Particular Refinancing, Household Refinance Calculation Book when you look at the Malaysia

You are together with advised in order to guess the present day position or reasonable market value in your home. Can be done a study out of current pricing get a loan Auburn AL due to websites you to definitely bring associated attributes. You can even utilize the house refinance calculator available on the net.

Basically, mortgage refinancing is the greatest choice for your requirements in case your latest value of exceeds the newest outstanding debt.

cuatro. Know the Refinancing Costs getting Sustained

The latest refinancing procedure try subject to certain costs and additionally moving will set you back. What is moving prices? Swinging prices basically is the money that you should invest or the cost that must be sustained locate an alternate loan. These types of can cost you is stamp responsibility, assessment charges, court costs, disbursements and the like which are on 2-3 % of the entire loan.

For those who re-finance to keep for the interest levels, compare current will cost you to your interest offers and that is gotten using refinancing before making a decision.

5. Fill in App

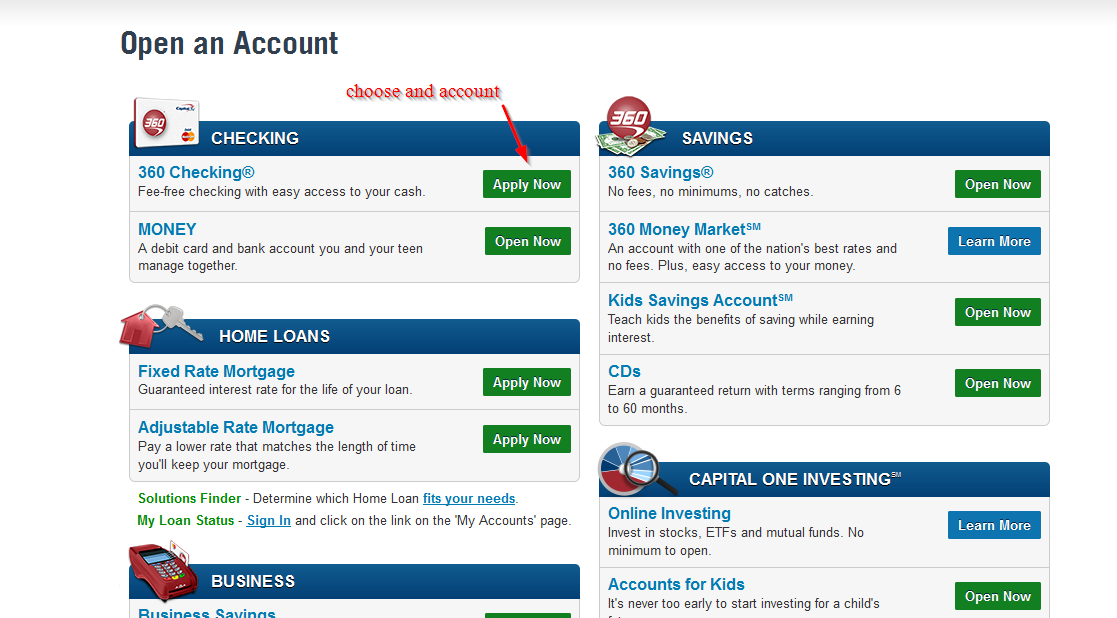

In advance of sending the borrowed funds refinancing app with the financial, check the plan and refinancing scheme offered. Make a comparison interesting pricing, an educated bank getting household refinance therefore the finest and you may sensible mortgage design to you personally. In the event the unsure, query a buddy getting advice or help from an experienced banker.

Household Refinance Several months

How long really does the home re-finance process take? Complete, the house refinance techniques usually takes as much as period centered to your situation (between a few so you can half a year according to the case). For the reason that, it requires of many procedure and additionally getting permission or approval regarding state government to the question of leasehold services having strata or personal possession.

On top of that, the financial institution might appoint an enthusiastic appraiser so you’re able to always check your property shortly after finding the job. The appraiser will ready yourself property valuation report just before submitting they to your financial for further processing.

The process of refinancing or refinancing finance during the Malaysia always relates to two types of money auto loans otherwise housing loans. It is split into many different types, considering the mission and requires. Mortgage refinance or casing mortgage including is divided in to three (3) kind of domestic re-finance below:

step one. Refinancing Costs and you will Words

This category of refinancing alter the current interest rate to a good brand new, finest interest instead of switching the level of the current loan. It factors the brand new month-to-month dedication to end up being straight down, hence stabilization debt reputation.

Like, a change in brand new Immediately Coverage Price (OPR) grounds the present rate of interest so you can ple regarding half a dozen per cent so you’re able to five per cent. If the refinancing is completed, you may enjoy deals with a minimum of a couple per cent of mortgage attention.

Should your current property is worthy of RM500,000, it can save you nearly RM10,000 annually. You might take advantage of this brand of refinancing in the event that there is actually a general change in brand new OPR price to love a lower life expectancy payment speed.

dos. Cash-In the Refinancing

It is possible to look at this dollars-in refinance should you want to repay many of one’s existing home loan dominating. It allows you to discuss down interest levels and you may monthly installments when you look at the yet another home loan.

It indicates, this refinancing in fact offers a much better option when you yourself have an security property value below 20 percent.

Simple tips to Discover Your Equity Standing

To ascertain the modern security reputation, you really need to determine the mortgage-to-Really worth (LTV) proportion very first. Imagine your existing property value was RM200,000 and you’ve got cleared RM10,000 of entire mortgage. This means, you still have a financial obligation balance of RM190,000.

Comments are Closed