Report: 83% off FHA Fund Go to Basic-Day Consumers

Lenders insured by Federal Property Administration (FHA) are among the top investment devices utilized by earliest-big date home buyers inside Nj. In fact, a recently available declaration of the Bonuses Urban Institute showed that 83% of those finance visit earliest-timers. This short article explains why a lot of basic-date homebuyers within the Nj have fun with FHA finance to finance its orders.

Fha home loan very first time consumer

During summer 2018, this new Washington, D.C.-centered Urban Institute wrote a study that reviewed secret home loan credit style nationwide. On top of other things, it report considering specific understanding of FHA finance and you will whom uses all of them.

Seem to, plenty of earliest-time homebuyers inside the Nj utilize the FHA financing system to finance the sales. Around the our very own condition and you will nationwide, roughly 83% off FHA home loan originations is getting very first-day people. Inside market meltdown, incorporate certainly one of very first-timers was at 75%. This appears that more of such customers is actually looking at FHA funding now.

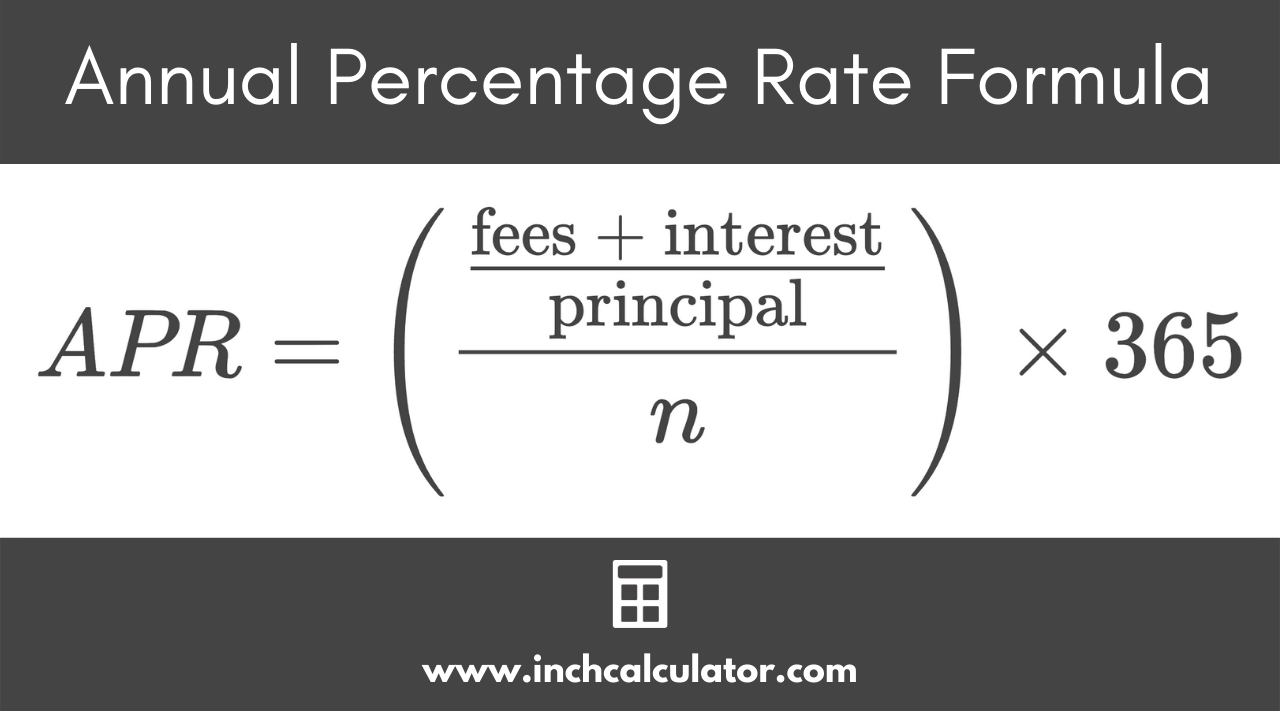

Definition: The Government Property Administration doesn’t give money to consumers. As an alternative, it provides brand new fund made by banks and you can lenders in the private field. It insurance coverage gets lenders certain safety against standard-related losses. Moreover it gets consumers the advantage of the lowest downpayment and flexible conditions.

The brand new Government Housing Administration (FHA), that produces lower-downpayment loans open to borrowers having poor credit, possess normally worried about the initial-time homebuyer market, which have first-timers creating throughout the 80 percent of the overall originations. One display fell to over 75 per cent in recession but possess much slower crept as much as almost 83 per cent today.

It declaration obviously shows that many basic-time home buyers in Nj prefer the FHA financing system since the a finance alternative. And you will we have touched towards the a number of the reasons for having which currently. This choice now offers consumers a comparatively low down percentage, also versatile degree conditions.

- Down payment: Below latest FHA advice, Nj-new jersey homebuyers which use this system can be set out only step three.5% of your cost or appraised well worth. That’s one of several low minimal expenditures available nowadays, aside from the Va and you will USDA applications (which are restricted to certain consumers).

- Eligibility: FHA financing are not only restricted to first-time home buyers. Anybody who match the minimum criteria because of it program can apply. The minimum standards getting credit ratings, loans rates, or other affairs try rather flexible, in comparison to traditional / non-FHA mortgage loans.

These represent the significant reasons why a good amount of first-date buyers into the Nj-new jersey check out this program. It allows to have a fairly reasonable initial resource, therefore also offers versatile qualification conditions to possess borrowers.

Dont Eliminate a beneficial Conventional’ Home loan

Of the meaning, a good conventional financial is one that doesn’t located bodies insurance rates support. One kits it besides the FHA program, and therefore really does cover such as for example insurance coverage.

Generally, traditional mortgage loans have experienced higher down-fee conditions than the Federal Construction Management. However, who may have altered in the last while, on account of policy alter from Fannie mae and you can Freddie Mac.

Now, one another Federal national mortgage association and you may Freddie Mac get home loan items with mortgage-t0-worthy of (LTV) ratios around 97%. It means consumers tends to make off payments only step three% for those kinds of money, in many cases.

New grab-home content is the fact antique lenders are now a great deal more aggressive having FHA, with respect to offering a somewhat low-down fee. Thus earliest-date home buyers inside Nj should speak about each of their capital options – hence boasts one another FHA and you will antique funds.

Financial inquiries? Please contact us when you yourself have questions relating to the different fund apps found in Nj-new jersey, down-payment requirements, or any other capital-related subjects.

Comments are Closed