Karuna Therapeutics Stock Price Today NASDAQ: KRTX Quote, Market Cap, Chart

Contents:

If you had invested in Karuna Therapeutics stock at $20.02, your return over the last 3 years would have been 891.21%, for an annualized return of 114.81% . Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Investing.com – U.S. equities were higher at the close on Monday, as gains in the Consumer Services, Consumer Goods and Technology sectors propelled shares higher. Provide specific products and services to you, such as portfolio management or data aggregation. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

- The consensus among Wall Street research analysts is that investors should “buy” KRTX shares.

- Monitor the latest movements within the Karuna Therapeutics Inc real time stock price chart below.

- This is a higher news sentiment than the 0.66 average news sentiment score of Medical companies.

- Karuna Therapeutics Inc share price live 205.11, this page displays NASDAQ KRTX stock exchange data.

- There are currently 2 hold ratings and 13 buy ratings for the stock.

- Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

Piper Sandler began coverage on Karuna Therapeutics in a report on Thursday, January 5th. They issued an “overweight” rating and a $285.00 price target for the company. Wedbush reaffirmed an “outperform” rating on shares of Karuna Therapeutics in a research note on Tuesday, March 21st. HC Wainwright dropped their price objective on Karuna Therapeutics from $320.00 to $300.00 and set a “buy” rating for the company in a report on Tuesday, March 28th.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Please log in to your account or sign up in order to add this asset to your watchlist. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

Karuna Therapeutics Inc (KRTX)

Karuna Therapeutics Inc is a clinical-stage biopharmaceutical company focused on developing novel therapies to address disabling neuropsychiatric conditions characterized by unmet medical needs. Its product candidate, KarXT is an oral modulator of muscarinic receptors that are located both in the central nervous system, or CNS, and various peripheral tissues. Sign-up to receive the latest news and ratings for Karuna Therapeutics and its competitors with MarketBeat’s FREE daily newsletter. The P/E ratio of Karuna Therapeutics is -23.52, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

Cantor Fitzgerald started coverage on Karuna Therapeutics in a report on Tuesday, March 7th. They issued a “neutral” rating and a $214.00 target price on the stock. Finally, UBS Group assumed coverage on Karuna Therapeutics in a research report on Friday, January 27th. They set a “neutral” rating and a $209.00 price target for the company. Two equities research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the stock.

In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. The chart below shows how a company’s share price and consensus price target have changed over time. The lighter blue line represents the stock’s consensus price target. The even lighter blue range in the background of the two lines represents the low price target and the high price target for each stock. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Time to Upgrade!

According to MarketBeat.com, the stock has an average rating of “Moderate Buy” and an average price target of $276.87. Karuna Therapeutics Inc share price live 205.11, this page displays NASDAQ KRTX stock exchange data. View the KRTX premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Karuna Therapeutics Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the KRTX quote.

Karuna Therapeutics’ stock is owned by a number of institutional and retail investors. The company is scheduled to release its next quarterly earnings announcement on Thursday, May 4th 2023. MarketBeat has tracked 4 news articles for Karuna Therapeutics this week, compared to 4 articles on an average week.

One share of KRTX stock can currently be purchased for approximately $204.76. P/B Ratios above 3 indicate that a company could be overvalued with respect to its assets and liabilities. Karuna Therapeutics does not have a long track record of dividend growth.

Cerevel Test Data Scrambles Schizophrenia Stocks

The company’s average rating score is 2.87, and is based on 13 buy ratings, 2 hold ratings, and no sell ratings. This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Karuna Therapeutics, Inc operates as a clinical-stage biopharmaceutical company. Engages in business of research and development of therapies utilizing muscarinic cholinergic receptors to treat psychosis and cognitive impairment in numerous central nervous system disorders. The company was founded by Andrew Miller, Eric Elenko, and Peter Jeffrey Conn in July 2009 and is headquartered in Boston, MA.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. KRTX – Has potential to reach new highs giving up to 6RA move above 238$ could take this to new highs giving a R/R of more than 3.5R. If price goes above 262$ (78.6% Fib retracement), it’s likely it can go towards the 127.2% level around 300$. A move above 238$ could take this to new highs giving a R/R of more than 3.5R. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time.

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. According to analysts’ consensus price target of $276.87, Karuna Therapeutics has a forecasted upside of 35.0% from its current price of $205.11.

KRTX gap fill lower targets b/t $19-$32A strong bearish RSI divergence showing here with a gap down in the level, buy orders would be set nicely there or short into that level. A strong bearish RSI divergence showing here with a gap down in the level, buy orders would be set nicely there or short into that level. We’d like to share more about how we work and what drives our day-to-day business. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

Key Data

Real-https://1investing.in/ last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Shares of Karuna Therapeutics Inc. soared 42.6% in premarket trading on Monday after the company said its experimental treatment for schizophrenia met the primary endpoint in a Phase 3 clinical trial. In the past three months, Karuna Therapeutics insiders have sold more of their company’s stock than they have bought. Specifically, they have bought $0.00 in company stock and sold $11,981,570.00 in company stock.

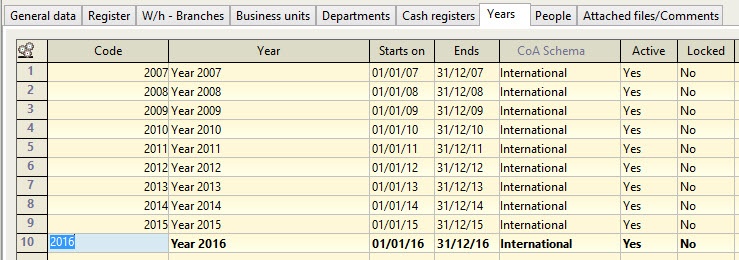

The company was formerly known as Karuna Pharmaceuticals, Inc. and changed its name to Karuna Therapeutics, Inc. in March 2019. Karuna Therapeutics, Inc. was incorporated in 2009 and is headquartered in Boston, Massachusetts. Market cap is the total market value of a publicly traded company’s outstanding shares. Karuna Therapeutics has been the subject of 5 research reports in the past 90 days, demonstrating strong analyst interest in this stock. While Karuna Therapeutics currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys. Intraday Data provided by FACTSET and subject to terms of use.

Recently Viewed Tickers

16.20% of the stock of Karuna Therapeutics is held by insiders. A high percentage of insider ownership can be a sign of company health. Only 3 people have added Karuna Therapeutics to their MarketBeat watchlist in the last 30 days. Only 8 people have searched for KRTX on MarketBeat in the last 30 days.

Karuna Therapeutics has a short interest ratio (“days to cover”) of 5.2. Sign-up to receive the latest news and ratings for KRTX and its competitors with MarketBeat’s FREE daily newsletter. Overall, this stock passed 10/33 due dilligence checks and has average fundamentals, according to our automated analysis. Karuna Therapeutics Inc. reported Q3 EPS of ($2.38), $0.27 worse than the analyst estimate of ($2.11). Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world.

This is a decrease of -47% compared to the previous 30 days. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Karuna Therapeutics has been rated by Cantor Fitzgerald, HC Wainwright, JMP Securities, Wedbush, and Wells Fargo & Company in the past 90 days.

Analysts like Karuna Therapeutics more than other Medical companies. The consensus rating for Karuna Therapeutics is Moderate Buy while the average consensus rating for medical companies is Buy. MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Institutional the 5 soft skills insurance agents need to master have recently added to or reduced their stakes in the stock. JPMorgan Chase & Co. increased its position in shares of Karuna Therapeutics by 19.6% in the 1st quarter. JPMorgan Chase & Co. now owns 20,218 shares of the company’s stock worth $2,563,000 after purchasing an additional 3,317 shares during the last quarter. Bank of New York Mellon Corp increased its holdings in Karuna Therapeutics by 132.7% in the first quarter. Bank of New York Mellon Corp now owns 211,678 shares of the company’s stock valued at $26,839,000 after buying an additional 120,709 shares during the last quarter. Cambridge Investment Research Advisors Inc. raised its stake in Karuna Therapeutics by 5.1% during the first quarter.

Real-time analyst ratings, insider transactions, earnings data, and more. Karuna Therapeutics’s market cap is calculated by multiplying KRTX’s current stock price of $198.44 by KRTX’s total outstanding shares of 34,473,905. The chart below shows how a company’s ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares.

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

Comments are Closed