All you need to Understand To order a beneficial Fixer-Upper Domestic

This particular article talks about all you need to realize about to find good fixer-higher house. Homeowners can buy proprietor-tenant first fixer-top repair financing having FHA, Va, USDA, and you can conventional financing. Of a lot homeowners looking to buy, treatment, or renovate their houses . FHA 203k loans was to possess proprietor-occupant residential property just. FHA 203k money aim to service members of its efforts to help you refresh their neighborhoods.

FHA 203k finance is actually to have homeowners searching for land trying to find solutions or updates. Its a blended order and construction mortgage which have good 3.5% down-payment of increased value.

FHA 203k financing are popular loans to possess homeowners to find a beneficial fixer-upper household. not, FHA 203k loans are merely getting holder-occupant property rather than capital characteristics. The latest continues are used for both pick and you can rehab loan amounts. FHA 203(k) money are also if you must re-finance their houses and you can pay for solutions. They are able to refinance its present mortgage and now have more substantial mortgage filled with the building costs. In this posting, we shall security to shop for a beneficial fixer-higher house with FHA 203k financing.

Benefits associated with Purchasing a great Fixer-Upper Household

To buy good fixer-top house is quite popular certainly a home people and a great satisfying enterprise, but it addittionally comes with challenges. In the following paragraphs, we are going to explore some methods to look at if you’re considering to invest in an excellent fixer-upper house. Dictate the purchase cost and your restoration finances.

Get prices estimates. Get several estimates out-of contractors and you may tradespeople to the works your propose to manage. This should help you funds alot more precisely and steer clear of unanticipated expenditures.

Just before thinking about fixer-upper residential property, dictate the acquisition and you will renovation will cost you. Be sure to reason behind the price and also the pricing of solutions and you will home improvements. Decide what we wish to achieve on the fixer-top. Looking for a home to reside in, flip to possess funds, otherwise rent out? Your goals will dictate their method of renovations and the funds you place.

Delivering Pre-Acknowledged To get a good Fixer-Top Home

Taking pre-acknowledged getting home financing ‘s the first rung on the ladder inside the to purchase a beneficial fixer-upper domestic. What kind of fixer-higher domestic are you to purchase? Is-it a manager-occupant house? Is it an investment house? Is-it a fix-and-flip domestic?

There are various choices for money an excellent fixer-higher home. If you are planning to invest in the acquisition, rating pre-recognized getting home financing you know the way far you might borrow.

This can help you restrict your options while making way more informed behavior. Keep in mind that to buy an effective fixer-upper shall be labor-intense and economically requiring, it is therefore vital to become better-waiting and just have a clear package. If you wish to become more proficient in household renovations, think hiring advantages otherwise consulting pros to help make suggestions.

Browse Venue To get an excellent Fixer-Top Home

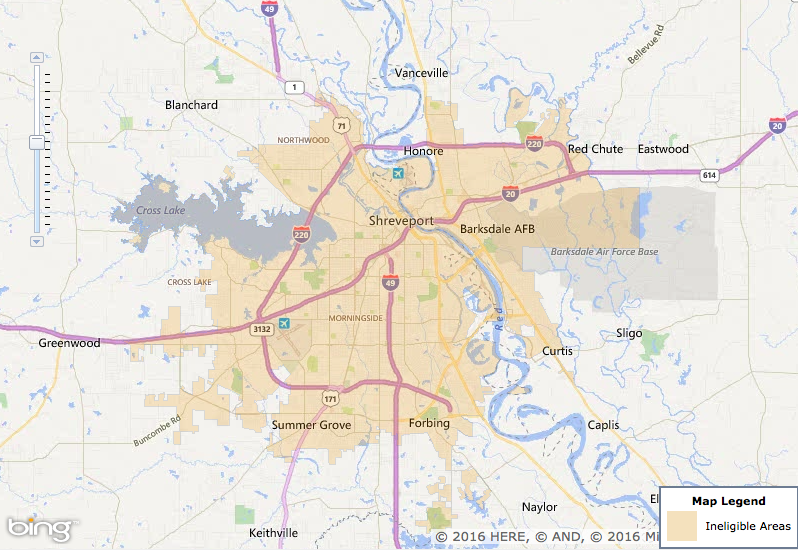

Look into the real estate market in which you want to buy. Glance at assets thinking, neighborhood style, as well as the prospect of future really love. Work with a representative proficient in buying fixer-uppers. Real estate professionals will help buyers get a hold of functions, negotiate income, and supply best spot for an informed potential like. You do not want to spend excess to your domestic and come across repair overruns.

Cause of contingencies when looking to buy a fixer-higher family. Reserved a backup fund to possess unexpected affairs during the renovation. Its prominent getting unexpected difficulties to enhance the entire prices.

Get a qualified house inspector to evaluate the brand new fixer-top. Get a hold of structural, electricity, and you may plumbing work troubles and other major concerns. The newest assessment report will assist you to estimate resolve will cost you much more accurately. Negotiate the cost: According to the evaluation as well as your renovation bundle, discuss the purchase price towards the merchant. They truly are happy to reduce steadily the rate otherwise promote concessions in order to Oklahoma title loans make up necessary solutions.

Comments are Closed