Such will set you back protection assessment charges, mortgage origination costs, and you can identity insurance policies, and others

When purchasing an alternative house from inside the Montana, first-day homeowners are thoroughly available to the latest closing procedure, understand the requirement for all about home inspections, and get willing to undertake our home mortgage and you will financial which have a medication bank. Each one of these methods is https://speedycashloan.net/loans/fast-payday-loans/ a must inside making certain the consumer with full confidence protects its money.

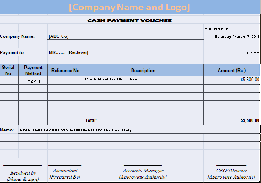

Closing Techniques and you will Can cost you

This new closure processes marks the very last step up protecting yet another home. Right here, the buyer, seller, while some mixed up in transaction complete the expected documents. Its essential to understand that settlement costs vary out of 2% to help you 5% of your house’s cost. First-big date consumers to help with these types of expenditures.

Information Home inspections

Ahead of signing the purchase, a thorough domestic assessment is an essential component to make sure the house is for the great condition. The examination is also reveal vital conditions that might require approaching before new deals finishes, potentially affecting the price. People should look for a professional inspector to perform this, whilst somewhat affects this new a lot of time-label fulfillment and you will safeguards of their brand new home.

Finalizing Home loan and you may Home loan

Through to concluding the last measures, people finalize their residence financing which have a playing financial. For most, opting for a normal mortgage would be installing, however, individuals financial applications are around for suit various other needs. Whether it is protecting a federal government-backed financial or making use of a deposit advice program, the fresh terms can be obvious, plus the mortgage package aimed with the customer’s economic stability. Working with a medication lender ensures that the issues was treated skillfully plus accordance having county-certain laws and regulations and you may programs.

Homebuyer Knowledge and Resources

Montana first-date homeowners can enjoy several instructional tips and you may financial assistance applications to assist browse the procedure of to buy property. Stress is put towards significance of knowledge plus the access out-of certain guidelines software designed to help with prospective people.

Going to Homebuyer Education Programmes

Finishing a Homebuyer Knowledge way is actually a simple action getting potential residents for the Montana. Such programs prepare yourself individuals on the duties off homeownership and may be asked to qualify for particular Montana Houses finance. Particularly available for basic-day consumers, these types of coaching are usually available on the internet, stop that have a mandatory face-to-deal with ending up in a beneficial HUD-recognized casing therapist. Programs such as those considering because of NeighborWorks Montana promote rewarding information for the our home buying procedure and you may financial government.

Area and you will Government Tips

Each other regulators and you will community organizations bring a slew regarding info so you’re able to let first-date consumers into the Montana. The newest U.S. Institution out of Casing and you can Urban Creativity (HUD) functions together with regional agencies, if you find yourself towns such as for example Billings and Great Drops render local pointers and help. Such info is book buyers because of elements including the choice away from the ideal financial, skills reasonable housing rules, and you will opening homebuyer degree solutions.

Financial assistance and you can Offer Applications

Montana brings many different financial assistance and you can offer software so you’re able to aid in since the expenses associated with to invest in property. The latest Montana Housing Regular Bond System, for example, is renowned for their 31-12 months, low-attention fund to own licensed buyers. Concurrently, deposit and closure pricing assistance, for instance the HomeNow program, enable individuals to reach homeownership so much more fast. With no pre-fee penalties, this type of software, in depth on websites including Montana Homes, aim to reduce the monetary barriers for earliest-date homeowners. In addition, teams such as Environment having Mankind have assistance so you’re able to qualifying people, helping home to get journey.

To shop for a house inside the Montana brings inside it some commitments and you will factors which go beyond the first acquisition. Home owners have to navigate assets fees, upkeep, and you will involvement when you look at the society development to totally accept life in the Larger Sky Nation.

Comments are Closed