america advance cash advance

now browsing by category

You will find desire-simply fund, spend alternative loans, zero-down software, reasonable if any-doctor programs, fast and easy software, and subprime money

Over the years, even if, Mozilo’s conditions slipped. Of the 2004, he had been giving 180 some other items to help you interest all types from borrowers. I’ve Possession, one-seasons Arms, three-seasons, five-year, seven- and ten-season.

His captain functioning officer informed buyers that it is all of our purpose to take all equipment otherwise program in which there is certainly practical consult… [I]f your own buyers is lawfully be eligible for financing somewhere else in the us, might meet the requirements on Countrywide. Internally, they called it brand new supermarket strategy: so you can widen underwriting advice to fit any product provided by opposition.

The methods shown a premise Mozilo had put up decades earlier: Should anyone ever surrender making the section the largest and also the greatest, this is the go out your die.

Centered on case introduced of the financial insurance provider, Financial Warranty, because of the about 2006, Countrywide’s internal exposure assessors knew you to when you look at the a hefty quantity of their mentioned-money finance fully a 3rd consumers exaggerated money by the more than 50%

By 2005, Mozilo are ripped. He may comprehend the threats preparing in the business, but is actually inebriated for the output. I’m significantly concerned about borrowing high quality in the full business, he told you regarding spring. I think the quantity of capabilities that’s been put up to have subprime is much greater than the grade of subprime fund readily available.

For the a contact in-being all the more worried about the environment encompassing the newest individuals who’re utilising the pay alternative loan and rate amount of a property generally… Read More >

If you have a number of Decades on your side

It generates otherwise break the issue for your requirements. The lending company may have agreed upon the mortgage matter which you have applied for immediately after checking that you earn sufficiently so you can pay the advised EMI on a mortgage . But the ultimate home loan disbursal depends on the property worth determined by the technology group based on the results. A technological class spanning certified architects check outs your residence, monitors their design and you may kits a property value predicated on its full findings. They talk about all in brand new technical declaration they submit to the newest bank, and therefore education they cautiously just before form the loan amount for you.

Money upto INR 29 lakh, significantly more than INR 29-75 lakh and you may more than INR 75 lakh try paid on upto 90%, 80% and 75% of the house prices, correspondingly. Try to shell out up to 10%-25% toward provider from your own avoid. This is when the necessity of coupons are experienced a whole lot more. Of course, if the loan eligibility appear less than your standard by way of all the way down value of, with a whole lot more coupons helps you pick a property efficiently. Very, when you are planning buy property, allow yourself restriction for you personally to gather coupons.

Men generating handsomely and that’s during the early 30s normally have more home loan matter than simply some one on the mid-40s given that former gets more time to function and you can earn as compared to second. As a home loan needs very good discounts out of your stop too, you can take more time than normal to accumulate an identical. If in case you become forty five yrs old or so at that time, the lending company you’ll disburse your less than questioned given the limited age of a position you’ll encounter after that. If you should be salaried, you’ll probably benefit a separate 15 years. Read More >

For the , Nancy Trafton submitted a good Petition in the state court against Defendants Ditech Economic (“Ditech”) and you may Owners Lender

She as well as alleges that the notice out-of purpose to speed their family guarantee loan one she gotten failed to condition extent must get rid of the latest so-called default, as required of the Colorado laws

Before Courtroom is Defendant’s Action for Wisdom toward Pleadings (Dkt. Zero. 7). Plaintiff Trafton failed to document a response. The fresh undersigned submits this Declaration and you will Testimonial to the Region Legal pursuant to help you 28 You.S.C. 636(b)(1)(B), Federal Rule away from Civil Techniques 72, and you can Rule step 1(d) out-of Appendix C of one’s Regional Court Statutes.

Trafton alleges that Residents Financial, which is the manager and you will owner out-of a property collateral mortgage one Trafton acquired, and you can Ditech, the servicer of one’s mortgage, worked badly to foreclose upon and take palms regarding Trafton’s assets, located in Austin, Colorado. Read More >

seven.How-to Estimate Mortgage-to-Well worth (LTV) Ratio? [Brand new Website]

step one. The kind of loan program you choose. Other mortgage programs has additional LTV standards and you will restrictions. 5% LTV. Va fund and you may USDA loans do not have a particular LTV restriction, nonetheless they keeps most other qualifications criteria that you need to meet.

dos. The sort of property you buy. personal loans Kentucky Specific attributes are thought more risky than others by the loan providers and ple, money properties, second belongings, condos, co-ops, and you may are produced belongings ily homes otherwise townhouses.

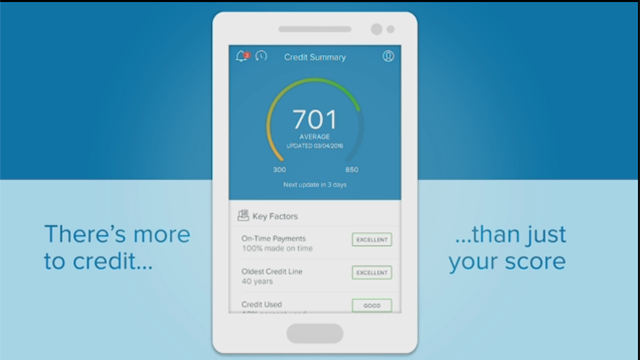

3. Your credit score and history. Your credit score and history reflect your ability and willingness to repay your debt. Lenders use them to assess your risk level and determine your interest rate and loan terms. A large credit rating and a clean credit history can help you qualify for a higher LTV and a lower interest rate. A lower credit rating and a negative credit history can lower your LTV and increase your interest rate.

Such as for instance, traditional loans generally want a maximum LTV out-of 80%, when you are FHA loans ensure it is as much as 96

4. Your income and debt-to-income ratio. Your income and debt-to-income ratio (DTI) measure your financial stability and capacity to repay your loan. Lenders use them to verify that you have enough income to cover your monthly payments and other expenses. A higher income and you may a reduced dti can help you qualify for a higher LTV and a larger loan amount. A lower income and a higher DTI can reduce your LTV and limit your loan amount.

5. The market industry conditions and you may styles. Read More >

More Strategies for Choosing a great Va Bank

Built inside the 1990, Liberty Home loan has grown easily, now a prominent Virtual assistant financial. The attract? Virtual assistant Interest rate Avoidance Re-finance Financing, better-known as IRRRLs. It specialty and you can commitment to streamlining processes make all of them a great wise decision for refinancing your Va mortgage. Although not, borrowers seeking a purchase financing will discover more suitable alternatives elsewhere.

NBKC Financial

NBKC Bank also offers a digital sense if you find yourself targeting personalized customer service. Whilst not as big as other lenders, NBKC Financial concentrates on ease and you may transparent communications, appealing to many pros wanting a personal touch in their financial travels. In addition to, through its clear on the web portal and you can dedication to helping you know every aspect of your loan, you could benefit from the simplicity they shoot for.

Carrington Financial

Even if focusing on antique and government-supported finance, Carrington Mortgage holds a new value towards the experienced area. Considering Experts Affairs investigation, Carrington got its start % of the many Virtual assistant fund in america throughout the 2023, which is nearly twice that of the following-place lender. Even if Carrington focuses primarily on entry to and you will offering consumers which have varied credit backgrounds, certain criticisms of the customer support an internet-based systems manage occur. However delight in Carrington’s individualized pointers, just remember that , in , an individual Monetary Defense Bureau ordered them to shell out a substantial $5.twenty-five billion in fees and penalties to possess purported abuses out-of debtor rights below the fresh CARES Work.

Fairway Independent Home loan Firm

Rounding out all of our top ten are Fairway Separate Financial Company. Read More >

FSA administers the direct and you can guaranteed financing applications

Over prior 75 ages, FSA has provided over $sixty billion from inside the financing financial support so you can farmers through its head mortgage program, and also guaranteed more than $59 million into the extra mortgage money

An applicant which enforce getting lead mortgage recommendations need to be a great birth farmer, one who have not acquired an immediate financing, otherwise person who has never got a direct loan an excellent to own more the term restrictions desired (a decade getting head possession and seven many years to possess head functioning). On top of that, the loan recipient should certainly pay-off in order to render sufficient collateral to secure the financing to your at the very least a money-for-dollars basis, and make use of the borrowed funds getting registered intentions.

As a whole, over step three.seven billion financing were made to help you farmers and you will ranchers within the every fifty states as a result of federal FSA loan applications.

- Not able to score financial support by way of the financial, producers when you look at the Minnesota put FSA Delivery Character and you may Rancher Loans in order to get homes and build a beneficial barn which have a-root-shop facility. Incorporating a-root-sites business greet them to develop conversion to regional dinner and you can colleges during the cold winter when demand from all of these organizations are higher and you may ranch production are lower. Read More >

Griffin Resource are seriously interested in providing our pros which have unmatched service therefore the extremely beneficial terms and conditions

Regardless, you’ll end up accountable for spending both mortgages. This means meeting Virtual assistant loan earnings standards , having a great sufficient credit score, and you will demonstrating your ability to repay both mortgage loans on the other hand. As well, you must have an adequate amount of your own remaining entitlement left regarding the initial financing to discover the advantageous asset of the zero percent downpayment associated with Va financing. You will end up responsible for a deposit without having enough of your own entitlement remaining.

From this point, the following matter you can also inquire is actually, Ought i has actually about three Virtual assistant finance meanwhile? The answer might not be. While it’s it is possible to to utilize the Va loan as many times as you wish, entitlement may become an issue with another family pick in the event the you have not repaid the initial financing entirely and ended up selling the house. Meanwhile, Virtual assistant money are designed for no. 1 homes, and you are unable to inhabit three metropolitan areas simultaneously.

What is actually Virtual assistant Loan Entitlement?

Your own entitlement is what the brand new Va pays towards the financial for those who default on your own financing which is doing twenty five% of the overall loan amount when you have your own complete entitlement. Read More >

How much cash are you willing to score off a funds-aside refi?

Yes, you can utilize a money-away refinance to shop for a second household. An earnings-out re-finance can provide you with a giant lump sum to help you be used for anything you want. Residents both inquire if they may use the income off their refi and work out a down payment with the yet another property. If you have the economic methods to create a couple of mortgages, a money-out refi would-be a good way about how to access a big down-payment.

Fortunately, it will be possible having homeowners to use a profit-out refinance to get 2nd property. If you find yourself contemplating to find an extra property, you will understand just how cash-away refinancing functions and exactly how you can be considered.

The process of making an application for a cash-out refinance to find second residential property is similar to the procedure of obtaining their original home loan. Your own bank will request details about your earnings, possessions, and you can expense to ensure to pay the financing. In addition, you’ll need to schedule a house assessment to decide how much cash you reside well worth. This permits their bank so you can calculate how much you can take-out. Read More >

How much Is it possible you Log in to a great Refinance during the Virginia?

- A new appraisal to confirm your residence’s value. This will help lenders influence your home’s guarantee.

- A credit history of at least 620. (If you find yourself searching for a traditional financing for the Virginia). Virginia FHA financing have significantly more easy borrowing requirements from 600 otherwise large.

- A financial obligation-to-earnings ratio away from 43% otherwise reduced. loans in Autaugaville Which metric are determined of the splitting their monthly loans expenditures from the their pre-tax income.

The level of bucks you might pouch utilizes the residence’s well worth. To choose how your residence measures up, you’ll want to safe an assessment. A real house appraisal was an expert assessment out-of an excellent home’s well worth using an in-person evaluation and you may current transformation from comparable attributes. An appraisal costs anywhere between $400 and you may $600 into the Virginia.

Following appraisal, the Virginia home loan company tend to determine a max amount borrowed. That it number is generally 80% of house’s well worth. But not, this dollars-aside limits start from lender so you can bank. Virginia Va lenders 5 , by way of example, typically allow consumers so you can cash-out ninety% so you can 100% of the residence’s worthy of. Read More >