Goodwill Accounting: Overview, Examples, & Purpose in M&A

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Understanding Goodwill in Accounting: A Comprehensive Guide for Business Owners & Students

Intangible assets are amortized, which means a fixed amount is marked down every year, resulting in a simultaneous charge against earnings. The amortization amount is adjusted if the asset’s value is impaired at some point after its acquisition or development. Just like other assets, the buyer who acquires your business will be able to take a tax deduction for the amount of goodwill they received as part of the sale. The way you calculate goodwill is by taking the purchase price and subtracting the other asset allocations. For example, if you are selling an outstanding product or providing an excellent service consistently, you are going to build this inherent goodwill a lot quicker. The $2 million, that was over and above the fair value of the identifiable assets minus the liabilities, must have been for something else.

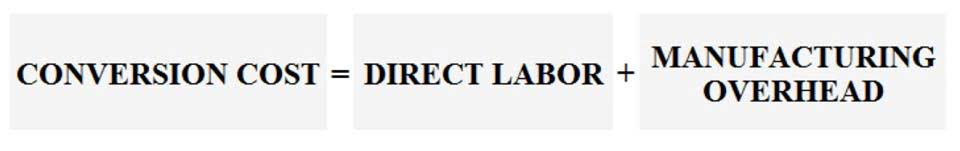

Type of Account & Formula

- Therefore, it helps in raising the overall revenue of the enterprise without any additional efforts & is recorded on the asset side of its balance sheet.

- As the seller, you will have to pay ordinary income tax on the $25,000 that you received from selling the truck to “recapture” the depreciation you wrote off on your taxes.

- Goodwill is the future benefit that accrues to a firm as a result of its ability to earn an excess rate of return on its recorded net assets.

- You can determine goodwill with a simple formula by taking the purchase price of a company and subtracting the net fair market value of identifiable assets and liabilities.

- It’s the portion of the purchase price that’s higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process.

- Goodwill only shows up on a balance sheet when two companies complete a merger or acquisition.

It represents a value and potential competitive advantage that may be obtained by one company when it purchases another. It’s the amount of the purchase price over and above the amount of the fair market value of the target company’s assets minus its liabilities. Goodwill is typically recorded on the balance sheet when a company buys another business and pays a premium for it. This premium reflects the buyer’s belief that the acquired company https://www.bookstime.com/ possesses certain valuable intangible assets which will provide future economic benefits. The company must impair or do a write-down on the value of the asset on the balance sheet if a company assesses that acquired net assets fall below the book value or if the amount of goodwill was overstated. The impairment expense is calculated as the difference between the current market value and the purchase price of the intangible asset.

Ask Any Financial Question

A different approach to finding the value of a firm aggregates the estimates of values for its individual components, including identifiable and unidentifiable assets and liabilities to be assumed. With all of your calculations completed, you can now calculate goodwill. This is done by subtracting the fair market value adjustment in Step 3 from the excess purchase price. For example, if your excess purchase price is $400,000 and your fair value adjustment is $100,000, your goodwill amount would be $300,000. Goodwill accounting involves a series of simple calculations to determine exactly how much goodwill will need to be recorded.

- This $3 billion will be included on the acquirer’s balance sheet as goodwill.

- First, get the book value of all assets on the target’s balance sheet.

- Your customers have an intense love for your specialty dishes that they can get nowhere else.

- Under this structure, a company’s assets (things like cash, furniture and equipment, and accounts receivable) and its liabilities (things like debt it owes) now belong to the new company.

These rules apply to businesses conforming to generally accepted accounting principles (GAAP) using a full accrual accounting method. If conditions indicate that the carrying value may not be recoverable, impairment tests are performed. After all, goodwill denotes the value of certain non-monetary, non-physical resources, and that sounds like exactly what an intangible asset is. Allocations that are positive for the seller are usually neutral or slightly unfavorable for the buyer, while allocations that benefit the buyer usually disproportionately hurt the seller. Because of this, you should be prepared to make some compromises on the allocation of the purchase price but will want to hold a line. Allocation is the process of dividing up the total purchase price into different categories, primarily for tax reasons.

Once you determine the book value of the assets, you can move on to the next step. Goodwill accounted for 8.5% of the total assets of S&P 500 companies in 2018. The opposite can also occur in some cases with investors believing that the true value of a company’s goodwill is greater than what’s stated on its balance sheet. There are different types of goodwill based on the type of business and customers.

![]()

Warren Buffett used California-based See’s Candies as an example of this. See’s consistently earned approximately a two million dollar annual net profit with net tangible assets of only eight million dollars. Because a 25% return goodwill meaning in business on assets is exceptionally high, the inference is that part of the company’s profitability was due to the existence of substantial goodwill assets. Brand recognition cannot be separated from a company and sold individually.

- It will help in forming a clear understanding of the concept of goodwill in accounting.

- However, businesses are required to evaluate goodwill in business for impairment (when the market value drops below the historical cost) on a yearly basis.

- LegalZoom is not a law firm and does not provide legal advice, except where authorized through its subsidiary law firm LZ Legal Services, LLC.

- When an intangible asset—something you can’t hold in your hand—decreases every year to reflect a lower value, that process is called amortization.

- Say you acquire a company and pay a goodwill premium because it has a strong workforce.

- Note – Additionally, the impairment loss of goodwill shall also be written off from the books of accounts if goodwill is impaired/devalued.

Small businesses using cash-basis accounting or modified cash-basis accounting can use the statutory rates set by the Internal Revenue Service (IRS). The IRS allows for a 15-year write-off period for the intangibles that have been purchased. There is a lot of overlap and contrast between the IRS and GAAP reporting. For example, say you as the seller bought a truck for $50,000 and then depreciated it to $0 over 3 years before the sale. That truck still has some service life left and the buyer will acquire it in the asset sale. Goodwill is valuable to a buyer because it represents your company’s ability to take physical assets and generate cash flow into the future.

What Is a Sales Invoice? How to Create One & Get Paid Fast

- When you acquire a new business, you’re not just purchasing their contracts, equipment, real estate, and inventory.

- But goodwill isn’t amortized or depreciated, unlike other assets that have a discernible useful life.

- Evaluating goodwill is a challenging but critical skill for many investors.

- In a successful business, the whole is greater than the sum of the parts.

- Goodwill cannot exist independently of the business, nor can it be sold, purchased, or transferred separately.

It’s considered to be an intangible or non-current asset because it’s not a physical asset such as buildings or equipment. Unlike physical assets such as building and equipment, goodwill is an intangible asset that is listed under the long-term assets of the acquirer’s balance sheet. It cannot be sold or transferred separately from the business as a whole. When a business is acquired, it is common for the buyer to pay more than the market value of the business’ identifiable assets and liabilities. The main difference between goodwill and other intangible assets is that goodwill cannot be separated from the business and sold, while other intangible assets can. To get a better understanding, consider the difference between brand recognition and patents.

Comments are Closed