How to get the most out of your house financing

Control your home loan the right path

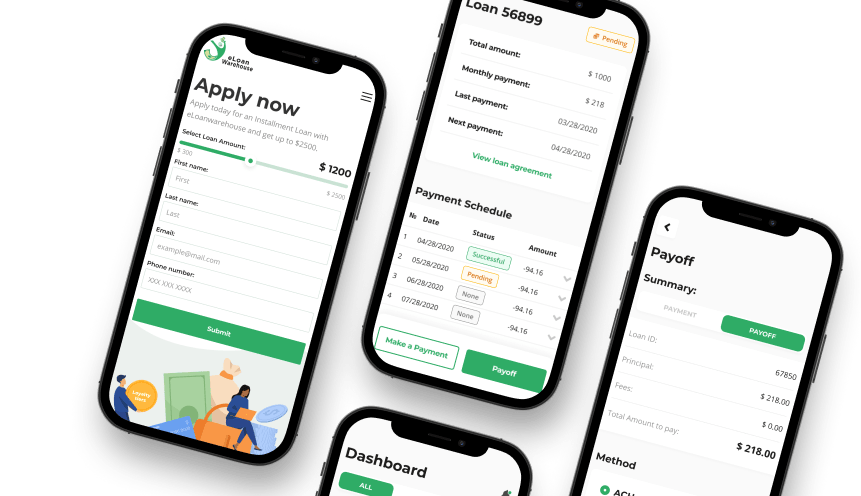

You have access to your finances simply and you will properly during the new disperse that have AMP’s digital choices: My Amp via pc as well as the My Amp software. If you are our website will bring equipment and you can calculators, with the help of our digital alternatives you might:

We have been always researching to create more comfortable for the customers to handle while making by far the most of its profile.

Take advantage of a few first installment measures and you will have the ability to pay-off your loan in the course of time. Use dependent-inside loan has actually and you can optional account available. Make certain you get to know and employ all of the features that are included with your house mortgage.

- Repay your home mortgage ultimately

- Access your own collateral

- Switching your house loan.

Your needs get transform for the lifetime of your loan very it’s wise so you’re able to regularly opinion the characteristics and you may design of your own mortgage to see how well they suits your circumstances. Amplifier Bank along with introduces the newest types of finance off time to date predicated on alterations in the market industry [therefore you should keep this in mind].

Switching your house loan

As your need, needs or condition change, you can even consider switching your property financing to better be right for you.

Before you can diving watercraft, it can be well worth that have a speak to a home loan specialist to see if they may be able aid in making your current financial operate better for your requirements. If you like to dicuss so you’re able https://paydayloancolorado.net/foxfield/ to some body in advance of exiting from your home financing, delight name 02 8364 6758.

It is essential to comprehend the charges and will set you back involved in refinancing your residence mortgage. Amp Financial fees an excellent $390 launch payment, therefore the House Name Office (LTO) hence may differ from the county.

Just be sure to complete a loan release power mode. This will ask you to answer concerning your property, an important somebody with it, and the financing security passwords. It is going to offer all about bank fees and you can people government fees might face when you finalise your get-off app. Asked operating minutes are listed below.

The new Limited Launch and you will Replacing mode should be complete back at my Amplifier on the web or application, rather is available to own download here. To complete the full launch, please e mail us to the 02 8364 6758 otherwise

Increasing your home loan matter

There are a number of reasons why debt items changes and you P home loans, an option you really have is to boost or better up your property financing. Topping enhance financial are an easy and you can energetic solution to availableness even more fund you want.

If you would like consolidate your financial situation, upgrade your home otherwise create a giant pick, you could potentially fund that it from the increasing your financing. Topping your financing might be a cost effective services given that interest rates into lenders are typically lower than handmade cards otherwise signature loans.

The total amount you need to use enhance your financing by the is actually dependent on just how much guarantee is available in your property, your existing financial situation and is also conditional on credit approval. And of the boosting your amount borrowed, this will suggest your repayments wide variety will get increase. It is crucial that you search monetary pointers to determine you to this is actually the best solution for your requirements. There will probably be also charges regarding the boosting your loan amount.

For further suggestions or even increase your mortgage, kindly visit our very own Increasing Financial web page, e mail us to the 13 30-30 otherwise email

Refinancing

Refinancing is the perfect place your alter your established mortgage that have good brand new one that’s preferably much more cost-active and versatile. It may include altering your home loan equipment together with your newest vendor, however, sometimes it would mean switching to an alternative bank who could offer you a much better package.

- We would like to shell out less. If you possibly could look for a lower interest, you could potentially spend less and reduce your instalments. Actually a great 0.5% prevention in your interest can save you tens of thousands out-of bucks across the life of the loan.

- You desire a smaller loan title. When interest levels was off, you will be able to reduce the term of the financing-regarding 30 so you’re able to twenty five years as an instance-instead of excessive change to your repayments, definition you are able to pay your house financing sooner or later.

- Need use of finest has. You’re finding after that savings and you will greater self-reliance by using additional provides, like endless even more costs, redraw establishment, an offset account and/or capability to utilize your property equity.

- You desire a much better contract, a lot more independency otherwise defense. Changing to a fixed, adjustable or spit-speed focus financing might provide your with these some thing.

- You want the means to access your house security. Collateral can be used to safe funds to possess big ticket situations like a residential property, home improvements or your own kids’ education. This might be risky whether or not because if that you do not improve costs, you can lose your home consequently.

- We want to consolidate established expenses. If you have numerous debts, this may seem sensible so you can move these in the financial if you’re diligent together with your payments. This is because rates of interest for the lenders are below other types out of borrowing from the bank.

Guess what you need? If you are looking so you’re able to refinance, guess what its you’re immediately after-a lower life expectancy rate of interest, added enjoys, better freedom, ideal support service or the above? You should influence these items when you might be comparing almost every other fund, you understand just what you are just after.

Do the financial experts surpass the expense? You’re in a position to spend less along the longterm by refinancing, although upfront will set you back can nevertheless be pricey. For this reason, it is best to investigate where can cost you will get pertain, or be negotiable-envision discharge fees, subscription out of financial costs and split will cost you when you have a beneficial fixed-speed loan. Including contemplate app can cost you for people who swap lenders-institution charges, judge fees, valuation charges, stamp duty, and you may lender’s home loan insurance rates for people who acquire more than 80% of your property’s well worth.

Keeps indeed there been one change to your own personal condition? A software techniques when you need to re-finance commonly incorporate. This means your own bank usually takes under consideration things such as your own work disease, a lot more bills you take towards, or if perhaps you’ve got an ever growing loved ones just like the many of these things make a difference your borrowing from the bank prospective.

Comments are Closed