Just like the a lending company, we believe really highly concerning the equity in our loan conditions

Do you know the Great things about Refinancing?

Refinancing is a great alternative since the most of the time, the individual is basically taking a far greater deal. Why which you re-finance really does not matter once the at the days end, you do therefore attain specific experts. Depending on your needs and you will choice, other refinancing solutions can assist you to gain access to some it really is great rewards

Straight down Monthly obligations

One of the primary benefits associated with refinancing would be the fact in lots of instances, you can reduce your payment. Your own payment is sometimes determined by how big is your own mortgage and your rate of interest. Because your financing will often be shorter additionally the terminology commonly be renegotiated, its extremely possible for one actually spend less for every single times by refinancing your own cellular family.

Monthly payments are extremely highest, particularly if you are on a fixed income. If you’d like getting straight down costs with the intention that here is much more liberty on your own cash every month, this might be something which will likely be establish using our very own refinancing choice. A lowered monthly payment can significantly boost lifestyle, which makes it easier on how best to get some even more place within the your own month-to-month budget without having to rely on playing cards.

Down Interest rates

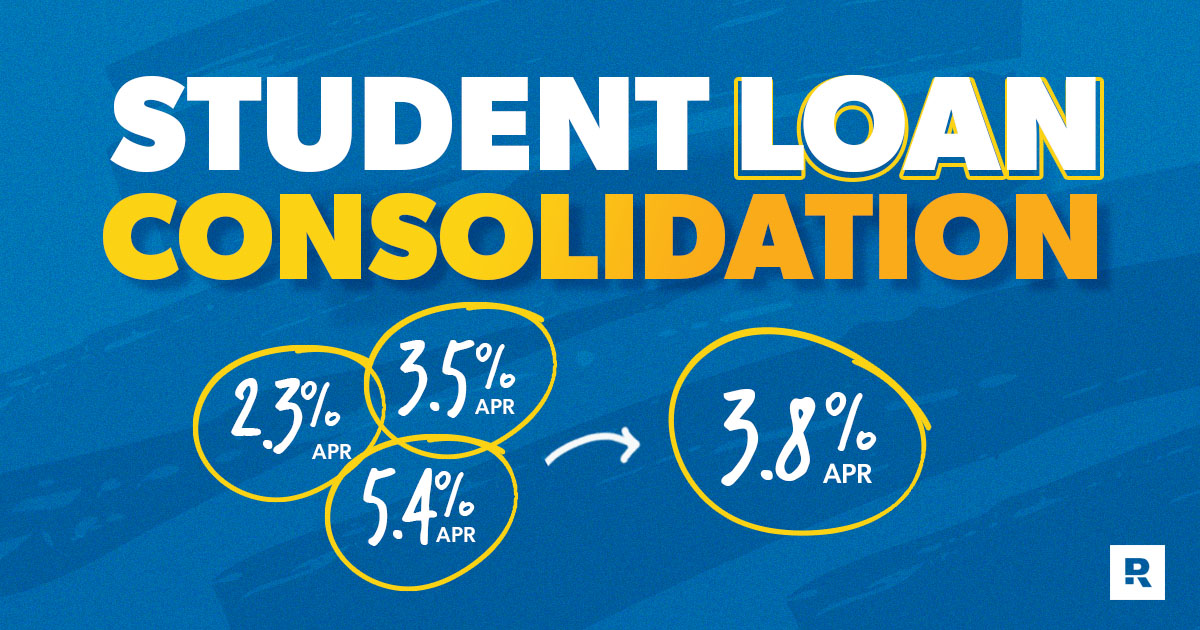

Rates had been proven to change drastically typically. Sometimes, some one find that the interest rate on the new financing was quite a bit higher than to your newer funds. Because of this after you re-finance, you’ll be with a lower interest rate.

Interest levels determine how far extra your in the course of time find yourself purchasing for your house. The interest try loaded in addition mortgage and can influence all round cost of borrowing the bucks. Less interest rate is an excellent topic because it mode that you will sooner save your self considerably way more. Not only can you get a diminished payment per month, but you can in reality rescue a substantial amount of money more than recent years.

Many property owners is actually shocked to discover how nothing of its monthly payments in fact wade to the its homeownership. In many cases, individuals are purchasing on the house for some time quantity of big date purely on account of attention, and this cash is maybe not actually going into the the resource up until the attention is entirely paid back. Once you re-finance, you might end up being confident know that more of your money was going into the running your residence.

Most readily useful Terms

not, that is not your situation for each lending company around. At times, mobile homeowners have discovered your terms of their arrangement with the old lending company are usually quite dreadful.

Every so often, it might simply be that the amazing contract lacked several of the benefits of progressive financing preparations loan places Dora. While this isn’t the bad, it can signify youre lost new advantages of a special lending contract. When you refinance, you could more readily speak about those individuals standards and also some additional benefits for your self. There are all types of great new choice into the progressive credit and then we need to make certain our customers are really and you can its browsing benefit from the the new agreement.

The reality is that some people and additionally understand the preparations that they inserted to the are extremely maybe not inside their best attract. Homeowners aren’t usually conscious of what is actually that is perhaps not felt preferred during the a financing agreement. We could only make the expectation that their agreements is fair, that is sad because the some companies learn it and take virtue from it. Luckily for us, refinancing enables one to arrange a better agreement that is mutually very theraputic for both you and Santiago Monetary.

Comments are Closed