You’ll be required to satisfy the 100 situations from ID system when obtaining home financing

You’re going to be expected to incorporate a minumum of one first photo mode of ID (age.grams. passport otherwise driver’s permit), plus one non-photo form (elizabeth.grams. birth certification), also secondary documents like a good Medicare credit, bank statements and you will utility bills.

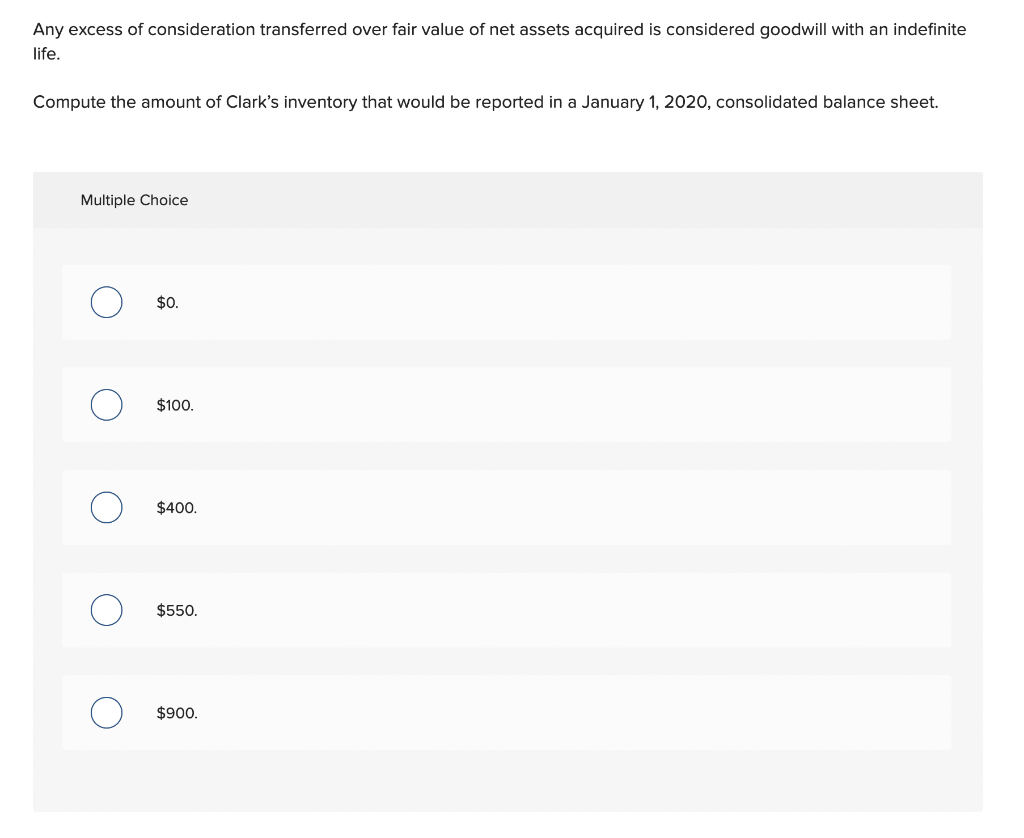

Home loan 100-section personal personality program

Really lenders will inquire about 3 months regarding lender comments in order to guarantee your earnings facing their cost of living. If you’re an initial-domestic visitors, they will certainly as well as make sure that your deposit could have been accrued more than date.

What loan providers like to see try a bona-fide history of savings and you can in charge expenses. Any later fees is a warning sign. When you need to know the way the bank statements may look to help you a loan provider, try our Free Lender Statement Medical https://paydayloancolorado.net/lynn/ exam.

Expect you’ll need identify people mismatch on your own earnings and expenses. Whether it’s a recently available auto buy otherwise a funds provide away from family (in which particular case you will need a letter from the benefactor), you should imply this into the financial having complete visibility.

Your own lender will require a listing of your debts and possessions so you can estimate the debt-to-earnings ratio (the fresh new percentage of their monthly revenues supposed toward bills) and you can evaluate your ability to settle home financing.

1. Fill out new lender’s home loan application form

You will end up expected some elementary questions relating to your bank account, put otherwise guarantee (while you are refinancing) in addition to style of assets we should purchase. Considering this particular article, their lender tend to guess how much cash you might borrow and also at exactly what speed.

Normally, this is quicker to try to get a mortgage on line via this new lender’s web site, you could rather guide a scheduled appointment having a home financing specialist if you need to dicuss in order to one, is care about-employed (other qualifications standards implement), or tend to have questions relating to the method. You could submit an application for a mortgage privately having a loan provider or thanks to a mortgage broker.

Mansour’s suggestion: All the financial possess a slightly additional financial software techniques and you can borrowing underwriting requirements. Aren’t getting weighed down on necessary advice and take it step from the action. Consider, correspondence with your lender is key on techniques.

The financial institution will give you a summary of documentation you need add, also payslips, financial comments, character data files, an such like. Home financing pro tend to be certain that your earnings up against their expenditures and obligations so you can so much more correctly determine the borrowing from the bank ability. They will certainly implement an extra serviceability barrier from step 3% (to be certain you might however pay for their financial if rates of interest rise). You need to assemble all necessary data in advance to help speed up the process.

Mansour’s tip: I constantly strongly recommend you complete all the documents and post all of them around the in one go in place of in pieces. The lending company does not determine the job until all the documents is offered.

The lender could possibly get conduct a great soft’ credit assessment in order to banner any possible issues with their borrowing from the bank file early otherwise will get choose to done a good hard’ credit score assessment (and therefore affects your credit rating) about get-wade. Which is when a home loan specialist usually check your credit file when it comes to an excellent bills, overlooked costs or defaults. Bear in mind loan providers need certainly to pose a question to your permission in advance of performing a formal credit assessment, in accordance with the National Credit rating Protection Operate 2009.

Mansour’s suggestion: Focus on a credit history towards yourself to score just before any up coming points and attempt to handle all of them just before rooms the home loan application. You really have problems on your credit file who would mean an automated refuse, very check with your large financial company to see if this really is strongly related to you.

Comments are Closed