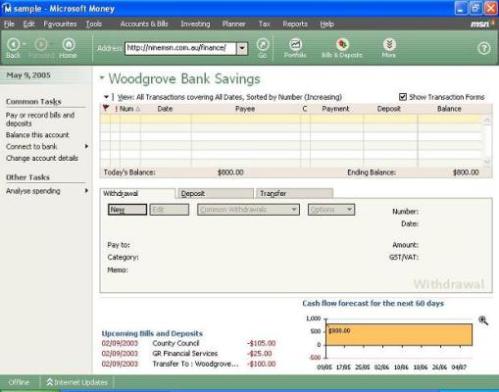

An enthusiastic escrow membership is almost usually put from inside the closure processes and will also be unsealed by the lender

The fresh new membership comes with in addition to vendor which have coverage, and therefore ensures that the fresh payday loans Hayneville closure techniques is continue versus question. Once the closing day happen, the new escrow membership that was made at the beginning of the fresh new processes can either become finalized otherwise kept open to possess upcoming insurance rates and you may assets taxation repayments.

When you find yourself questioning regarding the requirement for a keen escrow membership when you are you’re a resident, the clear answer is that the account isn’t a necessity. Alternatively, its for you to decide to determine and that choice is good for your situation. Which have an enthusiastic escrow account, your insurance premium costs and you will taxation costs might be included due to the fact part of the month-to-month mortgage bill. These money will be moved to the escrow account, which is in which they’ll be kept until he is paid down to the insurance company and the Internal revenue service.

While many homeowners fool around with a keen escrow membership to deal with this type of repayments, you may want to make the most of caring for the fresh new repayments on your own. If not use an enthusiastic escrow account, your monthly mortgage repayments could well be lower. not, you’ll be able to still need to save your self for the insurance policies and you can income tax payments, that can need to be paid back shortly after per year. As such, the option you choose mostly boils down to choice.

Understand that the kind of loan you decide on is influence whether or not an enthusiastic escrow membership was a requirement or simply just an enthusiastic choice. For individuals who sign up for an excellent Virtual assistant mortgage, the only method to decide of an enthusiastic escrow account try by having higher borrowing by and then make a down-payment of at least 10%. In terms of conventional finance, escrow levels are required if you do not make a premier advance payment of at least 20%. Any time you sign up for a keen FHA loan, all the debtor should have an escrow membership and will also be incapable so you can choose away from you to definitely.

If you don’t want a keen escrow account, be sure that you grab the escrow mortgage standards into consideration before choosing the sort of mortgage you need. There is the possibility that you’re able to remain a few of your own costs inside the escrow while some are held aside from it. Some lenders offer borrowers with the opportunity to remain their residence taxation inside the a keen escrow account however its homeowners insurance premium.

Just who Covers My Escrow Account?

Really the only signal from who can manage a keen escrow membership was the account should be treated by the a third party. This third party will be a home loan servicer, a keen escrow team, otherwise an escrow broker.

Escrow Enterprises and you will Agencies

If you are to find a property, their escrow account is going to be addressed of the an escrow organization or representative. The fresh escrow organization that handles your account is often the term business. Together with your deposit, the brand new escrow team normally do the house or property action and almost every other pertinent documents into sales of the property. Just like the escrow business otherwise agent are implementing behalf away from both vendor and you may customer, the full payment is commonly separated between your vendor and you can buyer.

Mortgage Servicers

Home financing servicer was anybody who’s accountable for handling all of your financial as soon as the closure happens up until you have completely paid down off the loan. They tend to collect the monthly homeloan payment, manage your escrow membership, and keep suggestions of the many money you have made. In some cases, your own home loan servicer will be the identical to your own bank. However, there is a possibility your lender will actually sell new repair legal rights for the mortgage.

Comments are Closed