80% of your own total settlement costs.

- A poor obligations to income proportion (the amount of money a person spends paying down loans compared to their month-to-month earnings)

- A shaky source of income

- Faster deposit protected

- Down credit scores

In these cases, a client’s loan options become most restricted as finance companies and you may financial businesses are cautious about financing their money to individuals with this sorts of economic portfolios. Because of this, buyers have to choose mortgage loans backed by the federal government.

Fun fact: Non-old-fashioned mortgages must be backed by a federal government agencies. These mortgages protect the lending company, maybe not the new debtor.

Is actually Old-fashioned Mortgages The high quality?

It is essential to keep in mind that old-fashioned funds aren’t the fresh new standard; buyers must possess the absolute minimum advance payment of 5% for a first home or 20% to possess an investment property. You can nonetheless pick a property with no good 20% advance payment saved up, however it have additional financing constraints and legislation you want to check out.

The great benefits of Old-fashioned Money

Traditional money have many advantages as possible delight in. We shall enter depth on the some of the gurus you can take pleasure in for many who cut adequate to found a traditional mortgage.

A traditional loan is more beneficial for homeowners while they enjoys a great deal more collateral right at the start of their loan.

Just like the consumers having a traditional mortgage possess paid down a much bigger off payment because of their assets, he’s even more collateral inside their house. More guarantee can be quite beneficial because it brings people that have accessibility more substantial household security loan or house equity range of credit.

2. You should never Pay Home loan Insurance

Financial insurance covers lenders if for example the borrower non-payments on the mortgage payments. Insurance policies generally speaking will set you back 2.8% in order to 4.0% of the overall financial matter. Once you shell out individual financial insurance coverage (PMI) towards the top of your own mortgage loans, they throws a-strain on the capacity to make your monthly costs.

Fortunately, home loan insurance is always simply required for people loan that is more than 80% of your own home’s cost otherwise market value. Therefore, property owners with traditional financing don’t have to purchase financial insurance policies.

step three. More enjoyable Financing Standards

The borrowed funds business has conditions you to definitely individuals need to meet and you can go after. Such requirements are proving your credit score, revenue stream, and. If you are these types of terms and conditions usually are an identical, they can disagree according to whether you are acquiring a normal or large proportion mortgage.

Unconventional mortgages are offered in order to customers who possess a reduced off percentage, less than perfect credit score, etc. Since customers do not have what loan providers think a good ‘stable financial collection,’ they discovered stricter financing standards. Thus, they might need to go far above to show one to he or she is responsible consumers.

4. Lower Financial Cost

Commonly, consumers can be discover all the way down interest rates if they have a normal mortgage in lieu of an unconventional you to. The speed you will get is an important determinant of your bank account. Interest rate has an effect on the level of their month-to-month mortgage repayment and, as a result, the cost of their overall financing.

Eg, for individuals who safer a twenty five-season mortgage getting $eight hundred,000 which have a beneficial step 3% interest, you certainly will pay $146, for the demand for the fresh new 25 years. You are going to need to pay $253, inside desire if you have the exact same mortgage that have a beneficial 5% interest.

Borrowers usually merely receive down prices when they have a great credit score and you may the lowest financial obligation to money proportion. We advice getting your credit history to lenders understand just what rates they may be able offer you.

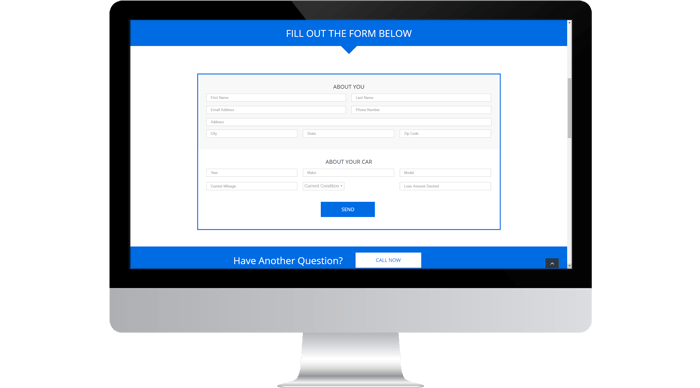

The first thing that you need to do would be to gather all content required by lending characteristics. You will have a copy of your own credit report, evidence of employment and you can people economic ideas to exhibit in order to potential loan providers.

Once you’ve you to guidance compiled, head to private loan providers like banking companies, credit unions, and you will financial organizations to ask a mortgage. I strongly recommend talking with a large financial company while they have a tendency to assist you in finding an educated costs.

Faq’s (FAQs): Bizarre Mortgage loans

Unconventional mortgages is actually low-antique mortgage brokers you to change from basic repaired-rates or variable-price mortgage loans. They often times have book enjoys, such as for example option degree requirements otherwise payment formations.

Antique mortgages follow simple lending guidance, if you find yourself bizarre mortgages deflect from these norms. Unconventional mortgages have lower credit rating conditions, interest-just money, or balloon money.

An attraction-only home loan lets consumers to blow just the appeal percentage of the mortgage to own a selected months, normally 5-a decade. Following this very first months, they must start paying off one another dominating and you may appeal.

Palms start with a predetermined interest rate to have a set months, immediately after which the interest rate adjusts sometimes centered on industry requirements. They’re sensed strange because of the uncertainty off upcoming interest change.

Subprime mortgages is actually fund accessible to borrowers with down credit ratings or shorter traditional borrowing histories. They often times provides highest rates of interest to compensate toward increased chance in order to loan providers.

Consumers get go for bizarre mortgage loans if they have book monetary points, such as for instance unusual income, limited credit score, or even the need for short-label capital.

The viability of a non-traditional financial depends on your unique financial points and you can desires. It is essential to cautiously check your capability to manage threats and you may talk to a mortgage professional and make the best decision.

Comments are Closed