W ant a cash put aside having all you require, whenever you want they, just like the The newest York’s Penny Discounts Financial claims?

Otherwise a bona-fide deal, courtesy of California Very first? People certainly are the types of advertising states which might be wafting these types of weeks doing banking’s top product, the home-collateral financing. The major worry: one to certain unwary users erican deals portfolios, the household home.

A beneficial boomlet of sorts is actually less than way since people operate that have love compared to that form of unsecured debt, whenever you are lenders vie seriously to own customers and you go right here will id the newest hurry, cautionary sounds was caution in regards to the risks of standard finance, and misleading nature of a few of your buzz

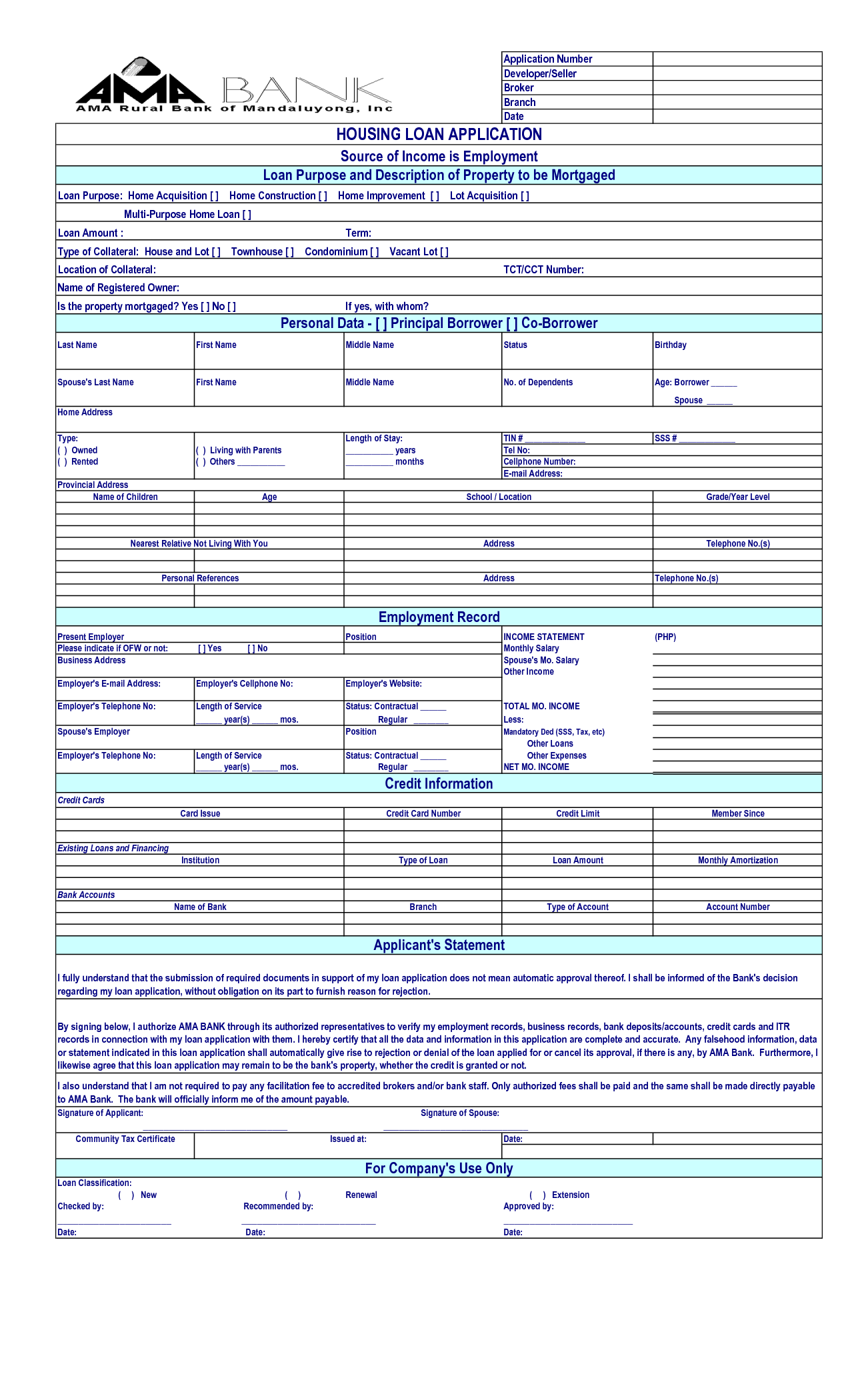

Home-equity money are doing an area-place of work company, expected to double to $70 billion in 2010 (pick chart). They are hence wearing easily to the a special kind of borrowing from the bank facing the brand new Western household, practical next mortgages, which happen to be probably be worthy of $130 billion into the 1987. The standard 2nd home loan is generally a preliminary-identity, fixed-commission plan for an appartment number, based on the value of property that stays immediately following deducting their first mortgage. As household-security financing are often used to get user affairs, along with everything from stereos so you can deluxe autos, its newfound impress is inspired by good loophole on Income tax Reform Act of 1986, and therefore phased out the new deductibility of the many attention money except financial payments into dominant and you may next homes. Home-equity borrowing from the bank already even offers markedly all the way down rates (in the 10%) than an unsecured personal loan (14%) otherwise borrowing-cards fund (in the 18%).

However, as well as those professionals come significant snags a large number of lenders neglect to market. The majority of the household-security funds is associated with motion on the best credit rates, now 8.25%, and can are very different greatly in expense because that rate transform. If your primary would be to gallop off 8% so you can 20.5%, since it did between 1978 and 1981, individuals now investing 9.75% for the a property-collateral loan might instantly need to pay %. Instance a massive raise can be done just like the many guarantee money lack the brand new thus-entitled caps common in order to normal changeable- price mortgage loans, and this maximum attract-rates nature hikes to a couple payment items or more annually.

Within their warmth so you can publication new customers, certain loan providers polish over the fact that incapacity to blow right up often means the increasing loss of new borrower’s domestic. In the a survey regarding 91 loan providers inside the country, a few individual communities, the consumer Federation out-of The usa and Customers Connection, discovered multiple other so-called abuses. Some lenders don’t divulge you to low basic, or intro, interest rates manage later become improved. Others don’t publicize the reality that its finance called for large lump amounts just like the finally costs. Past day New york city Consumer Things Commissioner Angelo Aponte warned a dozen local banking companies one their advertisements encourage frivolous purchasing within chance of foreclosure.

But house-equity finance are very different: it ensure it is people to put on their houses because the security to help you unlock changeable-rate, revolving-borrowing membership good for to 80% of your own guarantee the fresh homeowner has accrued

Consumer groups are starting to reception having more challenging legislative limitations to the the new finance, as well as attention-speed limits and a lot more information for the ads. An excellent spokesman for the Western Bankers Organization, a lobbying category, reacts you to it’s not from the banks’ focus so you’re able to deceive or discipline their customers. Loan providers claim that yet brand new 30-date delinquency rates to the family-guarantee loans is just .74%, compared with step 3.47% having conventional mortgage loans.

Interim, certain financial institutions is actually tightening the strategies. Wells Fargo Borrowing, hence operates for the seven says, also offers four-12 months, fixed-price financing within twelve.5% focus. Kansas City’s Commerce Bank often loan out only about 70% from an excellent residence’s appraised well worth, to get rid of saddling consumers having too-much loans. Officials on Chicago’s Continental Illinois is educated in order to craving consumers in order to utilize the fund to possess fundamentals, not only to purchase high priced snacks. The best advice to perform-getting individuals remains the eldest: read the small print before you sign at the base range.

Comments are Closed