How does a house Equity Mortgage Operate in Montana?

Domestic collateral money is going to be a great way to borrow money for those who have security of your home. House collateral financing during the Montana are a powerful way to quickly accessibility huge amounts of cash for whichever objective you want, whether it’s merging financial obligation otherwise capital renovations.

With regards to domestic guarantee finance during the Montana, Griffin Money offers aggressive rates and you will a straightforward on the internet app process, so it is very easy to start off. Take advantage of your home equity having Montana home collateral money out of Griffin Resource.

When you take away a house security mortgage , you might be essentially utilizing your home given that security to apply for a good secure mortgage. This means you can get the means to access cashflow which you might not have managed to supply through other types of financing and personal lines of credit.

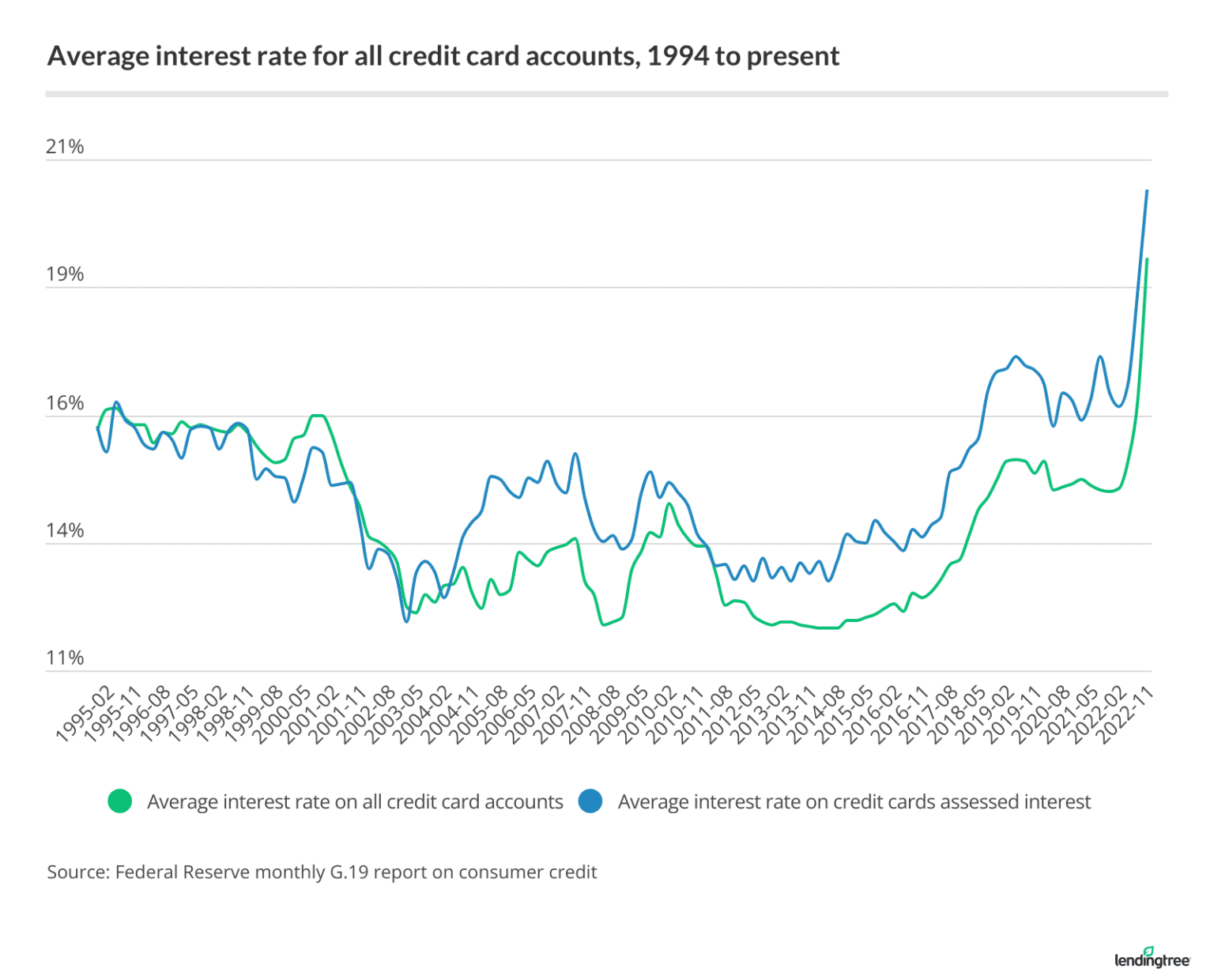

Domestic collateral financing prices in the Montana are usually below borrowing cards and personal funds, and you will financing attacks is lengthened. For these reasons, property collateral financing could be a smart monetary decision getting particular individuals, particularly if you’re interested in consolidating their high appeal obligations.

After you’ve enough collateral of your house to get recognized, you could typically use anywhere between 80 and 95 % of security you may have of your house. That it money may be available in the type of a lump sum fee or a line of credit dependent on which sort regarding loan your sign up for. For many who haven’t reduced your loan and decide you want to market your residence, you will have to use-money in the americash loans Hytop business to repay the loan.

We typically query which you give tax returns if you’re implementing for a house equity financing in the Montana, nevertheless enjoys alternatives. Instance, our zero doc house guarantee financing is made for mind-functioning someone.

Style of Household Equity Finance

Choosing the right version of mortgage for your needs helps you get the maximum benefit from your home equity mortgage. If you find yourself conventional domestic collateral money (HELOANs) is the solution for most borrowers, there are even household equity personal lines of credit (HELOCs).

A home collateral financing was a fixed-price loan which is paid in a lump sum payment, you rating all of your current money at a time. Since your interest rate is fixed, the monthly payment is the exact same during the course of the loan several months. Mortgage attacks are generally anywhere between five and forty years, so you features plenty of time to spend your loan right back. Such Montana home equity funds are generally useful house renovations and other biggest expenses.

A house equity line of credit try a personal line of credit you have access to by using your home’s security as the security. Your financial will go after a having to pay limitation in line with the value of your residence along with your equity. The monthly payment is founded on your own investing maximum too as your current interest rate. HELOCs try varying-price financing, therefore HELOC costs in Montana changes frequently predicated on industry indexes.

If you are HELOCs and HELOANs differ, they are able to each other come in handy if you are searching for money disperse to own things such as domestic renovations, scientific expenses, and you will college or university expenditures. This type of next mortgages may be placed into a first home, 2nd household, otherwise investment property.

Positives and negatives of Montana Home Equity Fund

Household guarantee financing bring many perks whenever used sensibly, however it is crucial that you definitely understand what you happen to be committing so you can. You can learn much more about just how an excellent HELOAN works plus the advantages and disadvantages of household equity loans below.

- You could improve income

- Griffin Financing has the benefit of competitive interest rates

- It’s not necessary to sacrifice their financial price discover a good financing

- Home guarantee funds generally bring all the way down interest rates than handmade cards and private fund

- You could potentially cure your home if you fail to pay back the financing

- Domestic equity fund can also add into debt burden

- Good HELOC can cause overspending in the event that put irresponsibly

Regardless of the negatives, domestic equity loans try a unit if you utilize all of them responsibly. If you are using your financing having something that you you prefer and you may repaying it punctually, Montana family security funds shall be a great money alternative.

Montana Household Guarantee Mortgage Qualification Conditions

Like any mortgage, you will find criteria you have to fulfill before you could rating acknowledged to have property guarantee loan into the Montana. Below are a few of one’s points lenders thought once you pertain for a home equity loan:

- Extremely loan providers need no less than 20% house collateral so you’re able to take-out property collateral mortgage. You might be in a position to take out a property equity financing that have as little as 15 percent security, depending on the financial you decide on. Yet not, you are going to sooner or later must retain at the very least five so you’re able to fifteen per cent of your own house’s collateral just after researching the bucks out of an effective HELOAN.

- Lenders look at the credit score and loans-to-income proportion to assess their creditworthiness. A premier debt-to-income ratio or lower credit history causes it to be hard to become approved.

- Your own homeloan payment record and you will earnings plus play a role in providing recognized to own property guarantee loan. We need to note that you will be making enough money to settle the loan and also have a beneficial background when it comes to making costs punctually.

It may be tough to meet many of these criteria, even though you have enough guarantee in your home. If you’d like to alter your economic reputation or assess your own qualifications, you can use the new Griffin Silver software observe your borrowing score, generate a funds, and you will functions into the providing approved to own property collateral loan inside the Montana. It is possible to get in touch with the brand new Griffin Financial support people to talk about whether your qualify for a great HELOAN otherwise HELOC.

Get a property Guarantee Financing for the Montana

When you need the means to access cash to possess medical costs or a beneficial highest investment, you might want to envision property equity mortgage. Prolonged financing periods and you will low interest rates helps make domestic security funds a pretty wise solution for the majority of individuals.

Have you been contemplating making use of their residence’s collateral that have a household security financing? Griffin Money will help. Trying to get a loan is as simple as filling out an enthusiastic on the internet software , plus you can expect competitive rates. E mail us or complete an internet app to get going having a property collateral loan from inside the Montana.

Comments are Closed