no credit check cash advance loans

now browsing by category

A bankruptcy proceeding normally bump doing 2 hundred circumstances of their credit history

The eye rates to have an interest rate immediately following personal bankruptcy will vary, with regards to the loan and borrower’s credit rating.

Rates of interest fall and rise, depending on financial issues. As an instance, in the 2020 and you can 2021, the latest U.S. Government Reserve leftover interest rates typically reasonable. When you are pricing fluctuate, the new gap between the speed getting a debtor with a high credit history and one having a minimal credit rating stays on the the same.

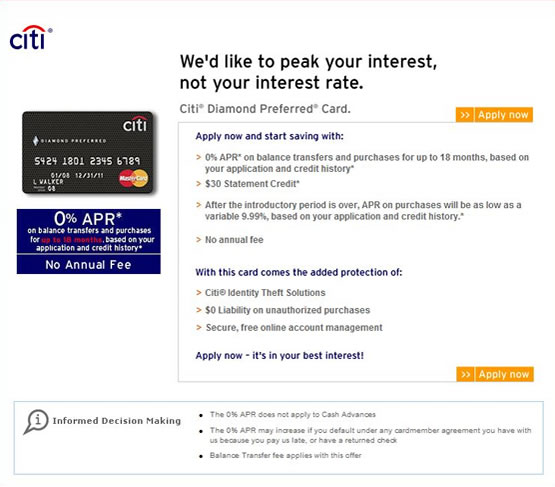

It chart, exhibiting cost regarding 2021, compares interest levels for various form of loans as well as how they vary having credit scores:

Exactly what are FHA Fund?

FHA funds was mortgages supported by the newest Federal Housing Expert, readily available for individuals who possess issues getting a normal mortgage due to a woeful credit record otherwise income. FHA money provides easier borrowing criteria minimizing down payments.

Given that U.S. authorities backs the money, lending associations much more prepared to www.clickcashadvance.com/loans/pre-approved-personal-loan/ bring them to individuals with bad credit score, whilst reduce your credit history, brand new harder it can be to locate a loan provider.

A borrower with a great FICO rating off 580 can qualify for an enthusiastic FHA home loan that have a down-payment of step three.5% and you will someone with a great 10% down-payment normally qualify with a 500 rating. The low the rating, the greater the rate together with much harder it can be discover a lender. If you’re applying which have a credit rating lower than 600 is achievable, less than dos% off FHA home loan individuals got a credit history you to reduced very early in 2021.

Chapter 13 – A couple of years in the event the bundle costs were made on time and the new trustee of your own case of bankruptcy offers a fine.

Preciselywhat are Old-fashioned Finance?

They aren’t protected because of the bodies, even so they typically have the best interest rates and terms, and thus all the way down monthly payments. Read More >

If you’re wanting a residential property, try to focus on a financial investment lender

By Amanda Dodge

Buying a new home after you currently own property is an excellent common practice. Many people buy resource attributes to enhance the money while others wanted vacation house for sunday escapes.

Even though you just want to live-in you to home, you might end up buying your upcoming house before you could promote your current one.

The whole process of to get the next home is a tad bit more challenging than simply purchasing your basic you to. You really need to produce a finance bundle and you will get ready for twin ownership. Luckily, into best thinking, you can proceed through each step effortlessly.

Hire a dependable Agent

The initial step in almost any a house purchase would be to works that have a representative you understand and you may faith. Choosing a talented agent makes it possible to smoothly browse the home-to shop for techniques. Regardless if the broker doesn’t have an answer for everything, they’re able to connect your having money and you may legal professionals that do.

Certain real estate professionals concentrate on working with consumers seeking second property. They’re able to help you scout funding properties or search for travel homes that fall affordable. By the reviewing your targets having possible agents, you could potentially look at exactly how much sense he has along with your types of out-of characteristics and how educated he is regarding the most useful part. You could potentially be confident that their agent is a good match to meet your needs.

To find a quality Realtor in your area, experiment FastExpert. You can read real estate agent profiles and learn about the types of homes they help people buy. Read More >