i need payday loan now

now browsing by category

Thankfully, For the Q Home loans causes it to be smoother along with its One to-Time Intimate Structure Financing!

One-Date Close Build Fund

That have home values expanding and you can index therefore scarce, it may be difficult to find an aspiration house. Even so, a potential bidding conflict and you may overpayment are sometimes sufficient to scare regarding audience. As opposed to in search of your dream domestic, why not generate you to definitely rather?

Sure, strengthening your dream domestic can come with its group of pressures. The buildings normally take more time right away of the processes to shut, and you also you prefer authoritative financing towards create and for the household alone.

What is Structure-TO-Long lasting Investment?

Construction-to-permanent funding refers to rolling your framework resource in the permanent mortgage. This will be a great choice if you are looking to own an excellent one-stop-shop as same lender aren’t handles these fund.

not, there are two things to keep in mind. As the structure-to-long lasting funding spends the mortgage to construct your residence, make an effort to build costs on the structure. But not, these repayments is attention-only and does not reduce your prominent until the loan are converted to a long-term financial.

With On Q Family Loans’s That-Time Intimate Mortgage, we personal ahead of build and customize the financing as needed during the building phase. So it modification comes to upgrading specific latest details as opposed to being a keen entirely the closure.

Benefits of Our That-Date Design Financing

We designed our very own One to-Go out Build Financing to clear up your financial processes. The original method i accomplish that is through providing you with only you to closing big date in place of a couple! Meaning you might not need to worry about in case your actual latest personal try you could mark their calendar immediately! Read More >

Check out re-finance your house loan to save into EMI payments

Anagh Friend

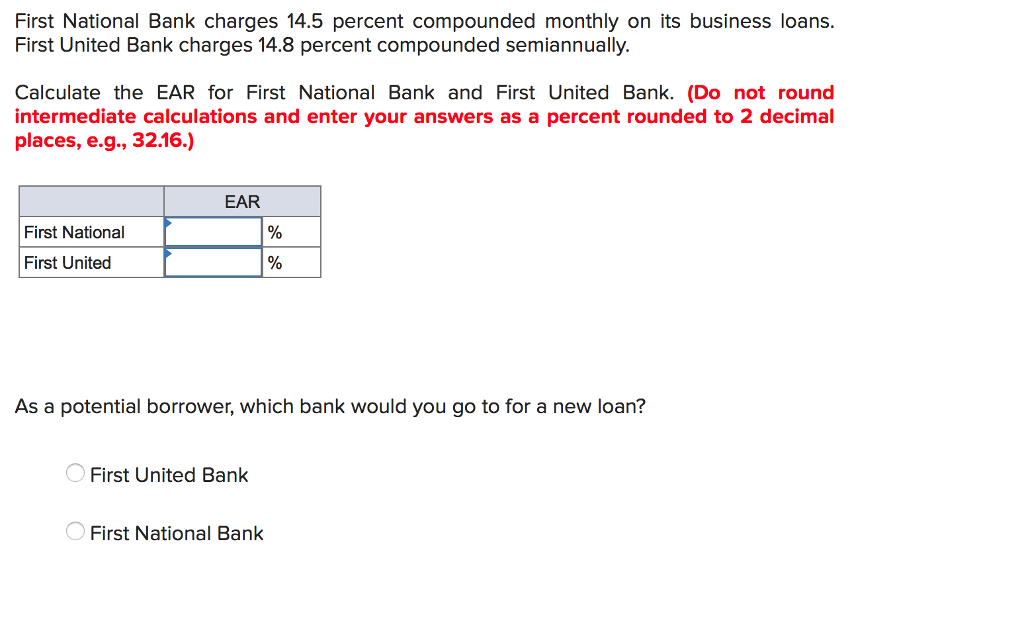

- As the , new EMI each lakh went up away from ?899 in order to ?1,044.

- You might prepay your loan otherwise shell out additional EMI every quarter otherwise nothing over the regular EMI every month.

Immediately following RBI raised the repo rates by the 25 foundation one or two facts 2 weeks before, very banks have increased their interest prices.

Between , brand new RBI features boosted the repo rate because of the 250 bps. Banking institutions enjoys carried almost all the pace nature hikes, or have been in the entire process of doing so in the next few weeks.

It means the attention per lakh into the an effective 15-year financing has gone right up out of up to ?62,000 so you’re able to just as much as ?87,000. The new EMI for every lakh has gone up by sixteen%, of ?899 to help you ?1044. So, getting a ?50L loan having 15 years, the EMI might have risen regarding ?forty-two,941 on seven% so you can ?52,211 during the an interest rate out of 9.5%.

Turn-to refinance your home loan to keep into EMI costs

Prepaying your home financing can lessen brand new EMI load: In the event of present individuals, loan providers generally have a tendency to boost the tenor of the mortgage rather of your EMI. not, for a loan which have 15-year a good, a 2.5% raise mode an increase off eight years and you will six months. Read More >

Good commenter offered the fresh suggested rule but told you there could perhaps not be enough liquidity to help with forty-year mortgage improvement

A beneficial commenter suggested one to 40-seasons words is going to be available for your house Affordable Modification Program (FHA-HAMP) and you can Presidentially Stated Significant Emergency Components (PDMDA) amendment apps (sometimes which have otherwise in the place of a partial allege) to achieve target money. So it commenter best if FHA establish a phrase as much as forty years into practical FHA-HAMP and you will PDMDA falls intricate regarding the FHA Single Family Houses Coverage Guide (Handbook 4000.1), Part III, Maintenance and you may Losses Minimization, in another rules up-date.

HUD Reaction: So it signal permits HUD to work out the legal power to allow into the 40-seasons mortgage loan modification for usage among FHA’s loss minimization equipment or even payday loans Oklahoma in integration with individuals. That it signal lets HUD to utilize which expert for the FHA-HAMP and in improvement getting consumers influenced by disasters. Then suggestions about how this might be followed inside HUD’s losses mitigation program might possibly be had written into the HUD policy, and you will HUD will take these comments into account contained in this context. It code does not preclude HUD out of and come up with a lot more alter otherwise and come up with other choices readily available for mortgagees to utilize which have battling borrowers. Read More >

Most of the loan’s initially speed are very different, it lasts for to 7 or 10 decades

Just what You will learn

Interest levels write a critical part of your own monthly homeloan payment. He’s usually changing, however when he or she is consistently moving upward through your house research, make an effort to think a means to lock an interest rate you really can afford for probably the 2nd thirty years. Several alternatives for individuals is actually adjustable-rates mortgage loans (ARMs) and you will home loan buydowns to minimize the pace. Why don’t we consider Palms very first.

What is actually a supply?

With an arm, your own price may start lower than regarding a fixed-price mortgage Home financing with an intention rate that perhaps not change over the life span of loan. fixed-rate mortgage A mortgage with an interest price that will perhaps not change over the life span of financing. Read More >

6.dos Next-stage Issues Design: Transitions from Arrears

six.2.1 Equity and housing industry turnover

This new twice-end in hypothesis predicts that degree of negative guarantee is the chief determinant out of whether a loan within the arrears transitions to foreclosures. In line with Hypothesis C, design quotes advise that the probability of finance transitioning to the foreclosures is expanding in the degree of negative equity. At the same time, the chances of fund treating otherwise fully settling declines to have finance that have negative guarantee. Finance which might be significantly into the bad security (during the section out of entering arrears) remain five to eight times while the planning to changeover to help you property foreclosure since the a loan into median LVR (Contour twelve). The fresh new magnitudes of these issues percentages was bigger than regarding earliest phase show. There are no type of thresholds around and therefore financing change in order to foreclosures, prior to internationally evidence that signifies that borrowers has heterogeneous foreclosures costs and you will homes rates traditional (Guiso ainsi que al 2013; Bhutta ainsi que al 2017). Read More >