Perform Basic-Time Homebuyers You desire Financial Insurance coverage during the California?

Mortgage Insurance (MI) can be go-off alarm bells to have earliest-date homeowners. Homeowners aren’t immediately necessary to purchase financial insurance coverage simply since they’re first-go out homeowners. MI requirements can differ ranging from loan quantity and mortgage programs.

Financial Insurance Trigger

Buyers are often needed to purchase financial insurance when the their deposit is actually below 20% of the price otherwise the mortgage-to-worthy of (LTV) proportion is more than 80%. Home loan insurance coverage getting old-fashioned loans is named Private Financial Insurance (PMI). Home loan insurance associated with FHA funds is actually called Financial Insurance rates (MI).

Private Home loan Insurance policies (PMI)

Individual Home loan Insurance policies (PMI) is for traditional lenders which aren’t backed or guaranteed because of the government. People has actually around three percentage options for PMI:

- Month-to-month PMI: Month-to-month PMI range out-of 0.1% to over step one% of one’s loan amount which will be repaid over the course of one year. According to consumer’s LTV, credit, while the loan amount, they’re able to petition out-of PMI when they have sufficient guarantee. Extremely loan providers want customers to keep PMI getting at least 2 years aside from really love.

- Lump sum payment otherwise Single Payment PMI: This occurs whenever a purchaser pays one contribution at intimate regarding escrow to help you permanently safety the PMI without monthly money. We generally speaking discourage this one because if a buyer chooses to refinance later on they won’t become reimbursed because of their lump sum PMI. When belongings delight in easily, people have a tendency to re-finance shortly after their PMI hits the security cushion regarding 20%.

- Financial Paid down PMI: Consumers have the choice when planning on taking a higher rate of interest from inside the lieu of PMI. Lenders pay the lump sum PMI on behalf of the buyer in exchange for a high rate. People commonly genuinely believe that they obtain a good handle financial-paid off PMI because they don’t need to make PMI costs. Buyers are incredibly taking stuck having a higher rate on expereince of living of its loan. We frequently deter buyers from using bank-reduced PMI also.

How to get Eliminate Individual Home loan Insurance rates

Customers normally refinance towards another type of loan with no PMI after their house values adequate to assistance less LTV. (Its LTV should be 80% or quicker.)

People can also treat the PMI if you are paying the loan off if they (1) alert their servicer with regards to request to get rid of, (2) the consumer features a great fee record, and (3) the customer is prepared to persuade the new servicer that their property has not depreciated through getting an assessment report.

In the event the a client’s financing is actually supported by Federal national mortgage association or Freddie Mac, they can eradicate PMI whenever they (1) notify the servicer of their request to quit PMI, (2) new client’s loan has been experienced for a couple of years with a good payment records, (3) the customer brings a recently available assessment with high adequate worth to support a great 75% LTV. In case the client’s mortgage is over 5 years old, the brand new LTV will likely be 80%.

Home loan Insurance

Home loan insurance policy is constantly you’ll need for FHA funds. Buyers pay for MI often because the an up-front advanced or a yearly superior spread out across the path away from one year.

- Up-side Home loan Top: It’s usually 1.75% of your amount borrowed which is put in the newest consumer’s overall financing.

- Month-to-month Home loan Premium: It is regarding 0.85% of your full loan amount split of the 1 year which is long lasting oftentimes.

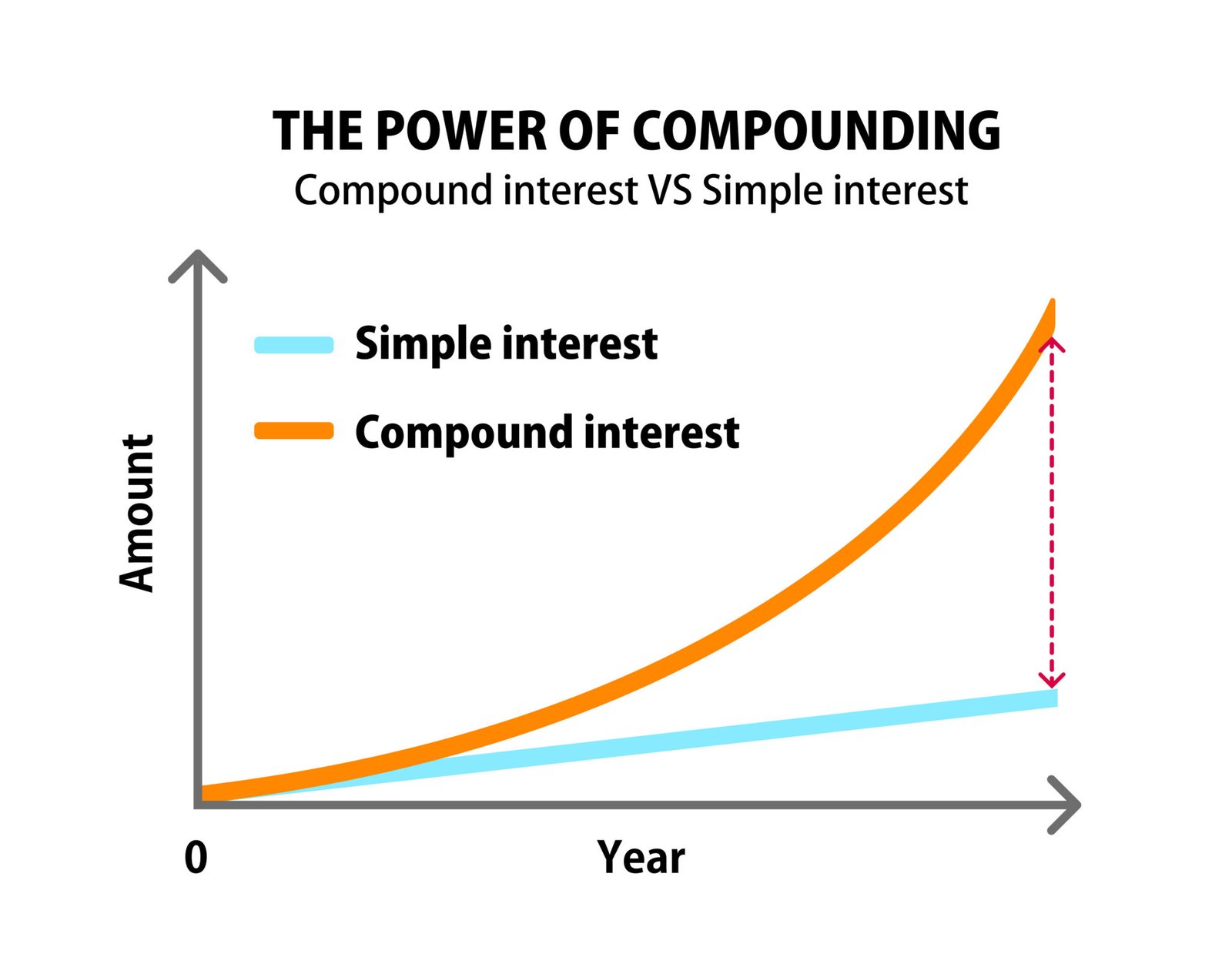

The latest Bright Side of Home loan Insurance policies

Buying financial insurance policies may seem including a supplementary load having customers however it does have a bright side. Financial insurance rates gets customers the chance to buy property sooner or later along with less cash down. It is a Bakersfield California loan companies large bonus getting consumers who won’t otherwise keeps the cash to acquire.

Brand new downside, however, would be the fact buyers will see a rise in their monthly payments making use of their mortgage insurance rates. For many consumers, the chance to very own much outweighs the other repayments for insurance.

Comments are Closed