Banks withdraw hundreds of mortgage loans: a knowledgeable rates however available for domestic moving firms and you can basic-day customers

Lenders was slowly just starting to place their mortgage sale straight back towards the on the sector, however, rates are now actually greater than just before.

More than step one,500 mortgage loans have been withdrawn over the past times off September, leading to mediocre pricing toward a couple of-season repairs ascending so you can an excellent 14-season higher.

Right here, i define as to why banking companies pulled their deals and you can story the least expensive mortgages however readily available for house moving services and you may very first-time buyers.

It publication brings free currency-associated articles, together with other information about And therefore? Classification products. Unsubscribe whenever you want. Your computer data could well be canned relative to our Privacy

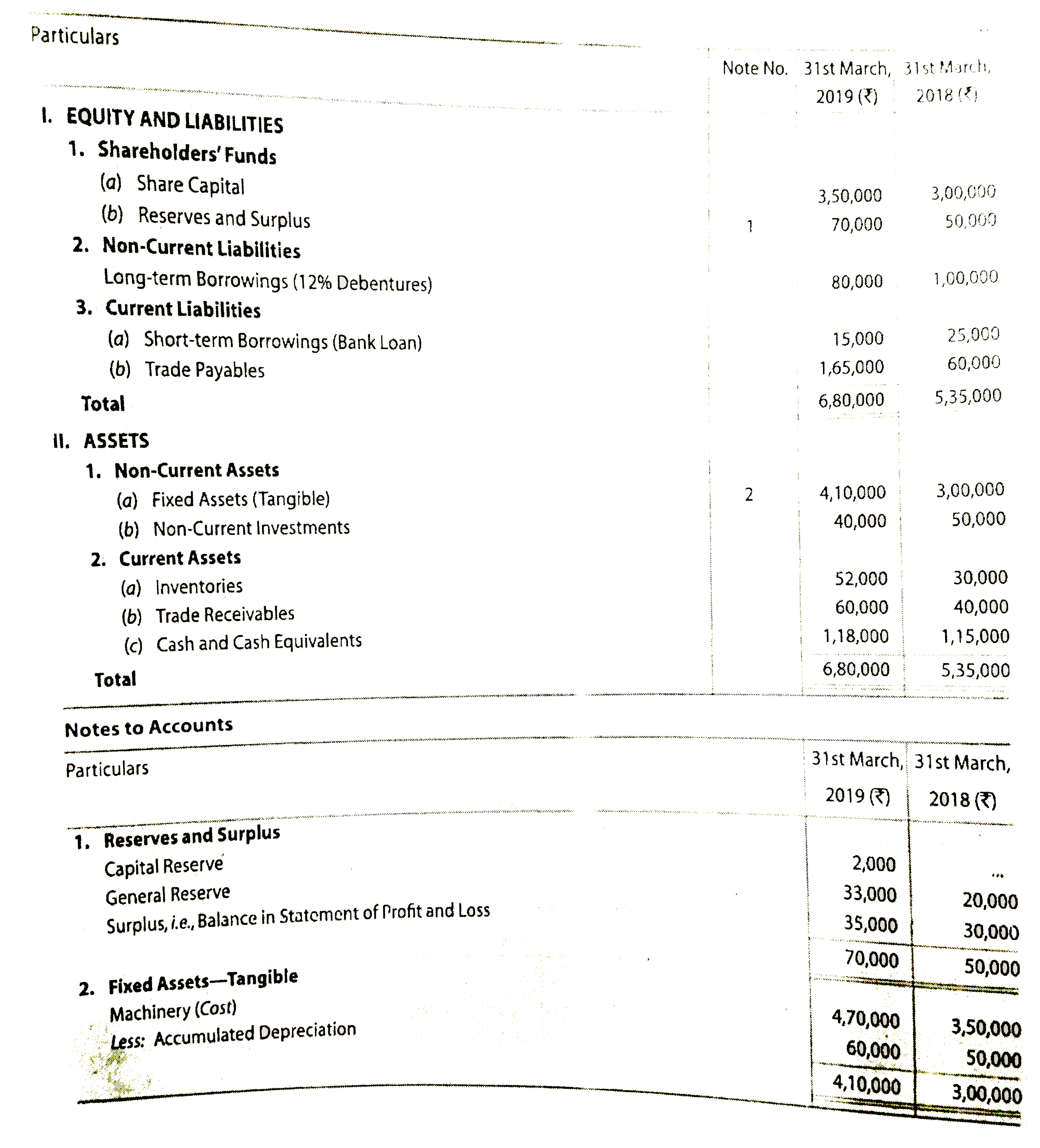

Above, we have indexed the new works together with the lowest priced 1st costs. Thus giving good indication of the speed you are capable of getting, according to measurements of your deposit, prior to going for a package you will need reason for upfront fees.

Some loan providers charge charge as high as ?step 1,999 to their reduced-speed purchases. Of the recharging large charges, loan providers could offer greatest costs and you may recoup this new shortfall elsewhere.

Banks aren’t charges fees such as for instance ?999, ?1,499 otherwise ?1,999, however some play with rates instead – such as for instance 0.5% of overall loan amount. While you are credit a much bigger contribution, this can be so much more costly.

You’ll be able to constantly have to pay a paid of 0.2%-0.5% to obtain a charge-100 % free deal. Both, this may pay back. Particularly, when you can score a mortgage within 5.5% having a good ?999 fee, otherwise 5.6% and no fee, aforementioned would-be decreased across the fixed name.

If you find yourself being unsure of on which type of bargain to go for, a mortgage agent should be able to analyse selling predicated on their genuine cost, taking into account cost, charge and you may bonuses.

Will you be concerned with your money?

Respond to a couple of questions and we will leave you a personalized list away from professional advice that will help you take control of your profit.

The length of time should you augment your mortgage to have?

One of the largest issues in terms of mortgage loans was: for how enough time any time you lock in their rates?

Borrowers mostly treatment for sometimes several otherwise five years. Five-season profit had been immediately following way more expensive, in most days it’s now actually lower to solve for longer.

Five-12 months repairs usually feature large very early payment fees, and therefore you are recharged a lot of money for many who ple, for people who flow domestic and do not import they with the the newest property).

With this in mind, it is critical to think about their average and much time-label arrangements just before buying a predetermined term.

Which? Currency Magazine

Find the best sale, avoid frauds and construct your offers and you will assets with the help of our professional recommendations. ?4.99 a month, cancel anytime

What the results are 2nd from the home loan field?

Residents into varying-rate marketing (including tracker mortgage loans borrow money online usa ) was extremely confronted with base rates transform, however, those people going to the conclusion their fixed words are now going to come upon higher cost once they remortgage.

It’s likely that financial cost will continue to upsurge in the short term, that have then feet price hikes around the corner.

In the event your repaired identity is on its way in order to a finish, its as essential as actually ever so you’re able to remortgage ahead of are shifted for the lender’s important varying price (SVR). For folks who lapse to your own lender’s SVR, your price will go up whenever the beds base price does.

Which? Money Podcast

Toward a recent episode of the latest And therefore? Currency Podcast, we discussed what the dropping value of the pound and rising interest rates mean to suit your money – including the affect mortgages and domestic prices.

Comments are Closed