Re: Knowing the Line Items of a great Re-finance Zero Settlement costs Financing

It is my personal in depth estimate. Many thanks for all time. I was expecting my personal newest principal cannot alter. Couple of anything, and therefore stands out in my situation. My current principal are 300k. But in the complete spend offs and you will repayments, it is found since 301,five hundred. Because websites closure prices try 6000, my the latest prominent becomes 301,five-hundred + 6000 = 306,five hundred. That is bothering myself. I’m able to promote the existing escrow harmony of 4000 on closing table. Yet still, discover a space I’m trying understand

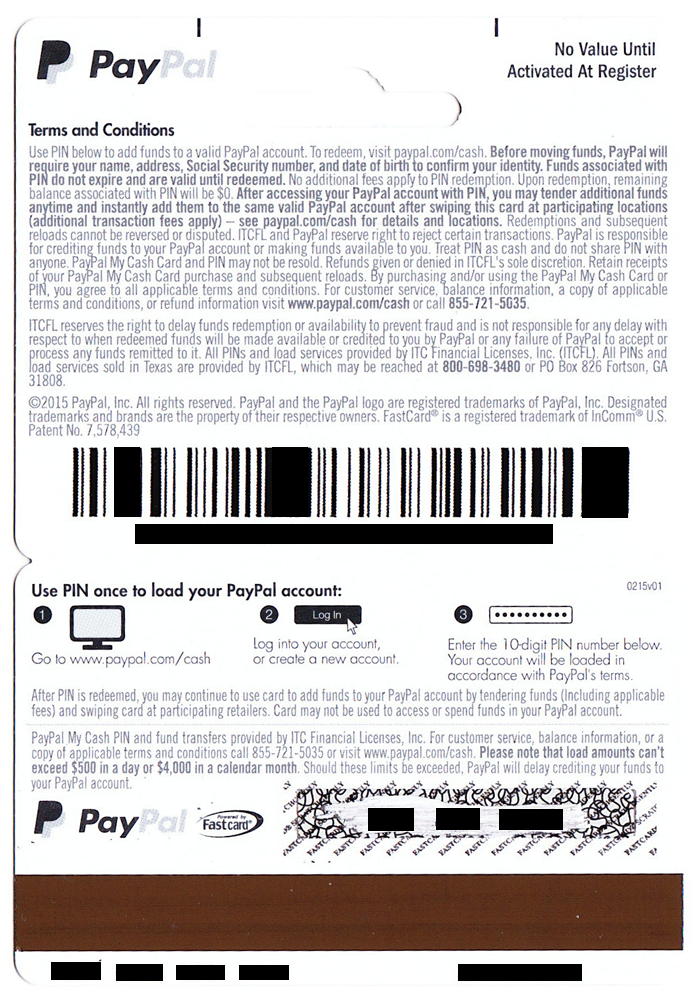

Closure Quote An excellent. Origination Charges 0 B. Functions Borrower Did not Search for 1100 C. Functions Debtor Did Buy 0

Its June. Getting six months you delivered your financial $1000 four weeks to allow them to spend the money for fees and you will house citizens insurance coverage to you after the year. They are going to spend $12,000 full shared during the December.

When you refi, brand new bank would have to spend one $a dozen,000 online personal loans Iowa at the conclusion of the year. They collect $1000 a month off July in order to December, 6k overall. They’ll be small $6000.

Thus either you give a try to find you to definitely 6k shortfall in order to closure or they provide you a supplementary 6k in addition they flow one to 6k they simply lent you with the escrow harmony

Once you close the borrowed funds towards the current bank there is going to become $6000 on your escrow membership together with them. They will certainly give you a seek out that 6k.

I might not need to invest in you to $6000 for 30 years personally. I really don’t loans certainly not a home purchase for this enough time.

I might upload it toward mortgage while the dominant commission. Or you could simply take you to escrow compensation due to the fact reimbursing your percentage on this new financial from the closure.

P.S. I am glad brand new $6000 increase to your dominant balance are bothering you. Which is an effective sign! Good for you!

It is sticking out in my opinion. The new Prepaid service Attention must be the focus from the time out of closing to finish out-of week for the basic commission due good month then so as that really should not be difficulty.

Heck, if you possibly could swing the latest 6k examine in the closure you can spend 12k upon dominant

However the Property Tax, instead of the area G initially attention, works out this new fee regarding a property tax bill due during the the immediate coming or currently early in the day and most likely paid back although term company doesn’t have facts it is already been repaid. I had trapped which have a time dilemma of an excellent refinance once in which we’d simply generated a property income tax commission (no escrow with it) nevertheless the identity team expected facts (and some age after, again that have a new refinance but that time, to your state treasurer now which have a web site appearing percentage status, that was thought this new called for evidence).

siankisr typed: ^ Mon As internet closure prices try 6000, my personal the fresh prominent becomes 301,five hundred + 6000 = 306,500. This can be harassing me. I’m able to render the current escrow harmony out of 4000 for the closure desk. But nonetheless, discover a gap I am seeking to discover

The fresh Area Grams escrow resource try fulfilling your minimum supplies from ninety days getting taxes and you are clearly throughout the ten days from your upcoming homeowner’s insurance coverage expenses.

The new Area F prepaids try sometimes (a) their legislation fees possessions income tax every six months (per during the 1/dos total cost) or, (b) you are romantic sufficient to if the property fees might be owed that the the new financial are gathering this new June – Dec 1 / 2 of brand new estimated taxes due.

Comments are Closed