User lender optimizes multi-condition mortgage document operating & compliance

Because difficulty away from managing unsecured personal bank loan files will continue to develop, lenders need certainly to adopt voice techniques to properly and you will effectively browse the fresh demands ? out-of increasing financing workflows to help you reaching document compliance certainty round the multiple claims and you can jurisdictions. Though some loan providers shot a diy means, this has been confronted with unforeseen risks, trials, and will set you back. Find out how that lender embraced automation with Wolters Kluwer and you can Expere.

Background

A fast expanding user mortgage lender support a working paperless initiative wanted to completely speed up the financing file control from inside the 13 says, that have an aim of increasing with the the 50 says in this several ages. The lending company, and that performs a huge level of unsecured unsecured loans, very first released an in-house venture to do this objective. The team encountered high risks, unanticipated challenges, and you can invisible costs within the Doing it yourself initiative.

Challenge: Beating multi-jurisdictional regulatory intricacies

Scaling businesses on the fresh new says and you may jurisdictions dramatically develops regulatory complexities to own loan providers, complicating file manufacturing and you may compliance processes. To develop a successful multi-condition credit impact, the fresh financial organization accepted so it necessary the best gadgets in order to speed up document generation, see stringent and ranged compliance requirements, and ensure smooth procedures across the multiple jurisdictions.

Even with trying to support its own solution ? spending more $one million and you may considerable inner tips to your efforts ? the lending company encountered different barriers. In the first place, the firm battled observe the brand new extensive list of laws that include one state to another, leaving it at risk of court and conformity dangers. In addition, the business grappled which have tips improve processes across the additional organization traces. The business was also hindered by the point-ingesting, proceeded means of monitoring and you will upgrading documents necessitated because of the constant regulatory changes.

That have inner due dates growing, the lending company try obligated to abandon its Doing it yourself method immediately after numerous days. They pointed out that it requisite exterior specialized help to make certain regulating adherence, reduce risk, increase results, and enable having scalability. The lending company wasn’t alone; an increasing number of businesses are losing to your Do-it-yourself pitfall. Drawn by impress of building an out in-household service, financial teams was alternatively uncovering tall threats, invisible can cost you, and you may unexpected demands throughout these means, somewhat doing conformity situations and scalability.

- Leverage seller-considering records with its own content

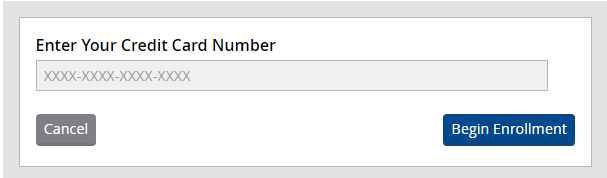

- Perform a different sort of SFDC loan origination program to reach a completely paperless techniques

- Operate in multiple claims, with went on extension

- Off-stream document compliance support and you may maintenance

- Easily put new items to help you the loan profile giving

- Speed up and help huge amounts off software and closings

- Be sure reliability out-of assistance

- Bring down any costs to possess loan purchase birth options

Solution: File conformity certainty, scalability, and you can accelerated credit workflows

The financial institution accepted one selecting the right mate was important to delivering its opportunity right back on course. They requisite a vendor that have deep globe systems, complete systems, and you will confirmed compliance components. Centered on an advice from its Salesforce execution corporation, the financial institution involved having Wolters Kluwer, a worldwide commander when you look at the elite guidance, software solutions, and services. The organization besides provides many years from cumulative feel monitoring the fresh U.S. regulating landscape into desk it is plus a trusted industry commander regarding provision off provided financing and you can regulatory compliance. Wolters Kluwer suits over seven,000 loan providers, also 85% of the most useful neighborhood banking companies and you can non-lender lenders.

Dealing with Wolters Kluwer’s conversion and you will options consulting teams allowed the brand new financial to deal with every one of its inquiries, questions, and you will challenges. The team were able to assess the lender’s portfolios and develop inside the on the optimal solution to fulfill the objectives. Just after several group meetings which have Wolters Kluwer, and you will conclusion out-of a profitable evidence of layout, the lending company located what you they necessary ? plus ? when you look at the Expere.

Deploying the new Expere centralized document program provides enabled the financial institution to help you streamline procedure, clean out errors, and easily measure to generally meet extension requirements. Delivering a complete number of units to possess creating, controlling, integrating, comparison, and deploying records, Expere is fantastic for creditors having footprints in multiple jurisdictions, and additionally people altering its financing origination system (LOS) or management properties just (ASO) arrangements. [WP1] Expere applies complete, automatic compliance reasoning and you may team laws and regulations in order to dynamically manage loan origination documents one to meet applicable federal and state laws.

- Justified articles assures documents is actually agreeable or more-to-go out, delivering assurance and you will reducing the dependence on an interior, time-sipping procedure

Due to the fact lender involved with gurus of Wolters Kluwer’s Top-notch Features, the organization been able to effortlessly pertain a great solution more easily much less expensively than simply it could alone owing to Doing it yourself solutions, causing minimal disturbance so you’re able to every single day workflows and you can high time and benefit. The latest Wolters Kluwer team https://paydayloanalabama.com/millbrook/ and additionally spent some time working directly on bank to help you implement and you may instruct staff to the solution to ensure affiliate use and you may optimized return towards the tech resource.

The information and knowledge and you may options attained from Wolters Kluwer’s Top-notch Properties class additionally the Expere solution has actually allowed the financial institution to expand and you will successfully browse the present regulatory ecosystem ? streamlining processes, reducing mistakes, and you can offering the scalability necessary to with ease build with the the fresh new says and jurisdictions. The lending company have count on in the knowing the solution’s automatic compliance reason implies that financing records round the all of the team outlines fulfill all of the state and you may government guidelines, reducing legal dangers. A lot more, as a part of this new lenders’ registration, Wolters Kluwer continuously checks and you can position most of the practical content they normally use.

Results: Multi-state extension that have smooth, automated compliance certainty

Which have purchased best devices and you will solutions to support multi-condition expansion and ensure lingering conformity and you may show, the financial institution is actually better on its way towards achieving each one of the objectives. Dealing with Wolters Kluwer allows the firm to conquer many pressures of the discarded Do-it-yourself method ? and also do it which have a lot of time-term discount versus attempting to keep the endeavor into the-domestic. Making use of Expere’s central file government program and you can enjoyable with Wolters Kluwer’s Top-notch Qualities team, the user financial could have been able to:

Getting rationalized file conformity certainty Quickening lending workflows Serving numerous business outlines which have a central document system Taking total, automated compliance logic so you’re able to lending files Seamlessly integrating with biggest financing origination assistance Reducing time and worry in the audits

Comments are Closed