10 Issues One Qualify You To possess A USDA Mortgage loan when you look at the Michigan

Some of the criteria that be considered you getting a good USDA financial mortgage in the Michigan become – income, down-payment, credit scores, and more. Taking a great USDA loan is not far diverse from taking a great conventional financial. Listed below are 10 issues which can effect the loan acceptance.

1munity Lender Recognition having USDA

USDA try a government agencies you to definitely sponsors the application form, your area bank tend to handle 100 % of the transaction. This means your own society banker does many techniques from bringing the application so you’re able to providing the very last recognition. USDA sets a final stamp out-of acceptance for the loan, and also which is treated by the lender. Providers can also be contribute as much as 6 per cent of the conversion speed towards the closing costs.

2. Zero Deposit

This new advance payment specifications – or insufficient you to ‘s too many consumers purchase the USDA mortgage program. No down payment needs, therefore it is one of the few 100 percent financial support home loans found in the current business.

You may have a downpayment advantage who does just take years having really family to store 5 per cent down or higher. In those days, home prices can go up, making rescuing an advance payment even harder. With USDA mortgage loans, homebuyers can buy instantly or take benefit of broadening household opinions. Minimal credit history for USDA acceptance are 640. The latest debtor should have a fairly good credit background with restricted one month late payments in the last 1 year.

cuatro. First-Time Homeowners

USDA secured mortgages are not suitable for every visitors. But, any basic-date or repeat consumer trying to find home beyond major urban centers is always to see its qualification towards the program. The application can be obtained for purchase exchange just, no money attributes or next belongings. A buyer don’t very own an alternate house at lifetime of purchase.

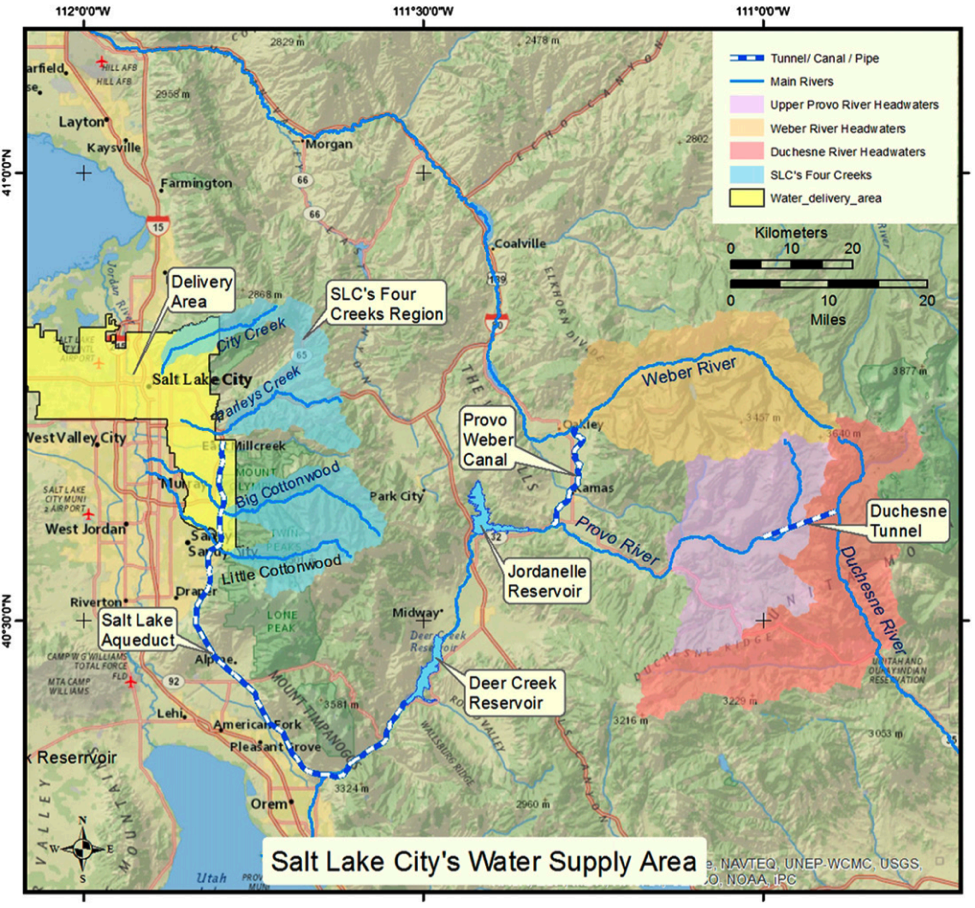

5. Geographic Limits

Geographical areas to have USDA mortgages try to have homes that have to be found contained in this a beneficial USDA-eligible town. Become qualified, a property should be for the an outlying area. Generally, places and you may cities with a people below 20,000 meet the requirements.

six. Assessment and Assets Requirments

An assessment towards the property to determine its worthy of becomes necessary. Brand new assessment report as well as verifies the home are livable, safer, and suits USDA’s minimum property standards. Any safety or livability circumstances will need to be fixed just before loan closure.

seven. Property Limitations

USDA mortgages commonly designed to fund facilities otherwise higher acreage features. Instead, they are aimed toward the quality unmarried-home. You may want to loans particular condominiums and you can townhomes with the system.

8. Number one Residence Requirements

Residential property are purchased must be much of your home, definition you want to call home truth be told there towards the foreseeable future. Rental attributes, financial support characteristics, and 2nd home instructions commonly qualified to receive the newest USDA home loan loan program.

nine. Loan Proportions from the Income

There are not any stated mortgage limitations to have USDA mortgage loans. Instead, an applicant’s money determines maximum mortgage proportions. This new USDA earnings limits, upcoming, ensure reasonable financing designs with the program. Earnings of all the friends 18 yrs old and you can more mature usually do not go beyond USDA guidelines here.

10. Payment Feasibility

Your generally speaking you would like an effective 24-times reputation of trustworthy a career to help you qualify, in addition to adequate money off said a job. not, schooling into the a connected occupation can be change particular otherwise each of that sense criteria. Your Centre loans own financial will determine cost feasibility.

USDA’s mandate should be to bring homeownership from inside the low-cities. Therefore, it generates the financing reasonable to a larger spectrum of house customers by continuing to keep prices and charges lower.

Learn more about the many benefits of a great USDA real estate loan and handling neighborhood society financial. Communicate with one of our mortgage loan pros at the Chelsea Condition Financial. Contact all of our office because of the mobile: 734-475-4210 otherwise on the web.

Comments are Closed