To invest in home outright vs brief home loan + investment

Should you have enough to pay money for property outright – could you? Although it suggested your own deals/opportunities would take exremely popular?

Or was we best to play with already property business enjoy maybe a part of the fresh savings following get home financing into variation? (Very economical money)

Of course we are going to getting asking our IFA but my DH believes he’s going to have to include brand new expenditures and also fee towards a the newest home loan as the that may benefit the brand new IFA a whole lot more.

Better, I finished up to get downright due to the fact I became extremely uncomfortable seeking locate home financing to the base no one create lend in order to me personally. Had We held it’s place in a posture to carry out financing, I believe it might have been wise in the date while the rates of interest had been suprisingly low towards the loans, and though they were in addition to reasonable to the assets, a great funding might have paid back more the loan prices, IYSWIM. You will never get a better go back with the a routine high-street bank/building neighborhood saver membership, but a good fixed label investment with a decent chance spread may possibly getting ok. You might be paying anybody somewhere over the range therefore go on IFA and have your to help you declare his earnings & fee

In my opinion just what he mode is that because you individual all the increase on the worth of but not a lot of our home you own, then you definitely create a much bigger profit margin smart for those who borrow funds and buy a far more expensive domestic, than if you purchase a less expensive domestic outright.

If you purchase 250k into the to invest in property downright and you may it is upwards 10%, you’ve create 25k, but when you borrow 250k plus it increases ten%, you’ve made 50k (quicker credit charges).

Sorry, my personal second section suggested if you buy an effective 500k house (which have good 250k financial), next good 10% boost means you’ll have generated 50k quicker costs

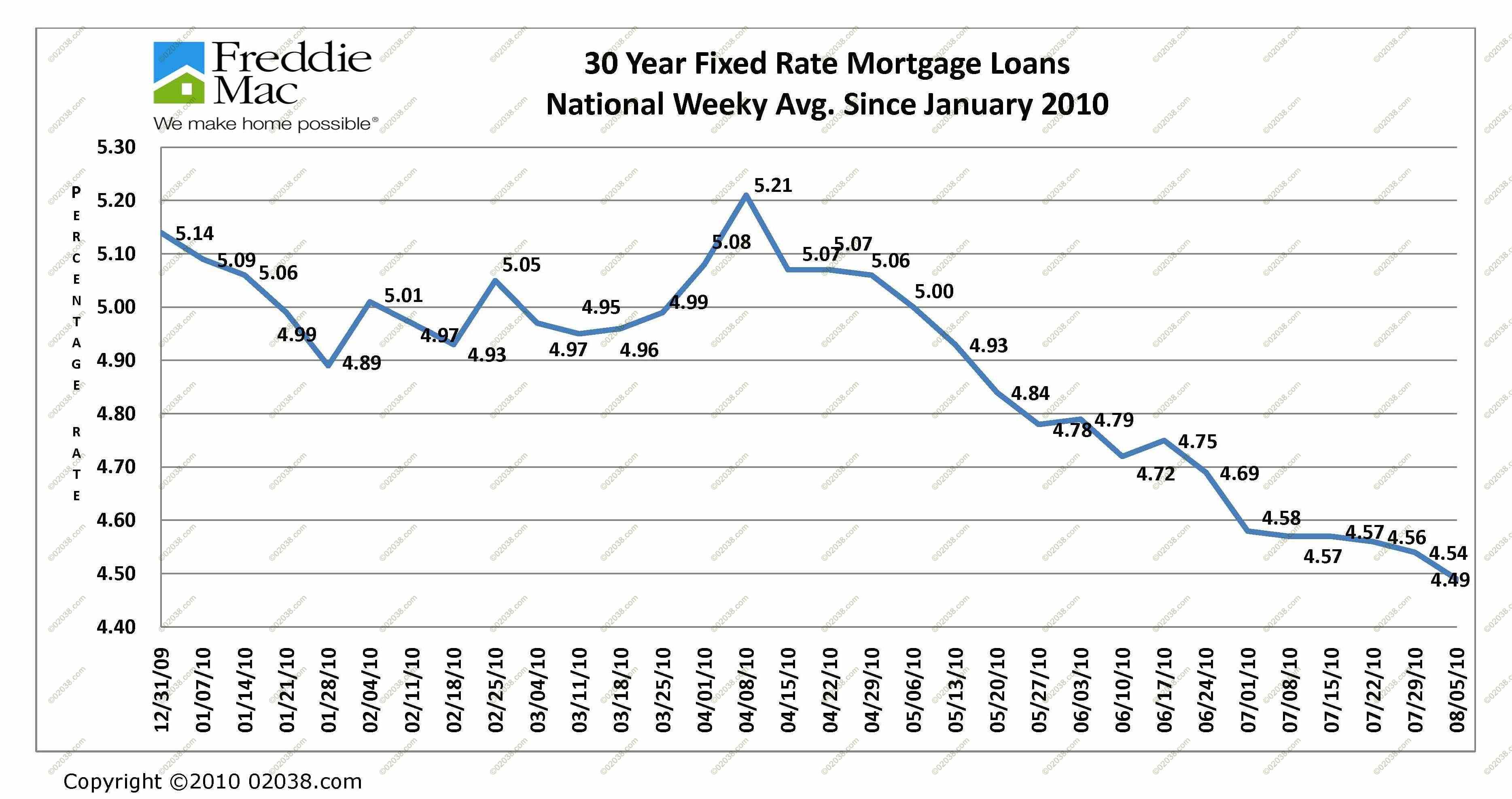

It all depends about how precisely financial prices compare to the deals/investments. Including, my financial is less than 1.5% already, and you can my ISA is up over 20% because the 2020. Thus for me, so you can withdraw deals and you can spend the money for financial from might possibly be insanity nowadays.

Needless to say we shall feel inquiring our IFA however, my DH thinks he’ll want to include the newest financial investments and also payment into the a beneficial new mortgage as that will work with the fresh new IFA a great deal more.

Some naturally, if you are paying notice in the 3% on the expense, such as for example a home loan, it seems sensible to spend people free cash on condition that that resource efficiency more than step 3%; in the event it does not, you’re better off settling your financial situation earliest

I performed since the advised and you will had a small mortgage and you will spent however, took a price regarding assets to invest the borrowed funds. However which choice is made mainly as we realized we’d just do this short label, we prepared for 5 many years nonetheless it only ended up being for timid from two years

State you get anything (instance a home) having 100, then you definitely sell it getting 110. You have made a 10% acquire.

OP, to start with you need to exit adequate on your own dollars and you will rescuing account to face any potential crisis: busted boiler, auto fall apart / replacement for, redundancy, etc

Today think credit 1 / 2 of and paying dos% interest: you invest twenty five, shell out step one.5 interesting (=75 x 2%), sell it getting 110, you have made income away from 10 – step one.5 = 8.5, but you have made it over an investment regarding twenty-five , which means your go back is not ten% however, 34% (=8.5 / 25) .

Thus, when you yourself have sufficient money in the financial institution, if you get with a mortgage otherwise as opposed to? This is actually the exact same concern while the: in the event that you pay back your own home loan very early whenever you?

Financial payday loans Blue Springs investments which have an ensured get back, like a protecting membership, commonly almost never produce more than the expense of a home loan. Riskier assets, eg investing the market, get, but there is however no be certain that. Generally, the brand new stretched disregard the panorama, more chances that takes place.

Comments are Closed