company loan payday

now browsing by category

Simple fact is that industry and you can people exactly who set it up, she told you

When asked whether property you may just be cost $25,000 higher so you’re able to be the cause of the brand new direct economic assistance, whether it are introduced, Fairweather are clear that sector forces may be the trick determinant.

Due to the fact any real estate professional perform reveal, it is really not the vendor whom establishes the purchase price for a property. Sellers can also be list belongings having whatever they require, but they still have to get an offer that meets that rates. I suppose the idea is that customers have this more income and you will suppliers will get all of it.

In the event it would get passed away to home values, it might be by some degree below $twenty five,000 simply because it will not apply at all of the house, Fairweather told you. Read More >

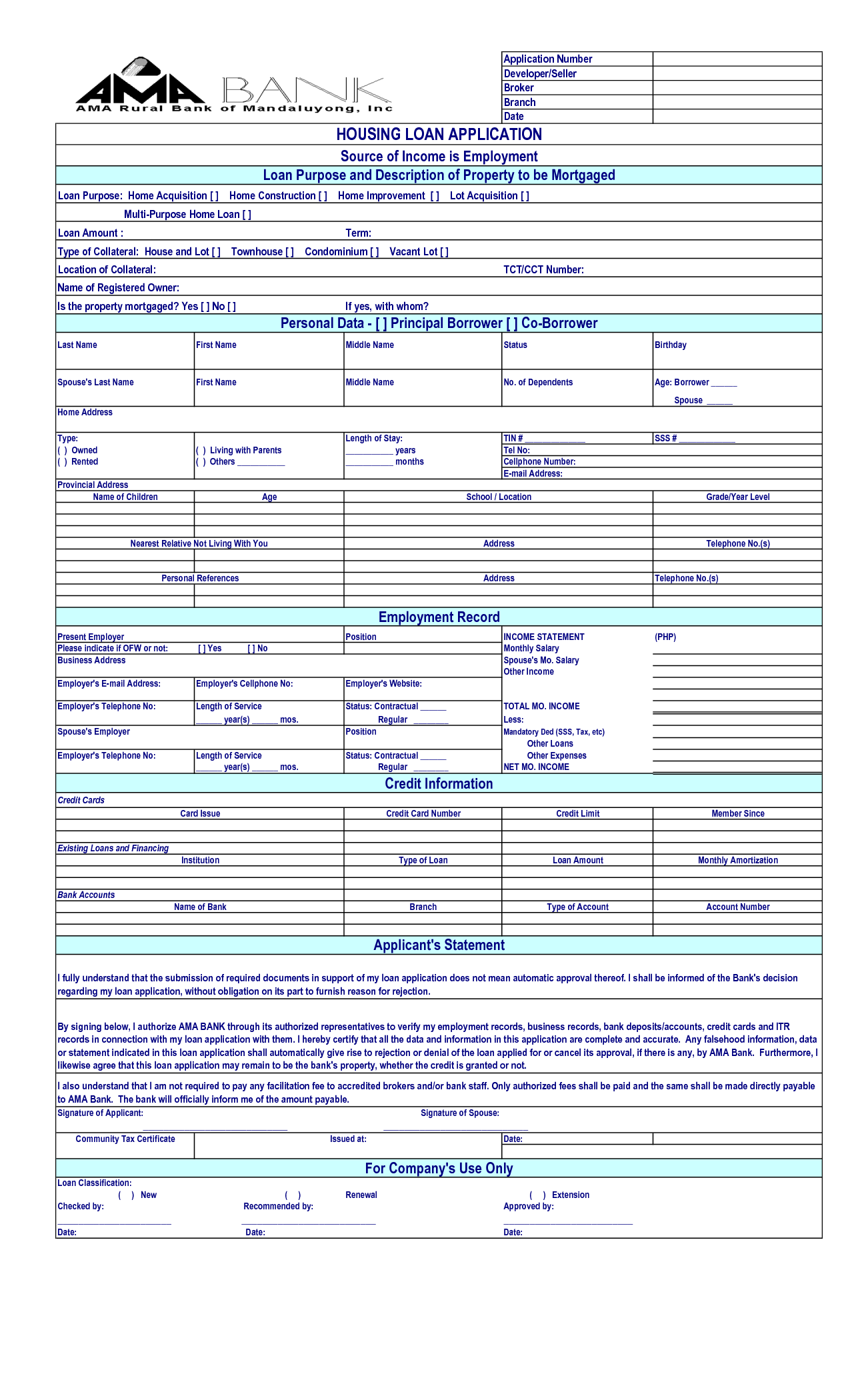

4.Knowledge Collateral in Investment Created Financing [Totally new Blogs]

- Whenever a debtor defaults, the lender starts the newest collateral liquidation procedure. This requires promoting brand new investment to recover the fresh a great obligations.

- In case the debtor uses the income smartly (elizabeth.grams., renovations), its a profit-win: they boost the living space when you find yourself leveraging the asset.

In a nutshell, information guarantee is a must to possess consumers seeking resource and loan providers assessing exposure. Contemplate, about most of the financing arrangement lays an asset that assurances trust and you can liability.

step three.Insights Equity for the Abs [Brand-new Weblog]

Collateral is a critical element of Asset Backed Bonds (ABS) and you will performs a serious role in choosing the general risk and you can return profile of them economic tools. Basically, equity refers to the hidden assets that provides a supply of percentage to help you investors in the eventuality of standard. Let’s delve deeper to your this notion to increase a far greater wisdom.

ABS can be backed by various types of collateral, depending on the underlying assets. Some common examples include residential mortgages, commercial mortgages, auto loans, credit card receivables, student loans, and even future cash flows from movie royalties otherwise rational possessions rights. The diversity of collateral types allows for a broad range of investment opportunities in the ABS market.

The standard of guarantee in person affects the risk from the an Abdominal muscles. Higher-quality guarantee, such as for instance best mortgages or high-ranked business money, essentially leads to all the way down default odds and, therefore, lower exposure for traders. In contrast, lower-quality collateral, such as subprime mortgages https://paydayloansconnecticut.com/old-hill/ or down-rated consumer finance, gift suggestions a top chance of default that can cause large yields to pay people into increased risk. Read More >

How much cash Leasing Income Often The banks Accept?

- Uncommon A career Finance

- Rental Earnings Home loan

As a general rule, lenders needs 80% of the terrible rental income along with other income, just like your salary, to help you estimate your borrowing from the bank power.

How do Financial institutions Evaluate Local rental Money?

Not totally all loan providers assess your own book money in the same manner. Read More >

Mastering Mortgage Data which have Overall Mortgage’s Mortgage Calculator

Inclusion

Have you been gearing as much as look into the industry of homeownership? Well-done to your bringing this extreme step to the securing your future! Before your embark on which fascinating trip, it is necessary to facilitate yourself on the products and knowledge expected to browse the reasons away from mortgage calculations. Full Mortgage’s Mortgage Calculator is your wade-so you’re able to investment to have without difficulty quoting their mortgage repayments and knowing the monetary intricacies inside it.

Tips Make use of Total Mortgage’s Home loan Calculator

Calculating the mortgage payments must not be a frightening task. Read More >

W ant a cash put aside having all you require, whenever you want they, just like the The newest York’s Penny Discounts Financial claims?

Otherwise a bona-fide deal, courtesy of California Very first? People certainly are the types of advertising states which might be wafting these types of weeks doing banking’s top product, the home-collateral financing. The major worry: one to certain unwary users erican deals portfolios, the household home.

A beneficial boomlet of sorts is actually less than way since people operate that have love compared to that form of unsecured debt, whenever you are lenders vie seriously to own customers and you go right here will id the newest hurry, cautionary sounds was caution in regards to the risks of standard finance, and misleading nature of a few of your buzz

Home-equity money are doing an area-place of work company, expected to double to $70 billion in 2010 (pick chart). They are hence wearing easily to the a special kind of borrowing from the bank facing the brand new Western household, practical next mortgages, which happen to be probably be worthy of $130 billion into the 1987. The standard 2nd home loan is generally a preliminary-identity, fixed-commission plan for an appartment number, based on the value of property that stays immediately following deducting their first mortgage. As household-security financing are often used to get user affairs, along with everything from stereos so you can deluxe autos, its newfound impress is inspired by good loophole on Income tax Reform Act of 1986, and therefore phased out the new deductibility of the many attention money except financial payments into dominant and you may next homes. Read More >

Rental Income Out of Accessory Dwelling Equipment (ADUs Or Mother-In-Law Units)

Debt-to-money rates so it higher dont qualify for ordinary mortgages. HomeReady mortgage loans limit your debt-to-earnings ratio from the forty-five per cent. It is still you’ll be able to to get recognized for a financial loan if you slide exterior it limit, and additional money are attained because of the most other members of your family members is certainly one component that you may persuade your lender so you’re able to agree your own loan.

Co-Signer Income

On HomeReady program, money away from non-renter co-individuals (parties who sign the borrowed funds although not live-in your house being ordered) can be regarded as to have certification.

The latest classic disease let me reveal that mothers which individual their houses can co-sign an interest rate the help of its students. Lenders have a tendency to mix their earnings toward head borrower’s in relation to the mortgage. Read More >

What is Connection Investment and how Will it Really works?

There are many different advantageous assets to examining the option of being able to access established guarantee of your house a variety of small-label economic needs. Anyway, you may have spent some time working much time and hard to blow their monthly mortgage money. The target is to get prominent financing paid in complete.

In the process, off taking out fully an initial mortgage so you can no longer due one currency for the bank, financial concerns get pop-up, pressuring a citizen to check financial concerns. It can be time and energy to consider 2nd financial choice using the new collateral gathered in your property.

In top of one’s pandemic and you will throughout the basic one-fourth of 2021, possessions appreciation might have been good-sized for the properties throughout the Ontario along with types of Toronto in addition to related GTA. homes amounts are impressive.

Depending on the Toronto Summer Housing Declaration, the typical price of an individual detached property throughout the Toronto area enjoys increased to step one.1 million. Homes are providing very quickly. Home are offering normally after merely 13 days with the markets. These number are encouraging having established Toronto property owners serving as further added bonus to look meticulously for the individuals next financial selection offered.

The option of Bridge Funding having Ontario Home owners

There are several second home loan solutions for these Ontario home owners that must utilize the guarantee in their house to greatly help go small-title economic goals. Variety of next mortgage choices may include:

- Debt consolidating loans

- Home security financing

- Household Security Line of credit (HELOC)

- House Repair financing

- Refinancing a primary financial

What is actually a bridge loan? In other words, bridge funds show quick-term loans (constantly 3 so you’re able to a dozen day terminology) in which a resident borrows contrary to the existing collateral inside their house. Read More >