payday cash advance near me

now browsing by category

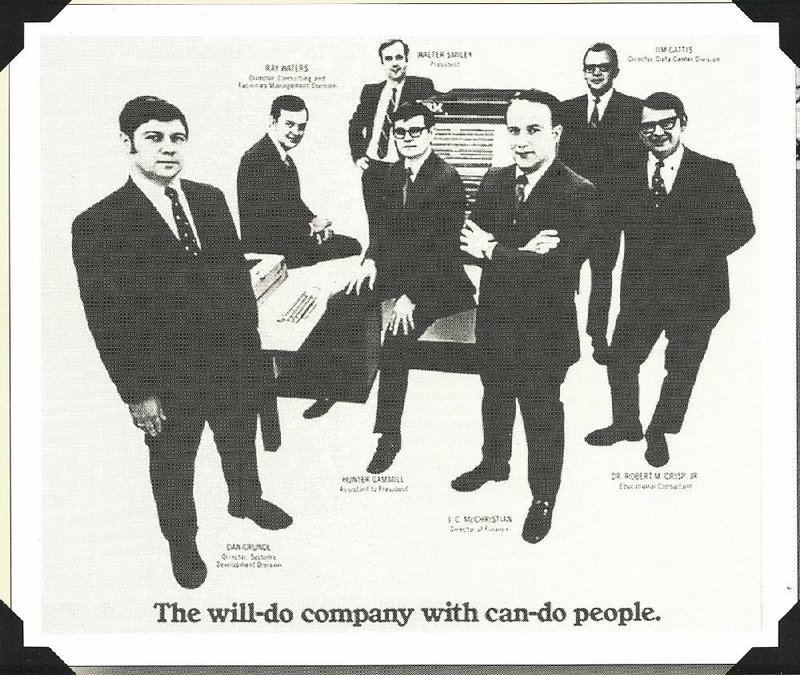

We’ve got become the well-known financial for most of the biggest labels in the industry

Extend and you may write to us we can evaluate and you can tell you!

Mortgage brokers to possess Cops Lenders to possess police is actually one ways we could surrender to the people just who put the lifestyle at risk towards coverage of our own teams. Our Earliest Responder Home loan system can be used having any of the internally real estate loan applications. As well as USDA, Va, FHA, and Old-fashioned investment.

Within RealFi Home Resource, i developed the Mortgage loans getting Winners Program since the a thank you so much to your selfless, hardworking winners regarding following the areas: EMT, Firefighting, Regulators, The police, Medical, Army, and you can Training. Read More >

There is certainly significantly more to help you a mortgage than just paying back the new prominent and desire more than three decades

What about home loan keeps?

You can include has to your house loan to really make it be more effective to you. The available choices of these features utilizes your loan form of (they aren’t usually a choice for repaired rate finance). Read More >

Should i Rating a loan Which have an effective 650 Credit history?

Credit scores was crucial from inside the shaping the borrowing travel and you will typically dictate the eligibility for different financial products such as for example personal loans and you can credit cards. A good 650 credit history belongs to the class out of fair credit scores even though this rating actually categorized just like the bad because of the FICO conditions, it does include specific options.

As of ericans got a credit rating lower than 650. When you find yourself an excellent 650 rating isn’t perfect, it is from a-dead stop. On this page, we’re going to talk about various sorts of funds offered to people with a reasonable credit history.

Can i Get financing Which have an effective 650 Credit score?

Yes, you can. A credit rating regarding 650, categorized just like the fair credit, reveals the doorway to several financial products, in addition to mortgages and automotive loans. not, it’s imperative to understand that that have that it credit history can indicate it is possible to deal with higher interest levels as opposed to those with more sturdy borrowing from the bank pages.

For example, a score from 690, which is considered good credit, normally secures way more favorable loan terms. Despite this, particular finance bypass the necessity for borrowing monitors, possibly providing most useful words for even individuals with an excellent 650 borrowing rating.

Is it possible you Rating a car loan With a beneficial 650 Credit score?

Yes, getting a car loan that have a good 650 credit rating can be done, however, be prepared for high rates. To help you show, inside the , borrowers which have prime borrowing from the bank (FICO score of 720 or more) gotten an average Annual percentage rate of 5.34% towards the newest 60-month auto loans.

Meanwhile, those who work in the brand new 620-659 credit history diversity encountered the common Apr out of %. Read More >

Best Low interest rates Personal loans inside the )

*The loan words, also ount, name length, plus borrowing from the bank profile. Higher level credit must qualify for lowest costs. Prices start from 5.73% – % Annual percentage rate w/AutoPay. Speed try cited that have AutoPay disregard. AutoPay discount is just available before mortgage resource. Costs rather than AutoPay is .50% activities large. At the installment loans online in Indiana mercy of borrowing acceptance. Requirements and you will restrictions implement. Said cost and conditions are at the mercy of change with no warning. Commission analogy: Monthly premiums to have a beneficial $10,one hundred thousand mortgage within 5.73% Annual percentage rate that have an expression from three-years create end up in thirty-six monthly installments of $. 2022 Truist Monetary Business. Truist, LightStream, and the LightStream signal was provider marks away from Truist Economic Organization. Some other trademarks is the assets of its particular owners.

Your loan term will impression your Annual percentage rate, and this can be greater than the lower claimed rates

- Unsecured loans up to $50,100000 having lower repaired rates that can never ever transform

- Sensible monthly payments that fit your financial budget without prepayment charges

- ??Timely Resource -You really need to receive your own finance inside a day out-of clearing verifications/li>

- No duty without impact into credit rating when you look at the rates

- Make use of loan as a consequence of Change to pay for the large desire credit notes, create a massive get, end one to do it yourself enterprise, or whichever life experience! Read More >