A couple of alternatives for doing this was contrary financial and you can domestic collateral mortgage

If you’re a resident and you can retired, you might be in a position to move your residence equity toward cash to pay for living expenses, health care will cost you, a property upgrade, otherwise anything else you would like. Each other enables you to tap into your residence guarantee with no need certainly to offer otherwise get out in your home.

Talking about some other mortgage affairs, although not, therefore is advantageous learn the choices to choose which is much better.

Reverse Home loan

Extremely family instructions are designed which have an everyday, otherwise pass, home loan. With a regular mortgage, you borrow funds off a loan provider to make monthly installments so you’re able to pay down principal and you may attention. Over time your debt reduces since your security expands. If the home loan are paid in full, you have got complete equity and you will individual the home downright.

Just how an other Mortgage Work

A face-to-face mortgage functions differently: Unlike and come up with payments in order to a lender, a loan provider helps make payments to you, considering a percentage of one’s house’s worthy of. Through the years the debt develops-just like the payments are made to both you and notice accrues-and your equity minimizes since bank requests much more about of one’s collateral. You still hold label to your house, however, whenever you get-out of the home to own more annually, sell otherwise perish-or be delinquent at your residence taxation and you can/otherwise insurance rates or even the household falls toward disrepair-the loan gets due. The lending company deal our home to recoup the cash which had been settled to you (plus fees). One security remaining at your home would go to you or your heirs.

Keep in mind that in the event the one another partners possess their name into the home loan, the financial institution never offer our home until the thriving mate passes away-and/or taxation, resolve, online personal loans MD insurance policies, swinging otherwise selling-the-domestic affairs mentioned above are present. Couples would be to take a look at the the latest surviving-mate thing meticulously before agreeing in order to a contrary home loan. The interest energized into the a reverse home loan generally accumulates up until the financial was terminated, from which big date the fresh new debtor(s) otherwise the heirs may or may not manage to deduct they.

Home-Guarantee Fund

A type of family equity mortgage is the house-equity credit line (HELOC). Instance an opposing mortgage, a home guarantee mortgage allows you to move your home collateral toward cash. It works in the same way since your top financial-in fact, a house collateral loan is additionally named one minute mortgage. You can get the loan as the just one lump-share fee and come up with regular repayments to settle the principal and you will notice, that’s usually a fixed rates.

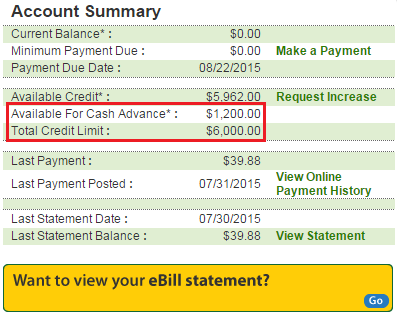

With an effective HELOC you’ve got the option to use as much as a prescription borrowing limit, toward a concerning-called for foundation. With a basic household-equity loan you have to pay attention into entire loan amount; with a good HELOC you have to pay desire just on currency you in fact withdraw. HELOCs are changeable financing, so that your monthly payment alter because rates change.

On HELOCs

Currently, the attention paid down to the home-equity loans and you may HELOCs is not income tax-allowable unless the cash was utilized for family renovations otherwise equivalent activities. As well-and this is a significant cause and make this program-which have property collateral mortgage, your residence remains a valuable asset to you as well as your heirs. It is very important notice, not, that your home acts as collateral, and that means you chance losing your house to property foreclosure for folks who standard into mortgage.

Differences between Financing Versions

Opposite mortgages, home-guarantee loans, and you will HELOCs all allows you to move your residence collateral on the cash. But not, it differ regarding disbursement, fees, ages and you will guarantee criteria, credit and you can income conditions, and you may taxation masters. Based on this type of issues, we information the essential differences between the 3 type of finance:

Why you have Paid down

- Reverse Home loan: Monthly installments, lump-sum payment, line of credit or some mix of such

- Home-Collateral Financing: Lump-share commission

- HELOC: On the an as-needed basis, up to an effective pre-accepted credit limit-has a card/debit credit and you may/or an excellent chequebook so you’re able to withdraw money if needed

Borrowing from the bank and you can Earnings Position

- Reverse Home loan: Zero income requirements, however loan providers get find out if you find yourself able to of fabricating fast and you will full repayments to own constant possessions charge-like assets taxation, insurance coverage, homeowners’ organization fees, and stuff like that

- Home-Equity Loan: A good credit score rating and proof of constant money sufficient to satisfy the bills

- HELOC: Good credit rating and you can evidence of regular money adequate to see every bills

Choosing the right Loan for your requirements

Opposite mortgage loans, home-equity fund, and you may HELOCs the allows you to transfer your residence guarantee towards bucks. Therefore, simple tips to choose which mortgage sorts of suits you?

As a whole, an opposite financial is regarded as a much better choices if you find yourself trying to find a lengthy-term income source plus don’t head that your house will not engage in their estate. Yet not, when you find yourself married, ensure that new rights of thriving partner are clear.

A property security mortgage or HELOC is a better solution if you like quick-label dollars, can make month-to-month money and love to continue your house. Both promote considerable exposure making use of their benefits, so comment the choices carefully before taking either step.

Comments are Closed