This research is made to protect the lender even when from property foreclosure

Underwriting mortgage loans helps to control losses for the mortgage loans because of the examining an effective borrower’s credit rating and receiving a different assessment of one’s property value our home becoming funded

The newest USDA software are created to helps the financing of rural construction. Part of the financial remark processes, entitled underwriting, will be to compare the cost the financial candidate is actually ready to expend from what comparable houses has recently ended up selling to have. Into the outlying parts, it may be hard to find equivalent property that have been ended up selling has just. This will generate outlying property even more high-risk so you can loan providers, in addition to USDA construction programs are created to often believe that exposure by making mortgages to help you home owners or reduce the exposure to help you lenders by the insuring mortgage loans. Likewise, new USDA financial programs complement the latest USDA’s outlying creativity system, and this pros reduced-create rural elements by the help many crucial outlying functions like construction, economic advancement, and you can medical care.

A standard instance to have mortgage restrictions is generated because of the particular who believe an instance can be produced getting bringing guidance from inside the to order first protection, but the circumstances is significantly weakened (otherwise nonexistent) having assisting the acquisition off upscale casing. Since the mediocre house rates are different extensively nationwide, the case having mortgage limits that vary by the part depends partially toward collateral issues. Homebuyers which have conforming, FHA-covered, and Va-protected mortgages discovered an indirect enjoy the national from inside the the form of straight down interest rates than just they might if not getting capable see, or when you’re able to receive a mortgage at some point or higher with ease than simply you are going to otherwise become instance. Once the houses rates differ across the country, this new geographical distribution associated with the benefit is uneven. In the event the there have been a nationwide mortgage limit, home surviving in highest-rates areas eg Nyc, San francisco bay area, and you may Miami will be reduced in a position to gain benefit from the programs. Even in this certain area, variations in home costs all over areas can impact who benefits from these types of software.

Will cost you and Threats

The expense regarding federal financial make sure apps are an important planning for the majority policymakers. Authorities home loan programs manage will cost you because of the limiting supply, restricting risks, and performing efficiently. On reason for so it declaration, risks is regarded as while the will set you back that may otherwise might not exists.

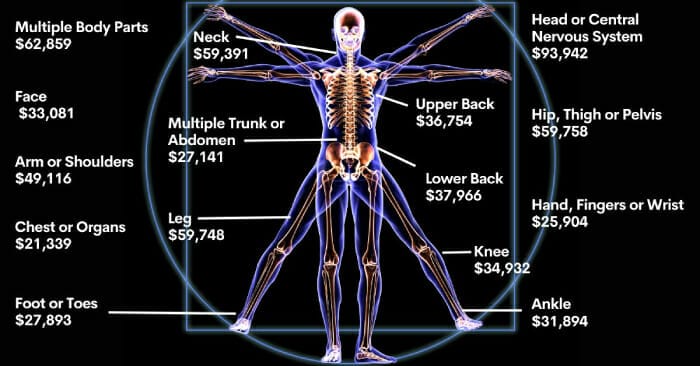

This new borrower’s credit rating can be used to know the danger you to the latest debtor you are going to default into the home loan, and also the appraisal suggests the fresh new most likely losses in case there is a foreclosure.

The latest FHA therefore the conforming loan constraints make an effort to remove risk because of the limiting the dimensions of the mortgages secured, and therefore restricting the amount of exposure directed regarding the bank so you’re able to the federal government. 31 The latest Va limitations the amount of the newest guaranty, however the level of the borrowed funds it can offer, hence shares the chance into the lender in the place of whenever all of it.

Home owners credit under the apps are energized charge (possibly rolling on interest) to own playing and you may ultimately shell out a user rates on government government. Not all the costs are included in pages. Like, whilst the FHA program can often be considered self-resource, which have borrowers and you will/otherwise loan providers investing charge to pay for will set you back of the insurance policies otherwise pledges, an effective dministrative and other doing work costs are appropriated by Congress. 30

Government entities plus faces the danger your programs’ fees usually not shelter can cost you and may produce a transfer from the authorities. (Inside the financial words, with the extent your charge do not safety new government’s will set you back, brand new programs is subsidized.) The newest FHA, this new Va, and the USDA applications introduce a risk fast cash loans Arriba CO that their supplies usually be shortage of and require most funds from Congress. 32 The brand new GSEs was in fact made to getting nongovernmental entities no budget effect. Observers argued that GSEs’ charters created a keen implicit federal guarantee when this new GSEs were not able to help you award its make sure out of prompt commission off prominent and you will attract, government entities will make this new payments. It amounts so you’re able to insurance policies which the government cannot located percentage. Just like the , the new GSEs can be found in conservatorship, and you will Treasury has furnished $187 billion in service on it.

Comments are Closed